You may think that you have no choice about how much tax you pay. Everyone has to pay taxes, right?

Wrong.

There are millions of people who legally pay little or no tax. What’s their secret? Do they know about loopholes that are in the law that allow them to get away with not paying tax? No. They simply understand how the tax law works. They understand that the tax law is not something the government uses only to raise taxes. The tax law is a tool the government uses to shape the economy and promote social, agricultural, and energy policy.

So how can you use the same tools the rich use to pay less taxes?

Play by the rules of the rich

Robert Kiyosaki says, “When it comes to taxes, the rich make the rules.” If you know anything about the tax laws, you know that taxes reward the rich, and punish the middle class. Afterall, someone has to pay taxes. The middle class, of course, does not like this. That is why they get so mad when they find out that the rich can avoid paying taxes and when they find out that the rich often avoid paying taxes because they help write the rules.

First, you must understand how different incomes are taxed differently.

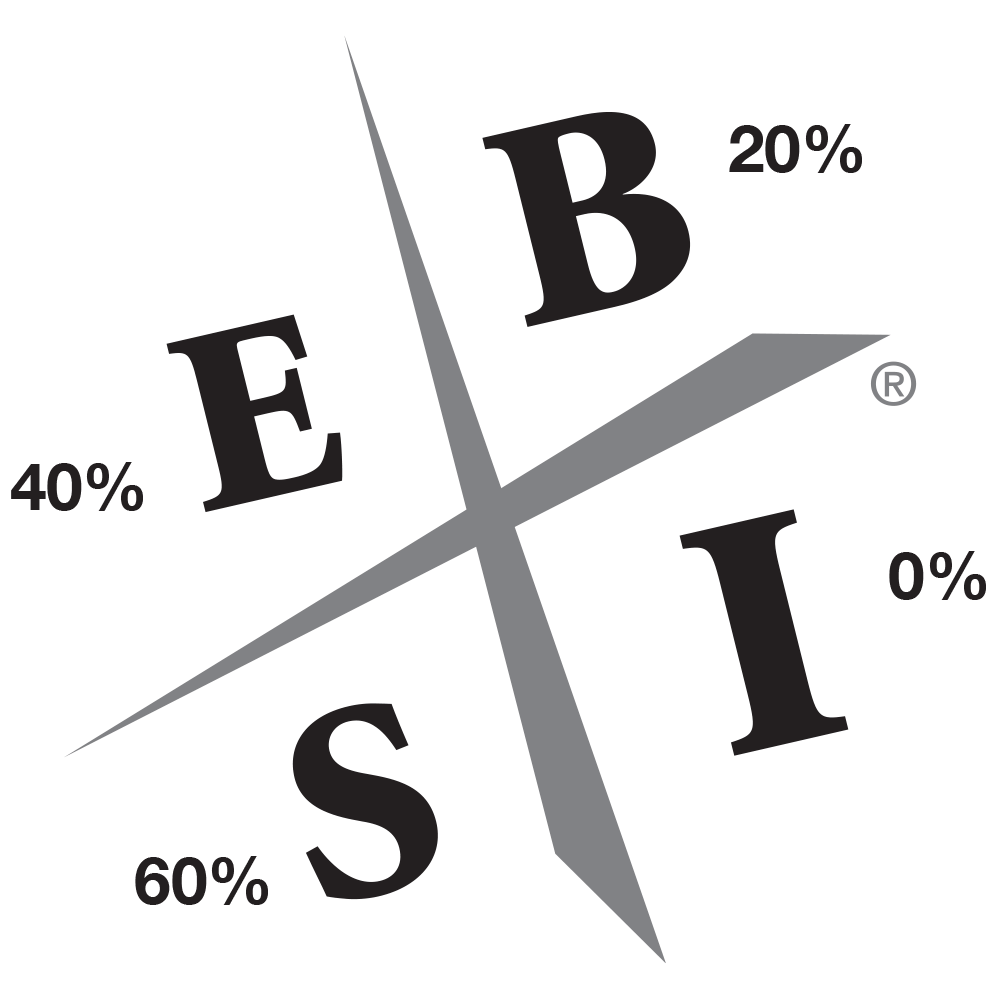

Robert’s rich dad taught that there are four different types of people in the world of money. He defined these four types with the diagram below, a diagram he called the CASHFLOW® Quadrant.

E stands for Employee

S stands for Self-employed or small business owner

B stands for Big business owner

I stands for Investor

The CASHFLOW Quadrant separates income earners into four quadrants. On the left side are the employees (E) and the self-employed individuals (S). On the right side are big business (B) and investors (I). You’ll notice each quadrant is taxed at a different rate represented by the number in each quadrant.

The rules of the rich

Rule #1

The rich pay very little in income taxes because they don’t earn their money as employees do. They know that the best way to legally avoid taxes is by generating passive income out of the right side of the CASHFLOW Quadrant-the business (B) and investing (I) side.

Passive income, the kind of income generated on the right side of the quadrant is much better than earned income, the kind earned on the left side of the quadrant. Passive income is taxed less, and it’s also a result of cash-flowing assets, not selling your time as an employee.

Those who earn their money in the I quadrant understand there are special rules for those on the right side of the quadrant and use them to their advantage. All you have to know is the rules and how to play by them.

Rule #2

Tax law is written to reduce your taxes. In the U.S. for example, there are over 5,800 pages of tax law. Only about 30 pages are devoted to raising taxes. One line, Section 61(a), says, “Except as otherwise provided in this subtitle, gross income means all income from whatever source derived…” There are then several other pages of tax rates and a few other miscellaneous taxes. The remaining 5,770 pages are entirely devoted to reducing your taxes .

If you do the activities that the government wants you to do, you will not only permanently reduce your taxes by 10 to 40 percent or more, you will also begin building more wealth and cash flow than you had ever imagined possible.

Understanding the government

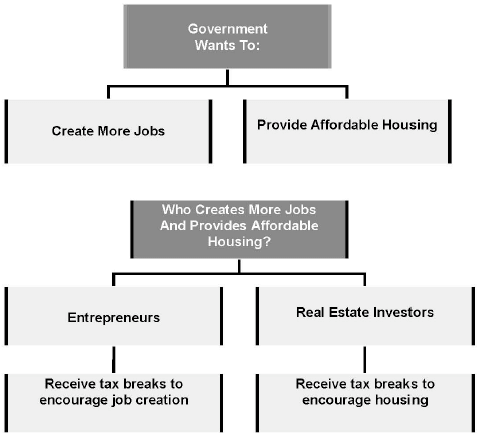

So what does the government want? First, they want to create more jobs. Who creates jobs? Entrepreneurs. Therefore, entrepreneurs get all sorts of tax breaks that act as subsidies to encourage job creation. What else does the government want? Affordable housing. Real estate investors get all sorts of tax breaks that act as subsidies to encourage building of affordable housing.

It is because of these goals that the government gives entrepreneurs and investors all the tax breaks they get. Governments even get more specific about the types of investing and jobs they want the market to create by giving specific tax breaks for oil and gas investing, farming and other agriculture, green energy, and low-income housing.

So how do you stop the government from stealing your money, and get the tax rewards that the rich have been getting for years?

Shifting quadrants

To summarize, there are three types of income:

- Earned income

If you are an employee, a self-employed individual or a partner, you make your money through earned income. Earned income is taxed at the highest rate possible. - Portfolio income

Where earned income is acquired by exchanging time for money, portfolio income is made through capital gains. - Passive Income

Generally derived from real estate, royalties, and distributions. It is the lowest-taxed income, with many tax benefits, and is the easiest income to build wealth with thanks to its combination of low taxes and potentially infinite returns.

The point is this: not all income is created equal. Passive income, the kind of income generated on the right side of the quadrant, is much better than earned income, the kind earned on the left side of the quadrant. Passive income is taxed less, and it’s also a result of cash-flowing assets, not selling your time as an employee.

You just need to shift some of your income-earning activities to the B and I side of the quadrant. Thankfully, that’s not difficult to do.

- Become an entrepreneur

Thousands of individuals all over the world have home-based businesses or invest in real estate, energy, or agriculture—and they all enjoy the benefits that come from saving money through the tax code. - Become an active investor

That means you have to be an investor who actively invests for passive income, not earned income. Very simply, passive income is income that comes from dividends, rents, and business. It’s taxed at a much lower rate than earned income, which comes from appreciation and capital gains, or from your paycheck. In order to become a super investor, you must find good, cash-flowing investments that produce passive income. - Become a passive investor

I’m not talking about the typical investor who invests in the stock market through a mutual fund or an exchange traded fund (ETF). I’m talking about someone who invests their money with an active investor who is working directly in a business, real estate, agriculture or energy—the tax-preferred types of investments. Passive investors also enjoy the benefit of deducting many of their expenses. With the right tax strategy, they can even deduct losses from the investment against income they earn from other sources.

Convert ordinary income into passive income

Many people start their lives earning money with a job and getting paid for it. The key to growing your wealth, however, is by converting your ordinary income into passive income to lower your tax rate.

Understanding how the different types of income are taxed will help you have a n informed discussion with your accountant to transform your income type.

Become a super taxpayer

The best way to enjoy deductible expenses is to make your way to the right side of the CASHFLOW Quadrant and start a business or to start investing for passive income. You don’t have to quit your job. Just start small.

It’s actually your patriotic duty to reduce your taxes by all legal means.

Hard to believe? Think about this:

If 99.5 percent of the tax law is written to help you reduce your taxes, then the government must really want you to do just that. Once you truly believe these two rules and have them firmly planted in your mind, you’ll realize you have the right to reduce your taxes every minute of the day. All you have to do is learn the rules of the game.

To learn more about taxes, get Rich Dad Advisor, Tom Wheelwright’s book, Tax Free Wealth, now.