The dollar is toast; here’s why you need real money

In 1971, President Richard Nixon took the U.S. dollar off the gold standard, transforming it from currency backed by tangible assets into “fiat money”—paper valued solely by government decree. Before this, dollars were convertible to gold at $35 per ounce. After Nixon’s decision, the dollar became an IOU backed only by “the full faith and confidence of the U.S. government.”

Robert Kiyosaki learned this lesson firsthand during his Vietnam War service in 1972. When his rich dad wrote that “President Nixon took the dollar off the gold standard—watch out, the world is about to change,” Robert and a fellow pilot attempted to buy gold from a Vietnamese woman, offering $40 per ounce when spot price was $55. She simply smiled, knowing gold’s value is universal while American dollars can be printed endlessly. Simply put, that shrewd woman understood what took Robert years to fully grasp: real money is the same across the world.

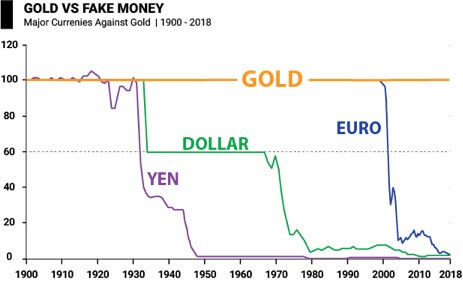

For 6,000 years, societies have consistently returned to gold and silver during economic crises. Every fiat currency throughout history has eventually fallen to zero value, while gold and silver have maintained purchasing power across civilizations and empires.

Dollar down, metals up

Since 1971, the dollar’s purchasing power compared to gold has dropped over 95%. Consider these dramatic changes:

1971: Gold $35/oz, Silver $1.50/oz

1996: Gold $387/oz, Silver $5/oz

2011: Gold $1,895/oz (peak)

January 2026: Gold $4,600+/oz, Silver $90+/oz

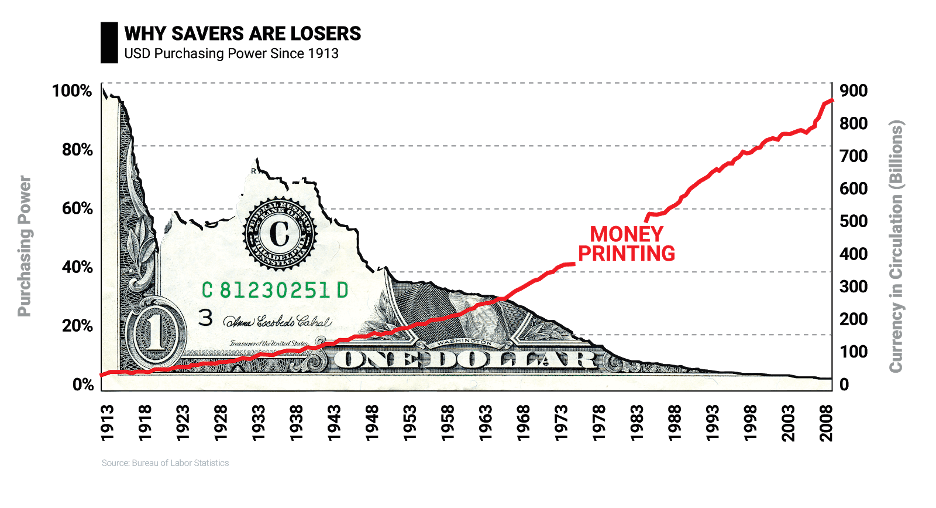

Meanwhile, the purchasing power of a 1971 dollar is now worth approximately 5 cents when measured against gold. This isn’t inflation—it’s currency debasement through excessive money printing.

The wealthy own physical assets, not paper– here’s why

Warren Buffett once said: “the best way to get rich is to not lose money.”

Buffett’s advice takes on new meaning here. When people save U.S. dollars or hold cash equivalents, they’re actively losing money through currency devaluation. The wealthy have more dollars not because they hold them, but because they immediately exchange dollars for appreciating assets—physical gold, physical silver, real estate, and businesses.

Physical gold and silver are assets with zero counterparty risk:

- Neither depend on companies, banks, or governments for value

- Both function as money even when financial systems fail

- Neither can be printed, inflated, or devalued by central banks

- Both are recognized and accepted globally, transcending borders

- Finally, both require no earnings reports or financial statements—they simply ARE value

The case for physical precious metals in 2026

National debt crisis

U.S. national debt now exceeds 120% of GDP—worse than post-World War II levels. Over 60% comes from mandatory entitlement spending (Medicare, Social Security) that will only increase as baby boomers retire. According to the Peter G. Peterson Foundation, this trajectory is unsustainable.

The mathematics are simple: when a country owes more than it produces, default becomes increasingly likely. The Federal Reserve’s only option is printing more dollars, which directly devalues existing currency. When President George W. Bush attempted Social Security reform, it was more unpopular than the Iraq war. Americans won’t accept the painful changes needed—which sealed the dollar’s fate.

Central banks voting against their own currencies

In 2024-2025, central banks—led by China—purchased record quantities of physical gold. When the institutions that control paper money buy gold aggressively, they’re voting no confidence in their own currencies.

Buffett reportedly holds one of the largest caches of physical silver in America, purchased in the late 1990s when silver was cheap. The world’s most successful investor understands tangible asset value.

Silver’s industrial demand explosion

More than 50% of silver demand now comes from permanent industrial consumption:

- Solar panels: Each requires approximately 20 grams of silver; global installation accelerating

- Electric vehicles: Use nearly 2x the silver of traditional vehicles

- Electronics: Smartphones, tablets, computers depend on silver’s superior conductivity

- 5G infrastructure: Network buildout requires significant silver

The Silver Institute reports persistent deficits where consumption exceeds mining production. Above-ground stockpiles are being drawn down—fundamentally bullish for silver prices. In 2025, silver surged over 140%, dramatically outperforming gold’s 65% gain.

The “panic-buying factor”

Most Americans don’t own physical gold or silver. Most have never purchased precious metals and have no idea where to buy them. When economic conditions deteriorate and average Americans panic into precious metals—as happened in 1980 and 2011—prices explode vertically as desperate buyers chase limited supply. Dealers already report inventory shortages. When the public wakes up to realize dollars are currency, not money, today’s prices will look like bargains.

What to buy: physical gold and silver products

Investment-grade gold

Gold coins (most liquid)

Government-minted coins offer instant global recognizability, consistent purity, and anti-counterfeiting features:

- American Gold Eagles – 1 oz, 1/2 oz, 1/4 oz, 1/10 oz sizes; 22-karat (91.67% pure); most recognized in U.S.; typical premium 5-8% over spot

- Canadian Gold Maple Leafs – 24-karat (99.99% pure); advanced security features; premium 4-7% over spot

- Austrian Gold Philharmonics – 24-karat; popular in Europe; premium 4-6% over spot

Gold bars (lower premiums)

For maximizing gold content per dollar, purchase 1 oz to 1 kilo sizes from recognized refiners. Benefits include:

- Lower premiums: 2-4% over spot for 1 oz bars

- Less liquid than coins but more metal for your money

- Serial numbers provide authenticity verification

Investment-grade silver

Silver Coins

- American Silver Eagles – 1 oz .999 fine silver; most popular U.S. coin; premium 20-30% over spot

- Canadian Silver Maple Leafs – .9999 fine (purer than most); micro-engraved security; premium 18-28% over spot

- 90% Silver U.S. Coins (“Junk Silver”) – Pre-1965 dimes, quarters, halves; recognizable, divisible, lower premiums

Silver Bars

When purchasing silver bars, buy 1 oz to 100 oz sizes; premiums 10-20% for small bars, 5-10% for large bars. These are best for maximizing silver ounces per dollar. Popular sizes are 10 oz or 100 oz.

As a note, silver premiums are higher because manufacturing and shipping costs are similar for gold or silver products, but silver’s lower spot price means fixed costs represent a larger percentage.

Fractional metals for flexibility

For potential crisis scenarios where precious metals serve as currency, smaller denominations matter:

- Fractional gold: 1/10 oz and 1/4 oz coins provide flexibility (higher premiums 8-15% but worth it)

- Silver naturally fractional: 1 oz coins already reasonable denominations ($90-110 each)

- 90% silver coins: Dimes and quarters offer even smaller units

Things to consider when investing in physical precious metals

It’s important to feel informed and educated when purchasing these physical precious metals. Afterall, the point is to build value, not get ripped off.

Look out for clear red flags from dealers, like pressure tactics or “buy now” urgency. Prices should be competitive, (basically, if it’s too good to be true, it’s not true). Always look for customer reviews, and look for a physical address (this one is obvious, but you’d be surprised).

Premiums also need to make sense. The premium is calculated as such:

Total Cost = Spot Price + Premium + Shipping

With that, expected premium ranges should be:

- Gold government coins: 5-8% over spot

- Gold bars: 2-4% over spot

- Silver government coins: 20-30% over spot

- Silver bars: 10-20% over spot

Compare dealers on total delivered cost, not just advertised premiums.

Storage and security strategies

Diversified approach (recommended)

For $50,000 in precious metals:

- 60% at home ($30,000) – Quality safe (bolted, fire-rated); immediate access; no fees

- 25% private vault ($12,500) – Professional security; geographic diversification

- 15% bank box ($7,500) – Low cost ($50-200/year); convenient normal access

Home safe requirements

- Minimum 1-hour fire rating at 1,700°F

- 300+ pounds weight

- Bolt-down capability

- UL-rated TL-15 or TL-30

Security measures

- Never discuss holdings publicly

- No social media posts about metals

- Home security system

- Insurance (valuable articles rider)

- Multiple hiding spots for diversification

Note on Bank Boxes: In 1933, gold stored in bank safety deposit boxes was vulnerable to government confiscation under Executive Order 6102. Though this is highly unlikely today, historical precedent exists for a reason.

Building your position: dollar-cost averaging

The disciplined approach.

Rather than lump sum at potentially elevated prices, systematic purchasing reduces timing risk:

12-Month example ($12,000 allocation):

- Months 1-3: $500 physical gold monthly ($1,500 total)

- Months 4-6: $500 physical silver monthly ($1,500 total)

- Months 7-9: $1,000 physical gold monthly ($3,000 total)

- Months 10-12: $1,666 physical silver monthly ($5,000 total)

Result: approximately $4,500 gold, $6,500 silver (40% gold, 60% silver)

This averages cost basis across different price levels and removes emotional decision-making about “perfect” entry.

Portfolio allocation guidelines

- Conservative: 10% precious metals (70% gold, 30% silver)

- Moderate: 12.5% precious metals (60% gold, 40% silver)

- Aggressive: 15% precious metals (50% gold, 50% silver)

- Crisis Preparation: 20-25%+ precious metals (70% gold, 30% silver)

Within broader wealth strategy emphasizing cash-flowing assets like real estate and businesses.

Rebalancing discipline

As metals appreciate, they can become oversized positions. Annual rebalancing forces “buy low, sell high”:

Example:

- Target: 10% precious metals

- Portfolio: $100,000 (metals should be $10,000)

- After bull run: Metals at $20,000, total portfolio $110,000

- Action: Sell $9,000 metals, return to approximately 10% allocation

Gold vs. silver: which should you own?

So which physical precious metal should you invest in? Here are some key differences to consider.

Gold:

- Higher value density ($4,600+/oz)

- Lower volatility (more stable)

- 90%+ demand from investment/jewelry

- Universal acceptance as premier money

- Better wealth preservation

- Easier storage (compact)

Silver:

- Lower price per ounce ($90+)

- 2-3x higher volatility

- 50%+ industrial demand

- “Poor man’s gold” (accessible entry)

- Greater leverage in bull markets

- Larger storage requirements

Some other takeaway notes:

- Gold/Silver Ratio: Currently approximately 51:1 (51 oz silver = 1 oz gold)

- Historical average: 55:1-65:1

Strategic allocation

Emphasize gold when:

- Primary goal is wealth preservation

- Large wealth to protect ($100,000+)

- Geographic mobility might be necessary

- Crisis protection paramount

- Lower risk tolerance

Emphasize silver when:

- Seeking maximum leverage to bull market

- Smaller starting capital

- Comfortable with volatility

- Believe industrial demand will drive outperformance

- Want smaller denominations for potential barter

A balanced foundation: the popular approach.

Most investors take on a balanced approach to investing in physical precious metals. This tends to look like: 60% physical gold, 40% physical silver.

When ratio is high (80:1+): Silver historically cheap—consider shifting toward silver

When ratio is low (40:1-): Silver expensive—consider shifting toward gold

As stated above, the current 51:1 ratio suggests relatively balanced positioning.

The fundamental problem

Many financial advisors promote ETFs, mining stocks, and futures as precious metals exposure. Understanding their limitations is crucial.

Paper metals represent claims on value, not value itself.

When you own an ETF or mining stock, you own:

- A promise that someone else will deliver value

- Dependence on financial system functioning

- Exposure to counterparty risk

- A digital entry in computer system

When you own physical gold or silver, you own:

- The actual metal itself

- Value independent of financial system

- Zero counterparty risk

- Tangible asset in your possession

When paper might make limited sense

The truth is, paper “money” might make sense, but only in specific circumstances:

- Inside retirement accounts where physical ownership restricted

- As temporary parking while accumulating for physical purchase

- Tax-deferred accounts (Roth IRA) avoiding collectibles tax

Even then, recognize you’re accepting significant compromises versus physical ownership.

Now ask yourself: when the dollar collapses, do you want a piece of paper claiming you own gold, or do you want the gold itself?

Warren Buffett owns physical silver, not ETFs. Central banks buy physical gold for reserves, not shares. When powerful institutions want protection, they insist on the real thing.

For genuine wealth protection and crisis insurance, physical ownership is essential.

Understanding the risks

No investment, even that of physical precious metals, comes without risks. Arm yourself with information to make strategic decisions and pivots. Consider the following:

- Price volatility: Silver particularly exhibits 2-3x gold’s volatility. Maintain long-term perspective through inevitable corrections.

- No income: Gold and silver generate zero cash flow. They should complement—not replace—income-producing assets.

- Transaction costs: Round-trip costs (buying premium + selling discount) = 5-35% depending on products. Metals must appreciate significantly to break even.

- Tax treatment: IRS taxes precious metals as “collectibles” at 28% maximum rate vs. 15-20% for stocks. Consult tax professional.

- Storage/security: Physical metals require secure storage, insurance, and discretion about holdings.

Critical mistakes to avoid

- Panic buying at tops – 1980 silver ($50) and 2011 gold ($1,895) buyers waited years/decades to break even

- Panic selling at bottoms – Locking in losses and missing recovery

- Ignoring premiums – Calculate total cost including all fees

- Over-concentration – 30%+ allocation creates vulnerability

- Poor security – Inadequate storage invites theft

- Buying collectibles – Stick to bullion; avoid numismatic premiums

- Timing perfection – Dollar-cost average instead

- Buying before educating – Learn verification, storage, tax implications first

Next steps to invest in gold and silver

For beginners

Week 1-2: Education

- Read precious metals book (Michael Maloney’s “Guide to Investing in Gold and Silver”)

- Study Rich Dad’s philosophy

- Follow metals prices for two weeks

Week 3: Define goals & choose dealer

- Clarify: wealth preservation, crisis insurance, diversification?

- Research dealers; verify BBB ratings

Week 4: First purchase

- Option 1: One 1-oz gold coin ($4,600-4,800)

- Option 2: 10-25 oz silver coins ($900-2,750)

- Option 3: 1/2 oz gold + 15 oz silver ($2,300-2,650)

Months 2-12: Dollar-cost average

- Set monthly purchase budget

- Alternate gold/silver purchases

- Focus on ounces accumulated

Ongoing: secure storage

- Purchase quality safe or arrange vault storage

- Document holdings (secured separately)

- Never discuss publicly

For experienced investors

- Audit allocation – Calculate physical metals percentage; compare to 10-15% target

- Optimize gold/silver balance – Review against strategic goals

- Upgrade storage security – Assess risks; consider diversification

- Establish rebalancing plan – Define triggers for taking profits

- Educate family – Ensure they know location, verification, selling process

The dollar is toast; choose wisely

As that shrewd Vietnamese woman taught Robert Kiyosaki in 1972: real money is the same across the world, while paper currencies can be printed endlessly.

With U.S. debt exceeding 120% of GDP, mandatory spending consuming 60%+ of federal budget, and the Fed printing trillions to paper over fiscal irresponsibility—the dollar’s fate is sealed. Not today, not tomorrow, but inevitably. Every fiat currency in history has eventually fallen to zero. The dollar will be no exception.

The question isn’t whether to own physical gold and silver. The question is: How much can you afford to NOT own?

Choose wisely. The dollar is toast. Make sure your wealth isn’t.

FAQs

While prices are at all-time highs, the factors that drive appreciation—currency debasement, central bank buying, geopolitical tensions—remain intact and intensifying. Rather than timing perfect entry, dollar-cost average over 6-12 months. For most investors, 10-15% physical precious metals allocation makes sense regardless of current prices as crisis insurance against currency collapse.

Financial educators recommend 10-15% of net worth in physical precious metals. Within that, balance 60-70% gold with 30-40% silver. Above 20% is aggressive; reserve for those preparing for financial system crisis. Remember: metals don’t generate cash flow, so complement income-producing assets.

Physical metals provide direct ownership without counterparty risk and function during system disruptions—but require storage and have higher transaction costs. ETFs offer convenience in retirement accounts—but create system dependence and won’t protect if banking fails. Rich Dad philosophy emphasizes physical: when dollar collapses, you want actual gold, not paper claims. ETFs might supplement in restricted retirement accounts only.

Diversify: 60% home safe (immediate access, no fees), 25% private vault (professional security), 15% bank box (low-cost convenience). Home safe requires fire-rating, bolt-down, 300+ pounds. Never discuss holdings publicly. For holdings under $10,000, home storage avoids fees consuming returns.

IRS taxes physical precious metals as “collectibles” at 28% maximum rate (vs. 15-20% for stocks), regardless of holding period. State taxes may apply. Cash purchases over $10,000 trigger reporting. Strategies: hold in IRA/401(k) to defer taxes, use Roth for tax-free growth, time sales to lower-income years. Consult tax professional.

In 1933, Executive Order 6102 required Americans to surrender gold at $20.67/oz, then government revalued to $35—confiscating 41% of value. Silver has never been confiscated. While unlikely today, reduce vulnerability through: home storage vs. banks, foreign coins (previously exempt), privacy about holdings. Complete prevention impossible but these steps reduce risk.

Measures how many ounces of silver equal one ounce of gold. Currently approximately 51:1. Historical average 55:1-65:1. Use strategically: when ratio high (80:1+), silver cheap relative to gold—shift toward silver. When low (40:1-), shift toward gold. Current 51:1 suggests balanced positioning, though slightly below average indicates modest silver value.