You can tell that the presidential race is heating up because the attacks are heating up too.

In the past, much of political advertising happened on the television. Now it seems to happen in the so-called news media too.

This week, The New York Times (Pay Wall), printed the “surprise” news that President Donald Trump paid next to nothing in taxes—$750 to be exact. Of course, the liberal, far-left crazies are losing their collective mind over this news. But it’s nothing new. Why would you expect them to understand how money and taxes work?

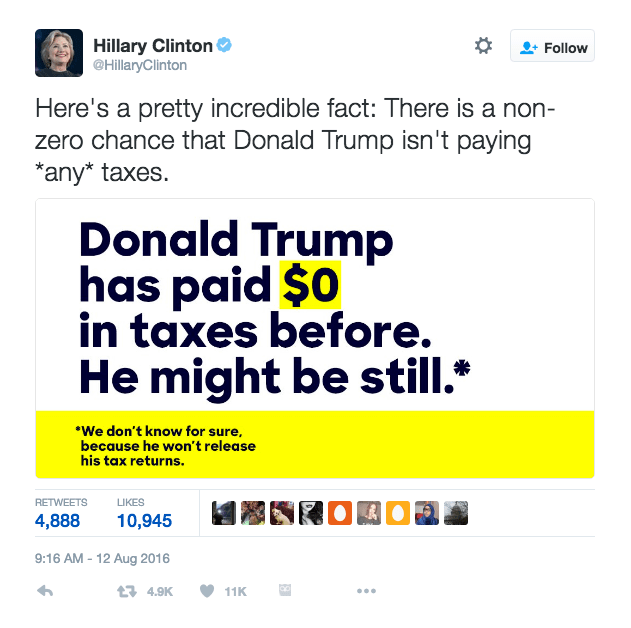

The attack about Trump’s taxes is nothing new either. Last election, Hillary Clinton, the Democratic nominee for president, sent this out on her Twitter account:

See the tweet here.

Why are the liberals so obsessed with Donald Trump’s tax returns? The candidates normally choose to release their tax returns if they are running for president. Donald Trump elected not to do this.

He is a smart man, and he knows that even if it is a sign of a good businessman that he pays little to nothing in taxes, that most people won’t understand. They’d rather vote for politicians who are bad with money than a businessman who understands how money and taxes work.

If you run the country like your bank account…

During the last election, Hillary and Bill released their tax return to the public. As The New York Times reported at the time, Hillary and Bill paid “$3.6 million in federal taxes for an effective tax rate of about 35 percent.” Most of this income came from speeches and Hillary’s memoir.

I find it interesting that Hillary chose to attack Donald Trump for not paying anything in taxes and celebrate that she paid so much in taxes. This to me shows that Hillary is a career politician, while Donald is a career entrepreneur. It also shows me that Donald is doing what the tax code was intended for while Hillary and Bill are being penalized for not doing what the tax code was intended for.

As I’ve learned from my Rich Dad tax advisor, Tom Wheelwright, the most patriotic thing you can do is not pay your taxes!

I’ll explain in a minute, but first a history lesson.

The US was founded on a tax revolt

If you paid attention in school, you would have learned that America’s true start came in 1773 with the Boston Tea Party. That’s right. America was founded on a tax revolt. Tired of paying taxes on tea, the patriots threw the tea into the water. This eventually led to the Revolutionary War in 1776.

I’m not sure when so many in this country fell in love with paying taxes, but the reality is that the DNA of America is to pay as little taxes as possible. Paying taxes is not patriotic. Taxes are theft. The reason why the rich, people like me, hate taxes is because when you give a beaurocrat money, all they do is spend. Our country is massively in debt and they still want more.

Again, as my Rich Dad Advisor, Tom Wheelwright says, the most patriotic thing you can do is not pay your taxes.

The tax code is made to incentivize

As you probably know, the tax codes in the US and in many different countries are long and complicated. The question is, why?

The reason is that government leaders learned a long time ago that the tax codes could be used to make people and businesses do what they want by utilizing the tax code.

In short, the many credits and breaks that are found in the tax code are there precisely because the government wants you to take advantage of them. For instance, the government wants cheap housing. Because of this, there are many tax credits for affordable housing that developers and investors can take advantage of that minimize their tax liability, put more money in their pocket, and in turn, create affordable housing. Everyone wins.

I would rather invest my money in affordable housing than give it to a beaurocrat.

There are many scenarios like this in the tax code that incentivize investors and entrepreneurs to do activities the government is looking for while rewarding those who take those actions with lower-or zero-tax burden.

Because of this, limiting your tax liability actually means you’re doing what the government wants you to do through the tax code. And that is the most patriotic thing you can do.

Why criticizing Donald Trump about is tax returns is wrong

The criticism of Trump in the media and by his opponents only serves to show their ignorance when it comes to money and taxes…and debt. The other part of the news story is how much debt Trump has, but as he points out, if you look at his assets, he is actually underleveraged.

I love real estate, and so does Trump. Why? Because of debt and taxes. You can purchase more assets for your dollar with debt. And you can save more in taxes through the tax code with credits and depreciation. It’s basic investing, but unfortunately, most people know nothing when it comes to money, taxes, and investing. So they howl and moan, showing they’re the highest-educated idiots in the room.

It was insanity for Hillary to criticize Donald for not paying taxes, and it’s insanity for Biden to do the same thing. The only way in which he would not pay taxes would be by doing things like investing and creating jobs to receive tax benefits created by the government!

Conversely, the fact that Hillary and Bill paid a 35% tax rate and millions in taxes shows they are not doing what the government wants. They are not providing jobs, starting businesses, or investing in a meaningful way.

Personally, I’d rather have someone who understands how money and taxes work, how to create jobs and invest in ways our own tax code incentivizes, than one who doesn’t. This is not an endorsement of either candidate, but it is a true observation regarding this one issue.

Criticisms of Donald Trump’s tax returns are capitalizing on the general ignorance around money and taxes that much of our country has. In that way, it is actually a lie and a form of fear mongering. It is an attack without legs to stand on, preying on emotions rather than appealing to logic and intellect.

But that’s what most of our politics has devolved to these days, so I’m not surprised.

Want to know more? Read Tom’s book on taxes

During the election season, you’ll hear lots of things that sound right, but fall apart upon further analysis. That’s why it pays to do your own homework, especially when it comes to money and taxes.

And that’s why you should read Tom Wheelwright’s book, Tax-Free Wealth.

Tom is a genius when it comes to taxes, and I encourage you to read his book- and to begin looking at how you can be patriotic by not paying your taxes by investing and building businesses that the government rewards with tax breaks and credits for doing exactly what they want.

Also, for more information on using the tax code to get rich, take advantage of our Rich Dad, self-paced online courses that will help increase your financial education and your wallet, while decreasing your tax bill.