Buckle up, money mavens. If you’ve ever dreamed of ditching the 9-to-5 grind, relaxing in the sunshine while your money works for you, or figuring out why your bank account keeps playing hide-and-seek, CASHFLOW is about to become your new best friend. It’s a fast-paced, real-world investing simulator that turns players into money-savvy strategists.

This isn’t a game where you get rich by luck. It’s the board game where you win by building cash-flowing assets like real estate, stocks, and businesses in order to escape the Rat Race for good.

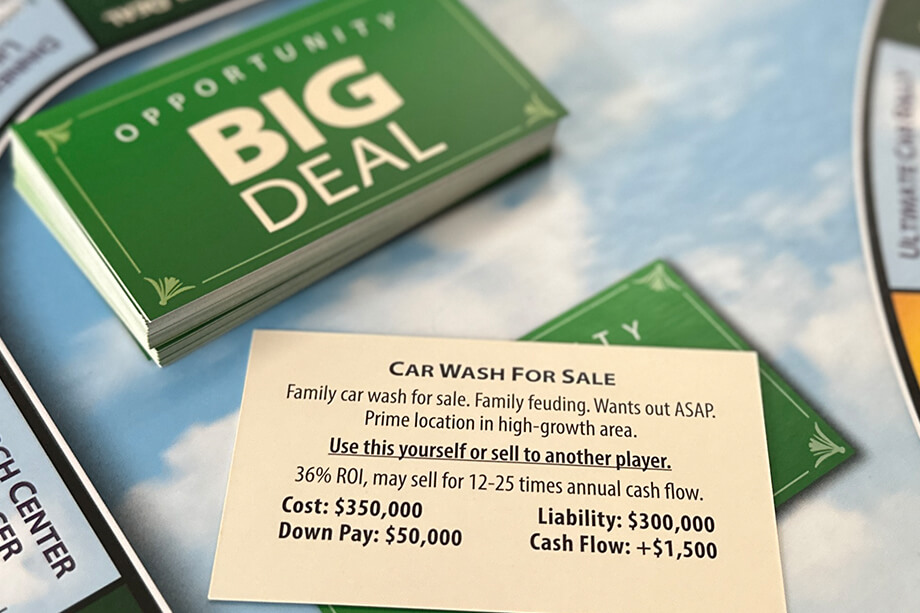

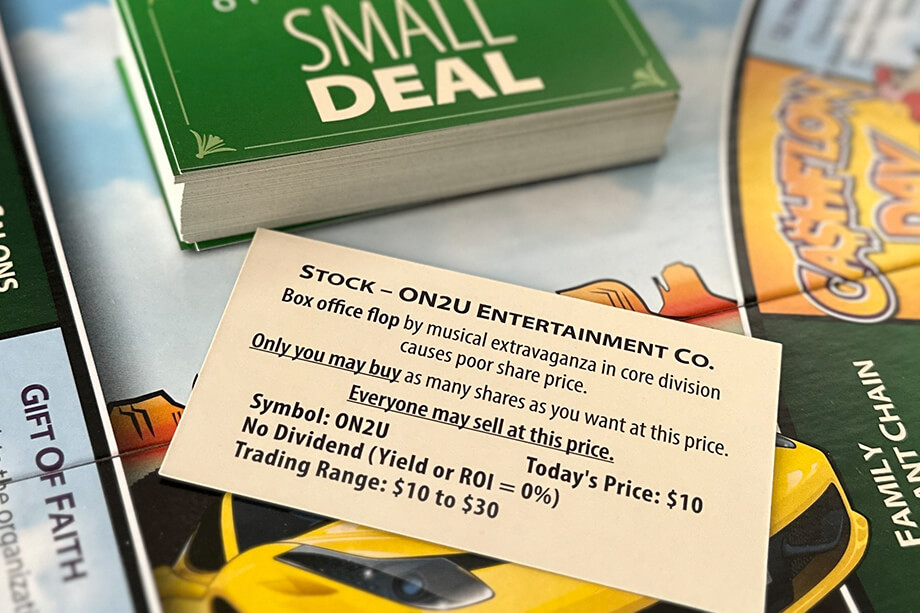

From rental properties to apartment complexes, you’ll practice evaluating real estate deals, using leverage, and calculating ROI—all while trying to dodge the dreaded Doodads that threaten to drain your cash. Learn the tactics investors use to create wealth, right from your living room table.

Discover how to build passive income and stop working for money. CASHFLOW doesn’t just simulate investing—it builds confidence, provides strategy, and gives you real-world skills. Each play-through is a new journey—one that reveals your habits, sharpens your instincts, and transforms how you view money.

You’ll laugh, you’ll strategize, and you might even cry when you realize how much you’ve been overspending on lattes. CASHFLOW is like a financial bootcamp disguised as fun.

Playing board games isn’t just about passing the time as a digital detox. Sure they’re fun, but it doesn’t have to be mindless entertainment. CASHFLOW masks the real-life mathematics of accounting with friendly competition and social connection.

Learn how to acquire assets that will help you to get out of the Rat Race… in real life

Discover the differences between assets and liabilities

Create passive income you make in your sleep that replaces your paycheck

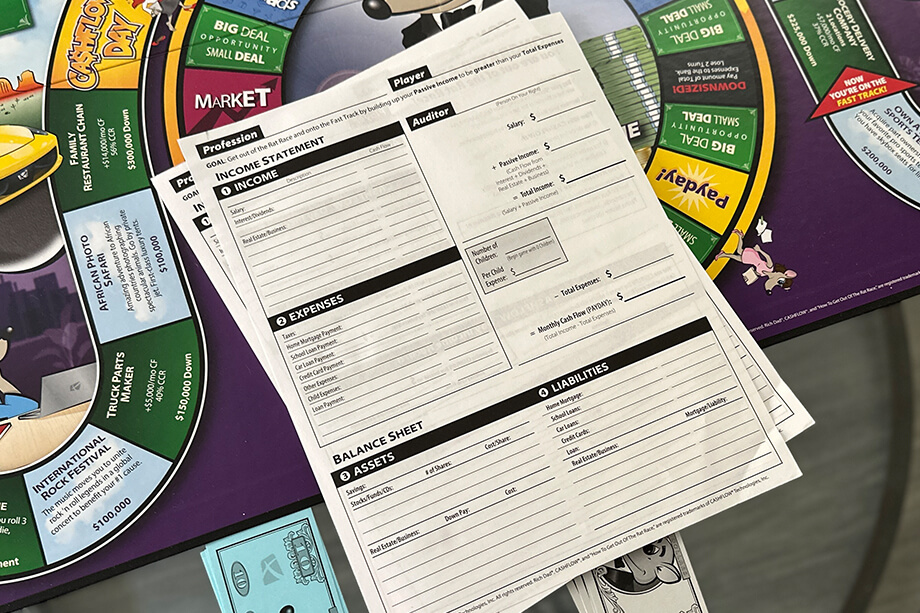

Complete personal financial statements (even if you’ve never done it before)

Understand what separates the the mindsets of the rich, the poor, and the middle-class

Finally “get” why a paycheck alone won’t make you rich

Unlike traditional games that rely on chance, CASHFLOW is about building skills that help you:

You won’t just play. You’ll change the way you see money—for good.

Playing board games isn’t just about passing the time as a digital detox. Sure they’re fun, but it doesn’t have to be mindless entertainment. CASHFLOW masks the real-life mathematics of accounting with friendly competition and social connection.

Learn how to acquire assets that will help you to get out of the Rat Race… in real life

Discover the differences between assets and liabilities

Create passive income you make in your sleep that replaces your paycheck

Complete personal financial statements (even if you’ve never done it before)

Understand what separates the the mindsets of the rich, the poor, and the middle-class

Finally “get” why a paycheck alone won’t make you rich

Unlike traditional games that rely on chance, CASHFLOW is about building skills that help you:

You won’t just play. You’ll change the way you see money—for good.

Forget boring lectures or textbook lessons. This is hands-on, interactive full of “aha” moments. Teach your kids the difference between assets and liabilities, how to manage money, and the importance of thinking long-term. CASHFLOW turns financial literacy into a family tradition.

Absolutely. It’s used by thousands of homeschooling families who want to bring financial concepts to life. Whether you’re teaching budgeting, entrepreneurship, or economics, CASHFLOW makes abstract ideas stick through action and engagement.

From teens to retirees, everyone walks away saying, “Why didn’t I learn this sooner?” Whether you’re preparing for college, launching a side hustle, or planning for retirement, CASHFLOW is the perfect money mentor in game form.

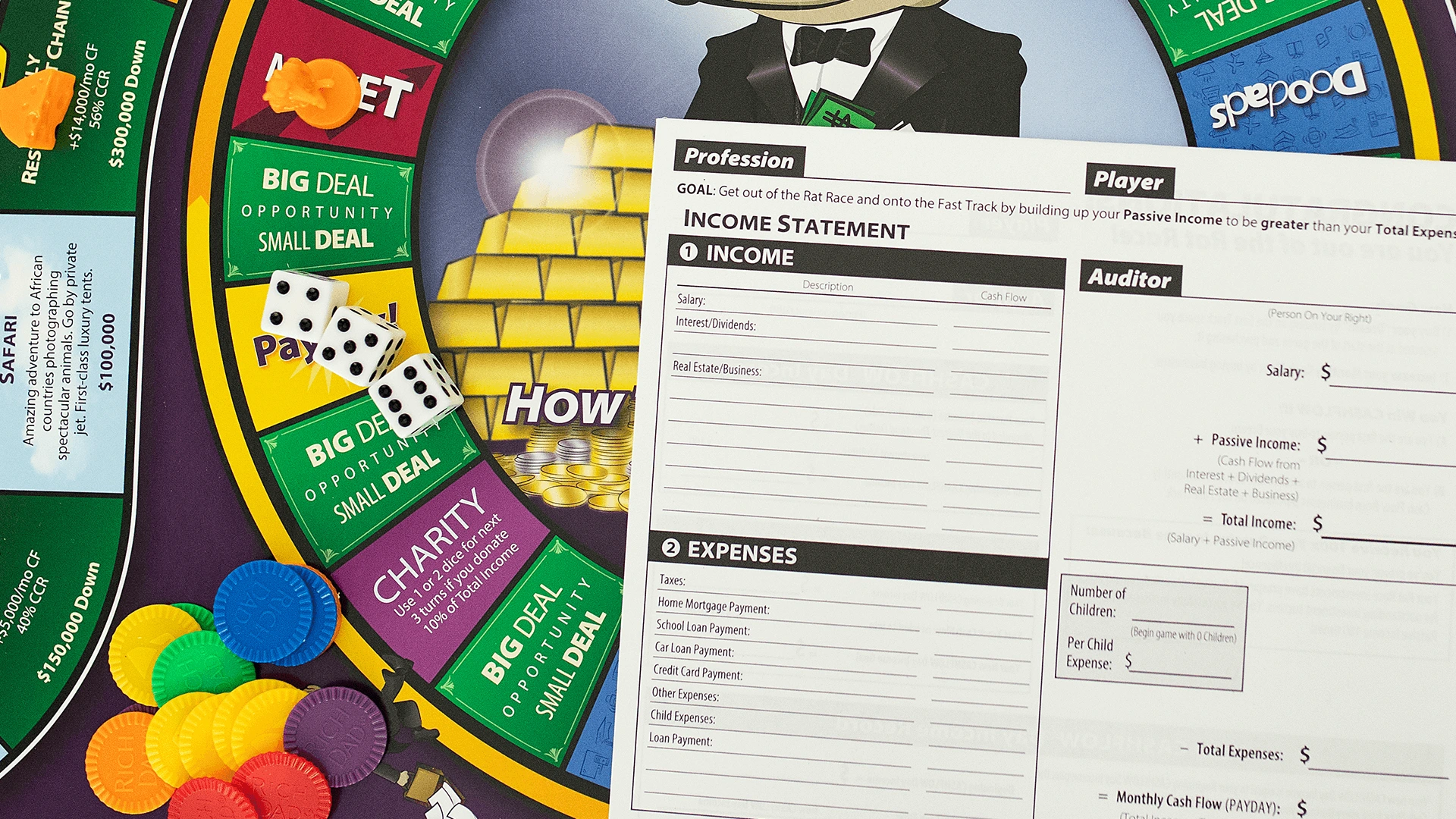

Easy to set-up, beautiful to follow

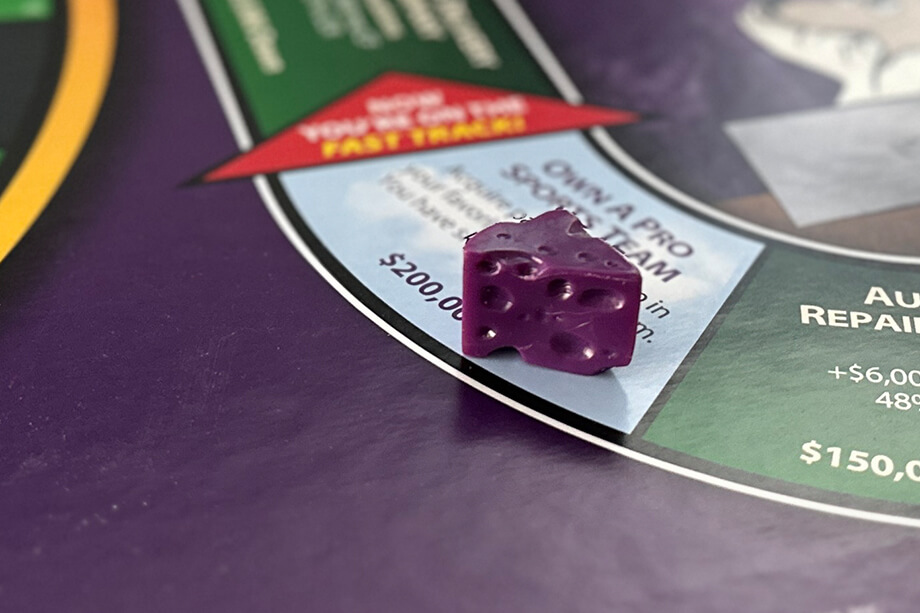

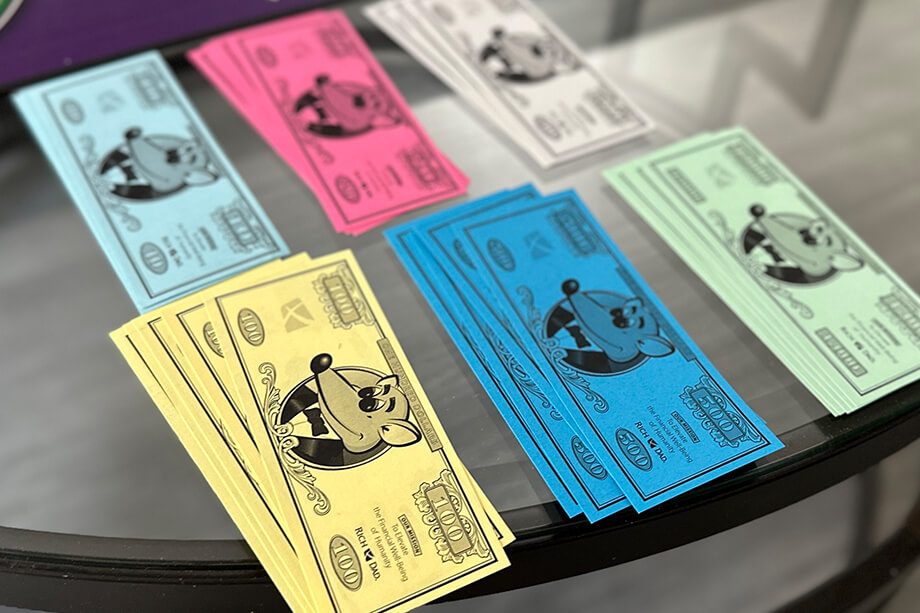

Pick your game piece from 6 eye-catching colors

Place the matching cheese of your dreams on the Fast Track

Keep track of your empire on the Fast Track

Go big or go home

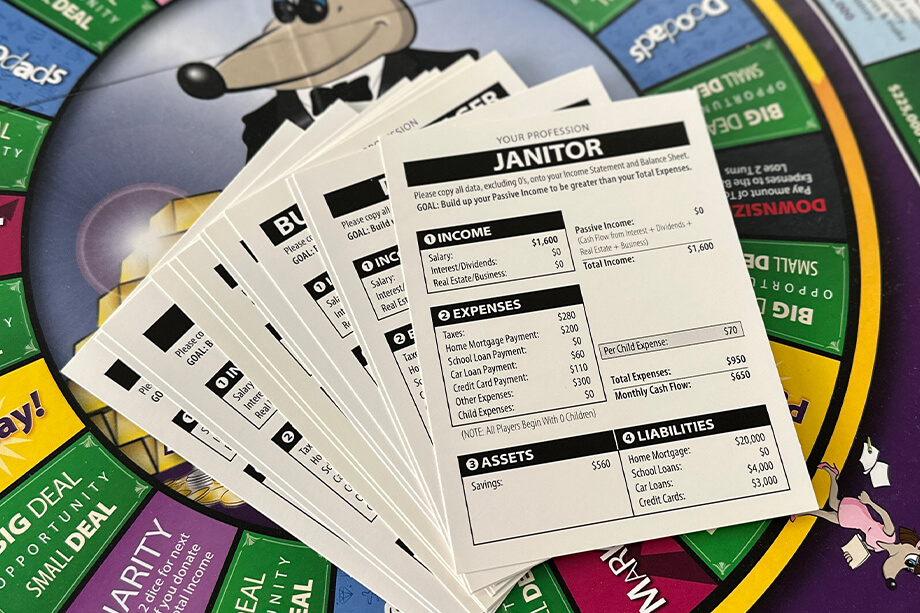

From janitor to CEO, pick your path

From janitor to CEO, pick your path

From janitor to CEO, pick your path

From janitor to CEO, pick your path

From janitor to CEO, pick your path

From janitor to CEO, pick your path

Income Statements

From janitor to CEO, pick your path

Select a Banker for the game.

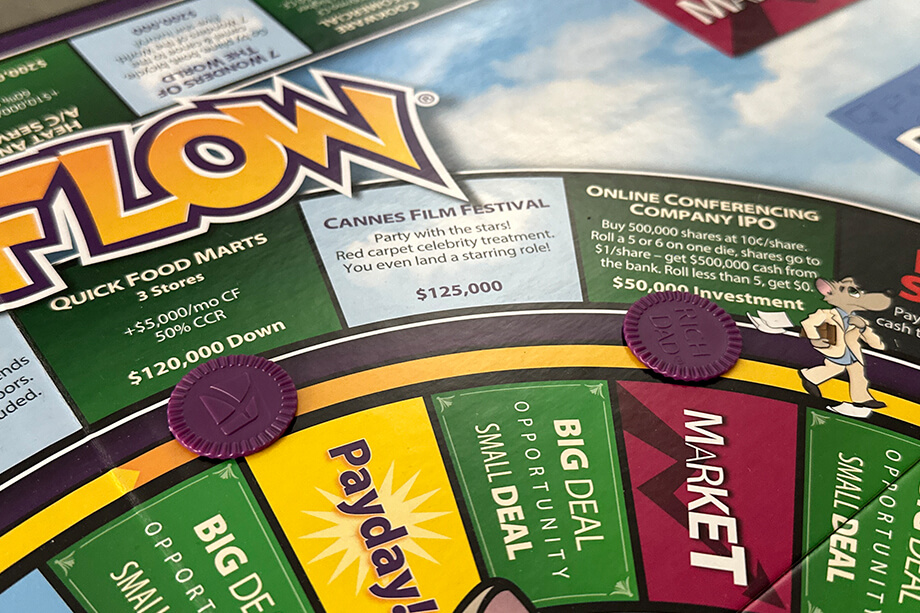

Place Big Deal, Small Deal, Market, and Doodads cards on the board.

Distribute a Financial Statement to each player.

Deal out one Profession Card to each player.

Transfer information from your Profession Card to your Financial Statement.

Meet your Auditor (player to your right).

Banker distributes cash (Monthly Cash Flow + Savings) to each player.

Choose your playing pieces: Rat, Cheese, and Tokens, all of the same color.

Choose your Dream on the Fast Track by placing your Cheese piece on it.

Place your Rat playing piece on the “Start” arrow on the Rat Race circle.

(Play clockwise)

Roll one die to determine who starts. The person who rolls the highest number starts first.

The first Player rolls one die and counts the green Big Deal/Small Deal space (above the “Start” arrow) as the first space.

| Feature | Monopoly | CASHFLOW |

|---|---|---|

| Creator | Charles Darrow (1935) | Robert Kiyosaki (1996) |

| Goal of the Game | Become the richest player by bankrupting others | Escape the Rat Race and achieve financial freedom |

| Core Strategy | Buy properties, collect rent, eliminate opponents | Acquire assets that generate passive income |

| Victory Condition | Last player standing with money and assets | Replace earned income with passive income |

| Focus on Debt | Generally avoided; debt can lead to bankruptcy | Debt is a strategic tool to leverage investments |

| Cash Flow Concept | Not emphasized | Central to gameplay—manage income, expenses, liabilities |

| Investment Types | Only real estate | Real estate, stocks, businesses, and more |

| Educational Value | Basic math and negotiation skills | Teaches personal finance, accounting, investing |

| Game Pace | Can be slow, with early elimination | Faster-paced; no player elimination |

| Player Emotion | Competitive, sometimes combative | Collaborative, reflective, educational |

| Real-Life Application | Limited | High—mirrors real-life financial scenarios |

| Teaches Financial Literacy? | No | Yes |

| Repetitiveness | High—same strategy each time | Low—multiple strategies and paths to win |

| Age Group | Ages 8+ | Ages 14+ (due to complexity and financial concepts) |

| Replayability | Moderate | High—each game varies with different financial choices |

First-timers might take 3-4 hours. Once you know the rules, games move faster. It’s fun and worth every minute.

Yes! Officially ages 14+, but savvy 9- to 13-year-olds love it. Great for family learning time.

Not at all. It’s easier than you think, and there’s a walkthrough to help. “Takes a while to figure out, but then it’s smooth,” says one fan.

Yes! Stocks, real estate, small business—it’s all here, and you’ll learn by doing.

Because it’s more than a game—it’s a full-on financial education you can play over and over. “Worth every penny,” says countless reviewers.

Let’s make your living room the first step toward getting out of the Rat Race. With every roll, you’ll move closer to the mindset, knowledge, and confidence it takes to live life on your own terms.

🎲 Click below to grab CASHFLOW® and turn game night into the smartest investment you’ll ever make!