Bed Bath & Beyond. Maybe you’ve heard of it? Perhaps it rings a bell but you can’t place it? Maybe you’ve seen it on the news?

Sarcasm aside, Bed Bath & Beyond, once a home goods haven, went bankrupt in April of 2023 after hundreds of millions of dollars in loans and funding to delay their final financial fate. That’s right — hundreds of millions. In 2022, BBBY took out a $375 million loan, followed by $1 billion hedge fund financing (that never went through), before ultimately closing hundreds of stores after failing to raise $300 million from investors through a share sale.

How could you have missed it?

Why Bed Bath & Beyond went bankrupt

While there are several speculations as to why BBBY went bankrupt, the leading theory is that the failure fell on the shoulders of its leadership and the chronic disconnection to their customers.

As Forbes put it:

“Legendary retailers fail in a predictable way. Their founders preside over rapid growth and market leadership. After the founders step back, aggressive rivals go after their customers and they lose market share.

They hire so-called professional CEOs from well-regarded rivals who bullheadedly apply what worked at their previous employer while skipping the crucially important step of listening to customers and giving them more of what they need than competitors do. That final failure sends the once-proud retailing icon into bankruptcy.”

Former Target Chief Merchandising Officer, Mark Tritton, was brought on as CEO, and his immediate strategy was to force the strategy of private label products — which worked at Target — onto a very different group of customers.

This strategy proved not only to be ineffective, but catastrophic. Tritton rescinded local store managers’ merchandising authority and forced them to discount branded goods on BBBY’s shelves to make way for his new strategy: replacing All-Clad cookware, OXO kitchen gadgets and other home goods alike, with private label items.

By the time Sue Gove took over in October of 2022, it was too late. Tritton’s strategy ultimately tanked BBBY’s revenue by 33% in November of 2022.

Forbes continued:

“In its bankruptcy filing, BBBY said at the end of November its total debt of $5.2 billion exceeded assets by $800 million. It owes money to ‘between 25,000 and 50,000’ creditors — Bank of New York Mellon ‘with a claim of $1.18 billion’ is its largest unsecured creditor.”

What could have helped — and maybe even saved Bed Bath & Beyond? Less focus on private labels and more focus on a better business system.

A better business system is not about product

While anyone can technically start a business, very few create businesses that continue to thrive. It’s easy for people to get excited about an idea of a new product that they believe is truly innovative and worth investing in. The truth is, the world is full of great products.

These people also believe their product is the best idea out there, better than any other existing product on the market—not unlike the leaders at BBBY felt. This, they think, also makes it foolproof.

Here’s a hard fact served cold: only those in the E (employee) and S (self-employed) quadrant of the CASHFLOW Quadrant, where being the best or highest quality is important for success, think that having the best product is most important.

In the B (big business) and I (investor) quadrant, however, the most important thing is the system behind the product or idea. Case in point, most of us can cook a better hamburger than McDonald’s, but few of us can build a better business system.

Rich dad said, “The product is the least important piece to inspect when evaluating a business.”

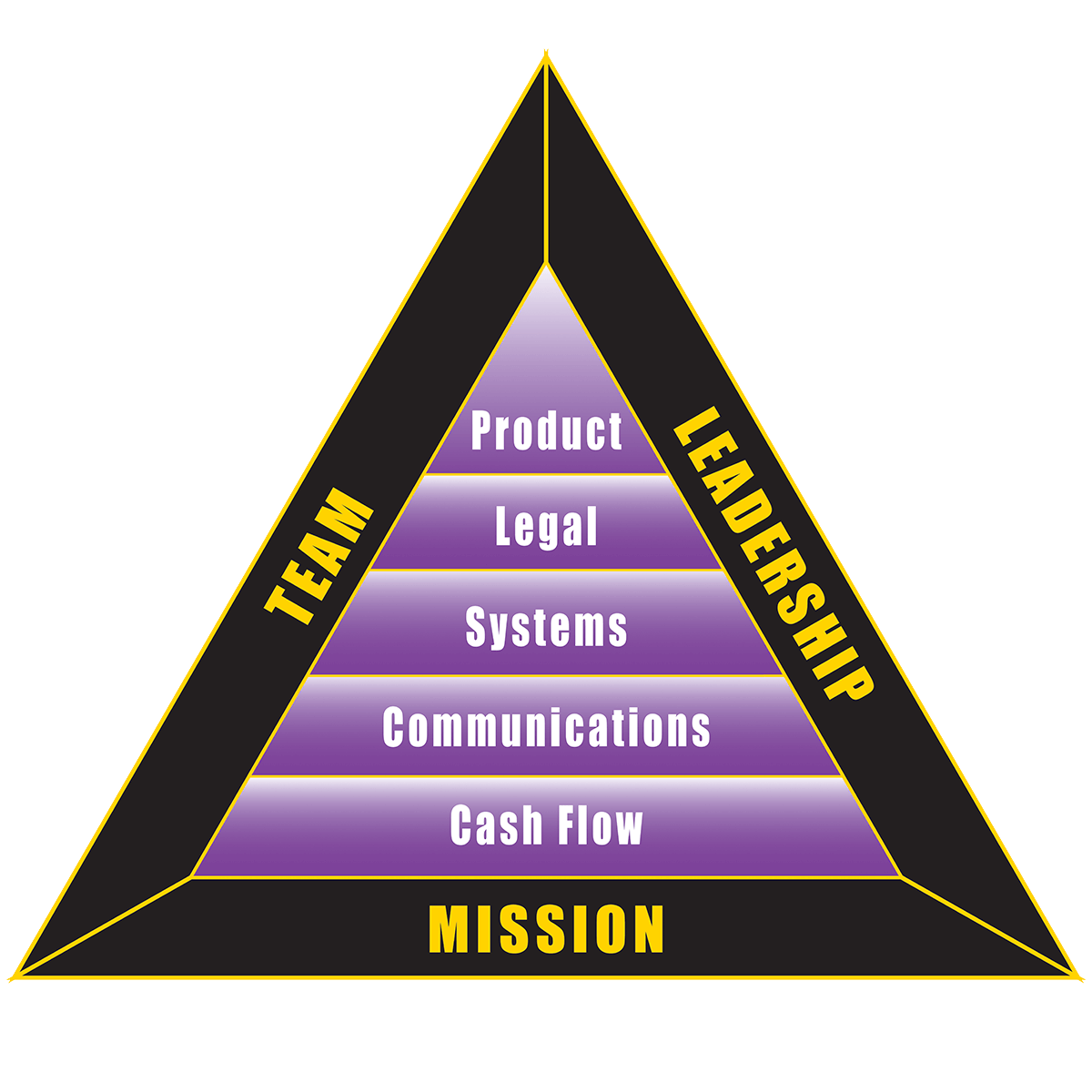

The best business systems excel in all eight integrities of Rich Dad’s B-I Triangle

Rich dad believed that a truly successful business was built on systems and that the product didn’t have to be the best if the systems were world class. It still had to be good, just not the best. That is why he always placed Product in the smallest portion of the B-I Triangle, his model for building the most successful businesses.

The B-I Triangle as a whole represents a strong system of systems, supported by a team with a leader, all working towards a common mission. It is made of eight vital components (or integrities), each of which are essential for success–the most important foundations being Mission, Leadership, and Team; without any one of these three, you are left with an unstable angle (and company).

Mission

At the base of the triangle, you’ll find the mission of the business. The mission will serve as a company’s focus, its beacon. Rather than be driven by the lure of profits, a company that stands on a clearly defined mission is much more likely to succeed.

Take for example, Henry Ford’s mission dedicated to making automobiles available to the masses: “Democratize the automobile.” It was Ford’s focus on this mission–not profits– that ultimately led to his financial success.

A mission that serves customers first, and serves them well, will:

• Keep the entrepreneurial spirit alive

• Serve as a north star in the early years

• Eventually produce profits

• Keep the business focused on the right priorities

It’s for this reason that the Mission lies at the foundation of the triangle.

Team

The second side of the triangle is Team. A commonly used rich dad mantra is “business and investing are team sports.” Simply put, success is not a one-man show. If there is no team work, the business will fail.

It’s important to note that a team is a collection of people who specialize in their own, specific areas. That means accountants, bankers, attorneys, insurance experts, and onward–all who provide their expertise to optimize a business’ operations.

The Team should be envisioned early on by the entrepreneur. Picking the right team relies heavily on understanding that you (the entrepreneur) can not (and are not) the expert on every aspect of the business. You are to tap the shoulders of trusted folks that are united in your business’ goals.

Leadership

The last side of the triangle is Leadership. This angle is critical for the execution of the entire B-I Triangle. One could argue that leadership can make or break the company focused on the mission, while simultaneously keeping the team in tact.

Leaders wear many hats, not just that of authority. As a visionary, a leader is who keeps all eyes on the mission while encouraging the morale of the team. They should be humble enough to hear the feedback from all team-members, and be trusted enough to make the tough decisions based on these conversations.

Finally, it’s important to note that leaders know they’re not the smartest people in the room. They are experts in utilizing the expertise of the team, and inspiring action that fulfills the company’s mission and goals.

As such, a business with the right Mission, Team, and Leadership has designed a company rooted in the B-I Triangle, and destined to succeed.

Cash flow always follows management

If any of the management functions of the B-I Triangle’s five internal levels (Cash Flow, Communications, Systems, Legal, and Product) are weak, the company will be weak. If you are personally having financial difficulty, or not having the excess cash flow you desire, you can often find the weak spots by analyzing each level. Once you identify your weakness, you may then want to consider turning it into your strength, or hiring someone else with that strength.

In the case of Bed Bath & Beyond, it’s obvious that Leadership’s vision for the future of BBBY was a major problem. Additionally, this may have led to exits of key talent, which is a weakness in Team. They’re spending money like drunken sailors, a weakness in Cash Flow, thus creating a breeding ground of underlying — and inevitable — problems in Legal and Systems.

Any one of these business system weaknesses would be enough to sink less-funded companies. All of them most likely led to such a lackluster launch for a highly touted product.

That means some of the best investments and businesses are the ones you walk away from; if any of the five levels in the B-I Triangle are weak and the management is not prepared to strengthen them, it is best to walk away from the investment.

The digital age makes Rich Dad’s B-I Triangle available to everyone

Despite being “rescued” by Overstock, there are many lessons to learn from Bed Bath & Beyond’s colossal mistakes when it comes to your own business or a business you wish to start.

It has never been easier to access great wealth than in today’s day and age. In the Industrial Age, you needed millions of dollars to build a car factory. Today, with a used computer, some brainpower, a phone, and a little education in each of the eight integrities of the B-I Triangle, the world can be yours.

If you want to be a successful entrepreneur who builds successful businesses or invests in them, the entire B-I Triangle must be strong and interdependent. If it is, the businesses will grow and flourish.

The good news is that if you are a team player, you don’t have to be an expert at every level. Just become part of a winning team with a clear vision, a strong mission, and an iron stomach. Find that, and you’ll be well on your way to success.

FAQs

The company’s brand remained largely recognizable, but disconnected from its core customers because of poor prioritization by leadership. Simply put, Bed Bath & Beyond went bankrupt due to a broken system.

Contrary to popular belief, a brilliant product is not enough to carry a business. A successful business is defined by having the best system behind the product.

The B-I triangle clearly outlines the eight integrities of the best business systems. Primarily, a business needs strong, world-class systems all cohesively established and supported by the right mission, leadership, and team.

For starters,the digital age makes the B-I Triangle available to everyone. Digital tools provide universal access to education and information on how to grow one’s business strategically by using the eight-integrities.