It’s all around you. You use it everyday. You can’t live without it. But do you really know what it is?

Money.

If you want to be rich, i.e. have a lot of money, then it would follow that you need to know what money is and how money works. Unfortunately, many people think that they know these things, but in reality, they don’t. And that is one of the reasons why they never get rich.

What is money?

The first thing you must understand when you ask the question, “what is money?” is that money has evolved over time.

“Money” was originally in the form of barter, such as chickens or milk, then shells and beads, then gold, silver, and copper coins. They were physical objects that were deemed to have tangible value, and thus were traded for other items of a similar value.

Today, most money is paper money, an IOU from a government, also known as a fiat currency. Paper money is worthless in and of itself. It is simply a derivative of the value of something else.

In the past, the dollar was a derivative of gold; now it is a derivative of debt, an IOU from taxpayers of a country.

Today, money is no longer a tangible object like chickens, gold, or silver. Today, modern money is simply an idea backed by the faith and trust of a government. The more trustworthy the country, the more valuable the money, and vice versa.

This evolution of money from a tangible object into an idea is one reason why the subject of money is so confusing. It is difficult to understand something we can no longer see, touch, or feel.

How does money work?

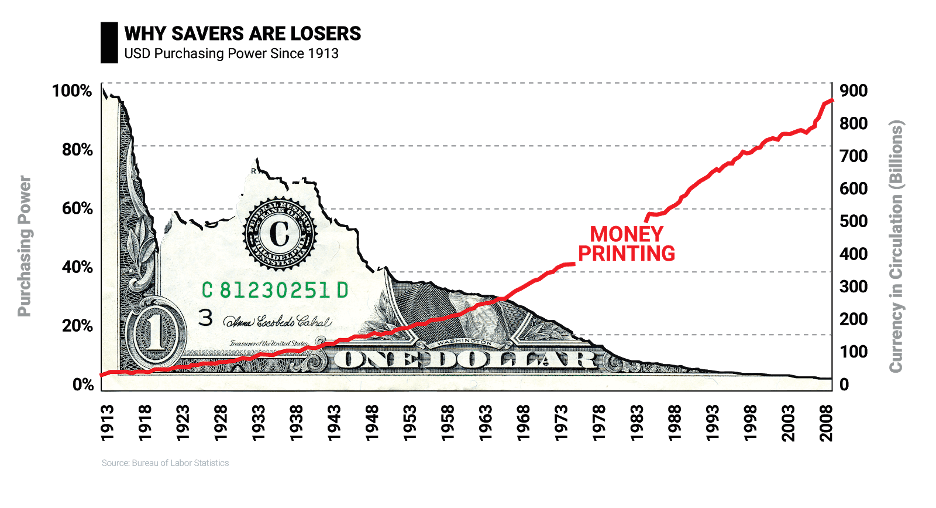

Today, what most people call money, we at Rich Dad would call “fake money.” It’s not that fake money isn’t useful. It is. It’s just that today’s money, which is really currency, has no intrinsic value in and of itself, unlike gold or silver, which has value and has always had value.

Unfortunately, most people do not understand this. They believe that money such as dollars are actually of value. This is why so many people think that it is financially smart to save money. But if you’ve read some of our other articles, you probably already know that savers are losers.

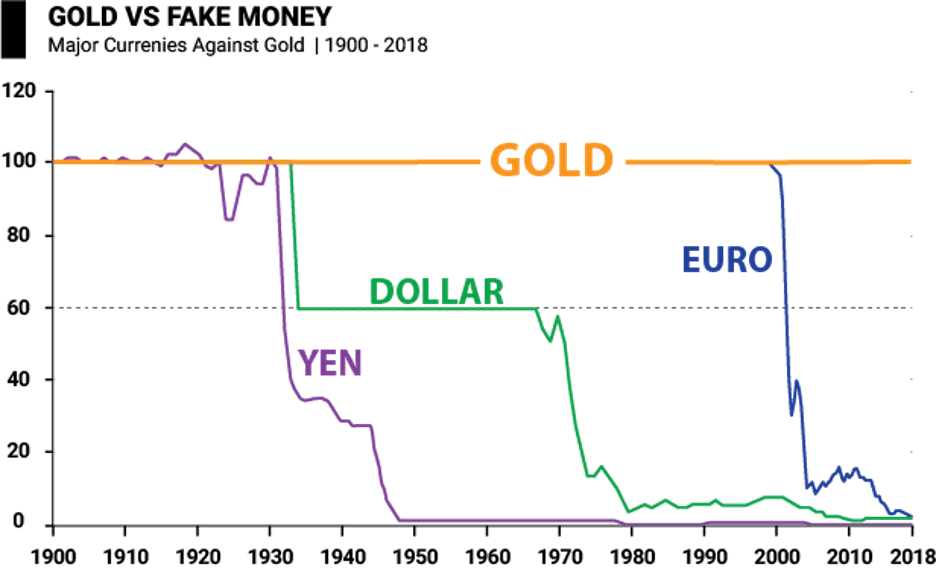

If you want to be rich, you have to understand how money as it is called today works. Today’s money is a currency. It is a representation of the faith economies have in a country’s economy rather than something of value like gold. This is because in 1971 President Nixon took the US dollar off the gold standard. This is when it became fake. It was only based on the “full faith and credit” of the US…a giant IOU. Other countries followed suit.

The word currency derives from the word current. Like a current, today money must keep moving in order to survive. Here’s an example of what happens to money—currency—over time.

As you can see, the value of fake money always goes to zero relative to real money. This is partially because governments can print as much as they want since it is tied to nothing of value…it is just paper.

How the rich use money

The rich understand this, so they always keep their money moving into things with tangible value: assets. Additionally, they invest their money in assets that produce more money in the form of cash flow, which they can use to invest in more assets.

This is the velocity of money, and it is the reason why some people are rich and most others are poor.

You can find the formula for using money to get rich, the formula for velocity of money, in another post, but we’ll share it here as well:

- Invest my money into an asset

- Get my money back

- Keep control of the asset

- Move my money into a new asset

- Repeat the process

If you want to read about the formula in detail, and see an example of it in practice, read the article, “Velocity of Money: The Secret to How the Rich Get Richer and the Poor Get Poorer.”

To use money like the rich, you have to know the language of money

When a student goes to medical school, she learns the language of medicine and is soon speaking of diastolic pressure versus systolic pressure. When Robert Kiyosaki went to flight school, he had to learn the language of a pilot. He soon spoke words such as “altimeter,” “aileron,” and “rudder.” When he shifted to helicopters, he used different words such as “cyclic,” “collective,” and “rotors.” He could not have succeeded as a pilot if he did not know these words. The same holds true for learning the language of money.

If you want to be rich, you must learn how to speak about money the way the rich do. When you learn the language of money, you learn the language of the 10 percent of the world that does not have to worry about money. By investing a little time every day to learn the words of money, you have a better chance of being part of this 10 percent.

More important, by learning the words of money, you will lessen the chances of being fooled by the false prophets of money-the same false prophets that preach the old rules of money: save money, buy a house, get out of debt, and invest for the long term in a well-diversified portfolio of mutual funds.

The good news is it doesn’t cost much to learn the vocabulary of money. In fact, you can learn most of it for free by researching online, checking out finance books at the library, and reading financial news.

Knowledge begins with words

Since money is knowledge, it follows that knowledge begins with words. Words are the fuel for our brain, and words shape our reality. If you use the wrong words, poor words, you will have poor thoughts and a poor life. Using poor words is the same as using bad gasoline in a good car.

But words alone are not enough. They are simply a manifestation of your mindset. Changing your mindset begins with changing your words. The following are the words that people with different mindsets in the CASHFLOW Quadrant use.

Employee (E)-quadrant words

A person who comes from the E quadrant might say, “I’m looking for a safe, secure job with good pay and excellent benefits.”

Words like these indicate that a person’s core value is security in the face of fear. People who embrace security as a response to fear like to have things in writing, knowing exactly what they’ll make and what their benefits are, such as health insurance provided by the employer. For them, the idea of security is often more important than money.

Employees can be presidents of companies…or janitors. It’s not so much what they do but the contractual agreement they have, that’s important to them.

Self-employee (S)-quadrant words

A person who comes from the S quadrant might say, “My rate is $75 per hour.” Or, “My normal commission rate is six percent.” Or, “I can’t seem to find good people to work on this project and get the job done right.” Or, “I’ve got more than twenty hours into this project.”

Those in the S quadrant like to be their own boss or “do their own thing.” When it comes to money, those in the S quadrant don’t like to have their income dependent on other people. If they work hard, they expect to get paid for their work. Conversely, they understand that if they don’t work hard, they don’t deserve to get paid well. They have fiercely independent souls.

Business owner (B)-Quadrant words

A person operating out of the B quadrant might say, “I’m looking for a new president to run my company.”

Those in the B quadrant are almost the opposite of those in the S quadrant. They like to surround themselves with people who can do the job better than they can. Their true motto is, “Why do it yourself when you can hire someone to do it for you, and they can do it better?”

Those in the B quadrant like to work on their company and hire smarter people to work in it.

Investor (I)-Quadrant words

Someone operating from the I quadrant might say, “Is my cash flow based on an internal rate of return or a net rate of return?”

Investors make money with money. They don‘t have to work because their money is working for them. Because of this, they know how money works. They understand the language of money, and they speak it fluently.

What do your words say about you?

Have you ever stopped and listened to the words that you use? A good exercise this week would be to slow down and listen to yourself. Find out what you say and how you say it. You may find that at your core, you’re someone different than you thought you were.

The same holds for those you work with or who work for you. Listen to their words this week as well.

In the end, our words are good indicators of what’s really important to us. The good news is that once we understand who we are at our core, we can then decide if we like that person or if we want to aspire to be something more. But it all starts with listening.