Blog | Personal Finance

How Strong is Your Financial Plan?

New Rule of Money #4: Build a financial plan to withstand the hard times

Rich Dad Personal Finance Team

April 04, 2023

Summary

-

Having a strong financial plan will provide more security when the hard times come

-

Building a financial plan that will weather the hard times requires basic understanding of your finances

-

Investing in a financial education is the key to having a solid financial plan

What are you doing with your money? Where is your money going? How is your money spent each month? Are you being wise with your money?

It’s so easy to lie to ourselves about what we really spend on eating out, clothes, or vacations. And it’s easy to pretend our investments are making money—or at least breaking even.

These are all personal finance planning questions that we should have answers to off the top of our head. But the reality is that most of the time we don’t. This is partly because we all lead busy lives and it’s hard to stay on top of our finances. But sometimes it’s also because we know deep down that we’re not making good financial decisions, but we don’t want to face the truth of it.

It’s so easy to lie to ourselves about what we really spend on eating out, clothes, or vacations. And it’s easy to pretend our investments are making money—or at least breaking even.

It can be uncomfortable to face the facts and learn that you’re actually spending more every month than you’re making, or that the money you placed in that mutual fund, which the “experts” told you would make 10 percent, actually lost 20 percent last year.

But here’s the deal: The truth shall set you free. Once you get a handle on your personal finance management, you’ll be able to improve your situation.

Are you prepared for trouble?

More than likely, you’ve heard the story of the three little pigs, and the big, bad wolf. As the story goes, there were three little pigs. One built his house out of straw, another out of sticks, and the third out of bricks.

The first two pigs finished their houses before the third, who was building a brick house that took longer to finish. They were laughing and playing, and enjoying life while the third pig worked. Eventually, the third pig finished and joined the other two pigs to laugh, sing, and play.

Then, one day a big, bad wolf came along and saw three tasty meals. He quickly blew down the houses made of straw and sticks. Thankfully, the pigs were able to run to the brick house, which the wolf, try as he might, could never blow down. The two pigs learned their lesson and eventually built their own brick houses. They lived happily ever after.

As many found out, 2020 brought a big, bad wolf to the world in the form of COVID-19. Millions were infected, hundreds of thousands died, and millions more have been financially devastated.

In the US alone, 47.1 million Americans filed for unemployment. Untold numbers of small business owners have gone out of business. People have lost their homes and way of life. Layer on top of this the fact that most people only have financial houses of straw and sticks with very little money saved and no investments to speak of, and you have a lot of people with their financial houses fully blown over by the big, bad wolf of COVID-19.

Bad times are always coming

The truth is that the global pandemic is not the first financial big, bad wolf to come, and it will not be the last. Bad times are certain to come. The only question is will you be ready for them? Will you have a financial house of bricks, or will you have a financial house of straw and sticks?

Today, unfortunately, most people have financial houses made of straw and sticks, and there are all sorts of wolves that live out there in the darkness ready to destroy those houses.

The problem behind the two pigs that didn’t build their houses out of brick is that they didn’t think bad times would come, so they put in little effort. Of course, trouble did come, and when it did, only the pig who built a house of bricks was ready. He prepared for the bad times.

Today, if you want to prosper financially, you have to prepare for trouble and change, and build a financial house of bricks.

Build a financial plan made of "bricks"

Rich dad said, “Those who are financially intelligent can make money in both up markets and down markets.”

During the last great recession, many people lost almost everything. Sadly, people lost homes, retirement funds, and more. Some even took their own lives.

For others, however, the story was different. They made more money than ever.

How?

They understood the new rules of money and had prepared for the bad times. They knew they were coming, and they were ready.

How to create your financial plan - 3 easy steps

Are you ready to build your own personal financial plan? Here are the steps to follow:

Maybe you want more control over your life and your finances. Maybe you are in debt and want to break free of the chains of debt payment. Maybe you’ve recently gone through a change in lifestyle that necessitates you getting your financial plan together. Whatever it is, be crystal clear on the reason why you are starting this journey. Hold on to it tight. Write it on a post-it note and put it somewhere you can see it. Your reason why will get you through those times when things don't go as planned, or when you start to doubt yourself. Having a compelling motive will keep you going.

Take stock of where you are today financially. What's your current financial status? Determine how wealthy you really are by asking yourself this question: If I stopped working today, how many days could I survive financially?

Look at your monthly expenses. Add up how much money you have in savings, stocks, and cash flow. Then, it’s time to calculate your wealth number.

Follow this equation:

Your Income ÷ Monthly Expenses = Your Wealth

Many people are surprised to learn this number — so if it shocks you, that’s OK. Knowing it is half the battle, and hopefully enough to motivate you to make some changes to your financial future.

- Find your reason why. Start by figuring out the reason you are finally deciding to become financially free.

- Determine where you are today. Before you can get to where you want to go, you have to know where you are. Be completely honest about your earnings, and brutally honest about your expenses.

- Decide which investment plan is best for your lifestyle. Now that you know where you are financially, where do you want to go from here? And, more importantly, how will you get there? In this part of the planning process, there are two questions to ask yourself:

- Am I investing for capital gains or for cash flow? Capital gains come when you buy an investment like a stock, and it appreciates so that you can sell it for more than you bought it. Or if you buy a house, fix it up, and flip it for capital gains. Cash flow is when you invest in an asset that pays you a certain amount each month, such as buying a house and renting it out. That monthly rent check becomes your cash flow.>/p>

Both are good investment options, and this decision comes down to personal choice (for us, cash flow is the clear winner!). The second question to ask yourself is:

- What's my goal?

Is your goal to be financially free? Is your goal to get out of debt? Is your goal to earn enough that you can quit your job and devote more time to your family or passions? Whatever it is, have a tangible goal that you can work toward.

Personal Finance Basics

Once you’ve gathered all the information from steps 1-3 above, it’s time to put all those facts and figures on your personal financial statement. What’s that? It’s comprised of two things:

- An income statement , which is made up of income (money flowing in) and expenses (money flowing out).

- A balance sheet , which consists of your assets (things that put money in your pocket) and liabilities (things that take money out of your pocket). Oh, and if you think your house is an asset, guess again! Watch this quick video to learn why your house is actually a liability.

Now, if you aren’t quite sure how to fill out these forms, that’s OK. Start by examining this example of a personal financial statement and you’ll be on your way to having everything you need to know about your current financial state right at your fingertips. Then, you’ll update this information as things change — especially as you begin to invest.

Building a financial plan takes different education

Now that you’ve got a firm understanding of the financial planning basics, you need a different kind of education to build a financial house of bricks.

There are three types of education:

-

Academic education: This is your traditional school where you learn how to read, write, and do math. These are important things, but you do not learn how money works. You can be one of the smartest people in the world, academically speaking, but be very stupid when it comes to money. Lots of very academically gifted people have financial houses of straw and sticks.

-

Professional education: If you want to be a specialist, like a doctor or lawyer, you need a professional education. This is also important, but again, you do not learn how money works. You can make a lot of money with a professional education, but you won’t know how to manage it. There are lots of professionals with financial houses of sticks and straws.

-

Financial education: It is important to have academic and professional education, but if you don’t have financial education, you have an incomplete education. There are very different lessons you need to learn about money in order to have a complete financial education. Those who master the lessons of money are able to build financial houses of bricks.

How can you get a financial education? Not from a traditional school. You have to find alternative ways to learn. You’ll find a lot on our website about the importance of learning by doing and playing games, for instance. Games like CASHFLOW are designed to teach you valuable lessons about money in a fun and interactive way. You can even play CASHFLOW for free online.

Other ways to get a financial education are to read books, listen to podcasts, take classes from real investors and business owners, find a coach, attend seminars and networking events, and find a mentor.

Building a financial plan takes a different intelligence

It is not enough, however, to have just head knowledge when it comes to financial security to keep you safe during bad times. You also have to have a different kind of intelligence.

A while back, Robert Kiyosaki wrote about the seven types of intelligence as developed by Howard Gardner, a professor at the Harvard Graduate School of Education, in his book, "Frames of Mind: The Theory of Multiple Intelligences."

While many people think of intelligence one-dimensionally, Gardner believed that there were many types of intelligence that need to be nurtured and accommodated.

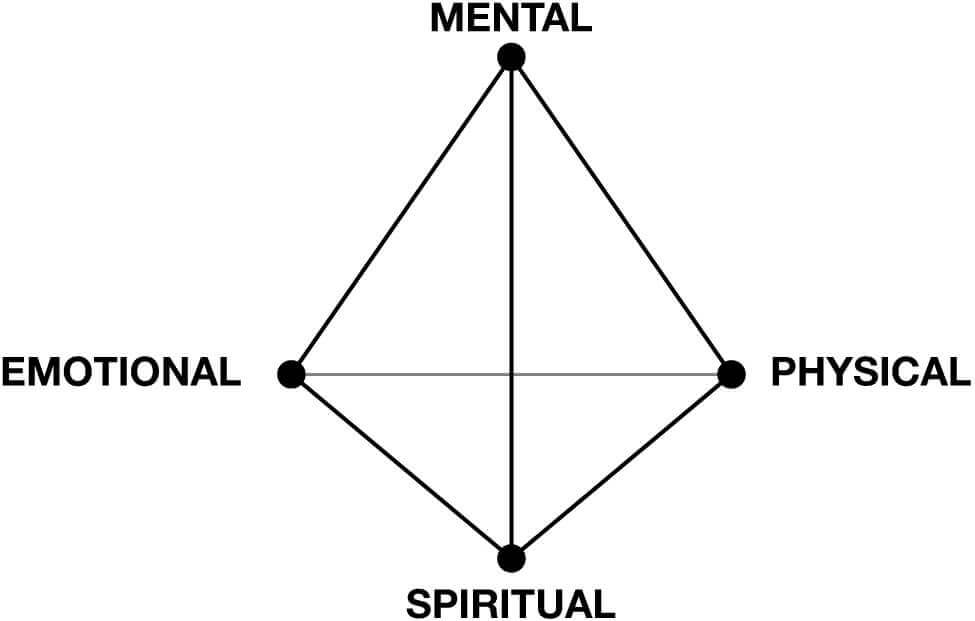

Over the years, Robert Kiyosaki has generalized these intelligences into the four types of intelligences below.

Mental intelligence is what most people equate with intelligence. It is head knowledge. It is very important, but without the other three intelligences, it is lacking.

Some people excel at learning physically. They have to do, not hear or read. This is what we call physical intelligence.

Spiritual intelligence is not just something you get in church, but rather it is the intelligence you gain when you are inspired by something. For instance, there is a spirit that is created when you watch special olympic athletes compete and push their bodies to the limit. That inspires something inside you.

Emotional intelligence is the maturity to keep a cool head and master your emotions to respond the right way in all situations, including very difficult ones.

If you want to be rich and be prepared for bad times, the most important intelligence you can develop is emotional intelligence.

At Rich Dad, we firmly believe that financial intelligence is 90% emotional and 10% technical information about finance and money. The reason for this is that most people struggle financially because of fear. They are afraid to take the leap to a new business idea. They are afraid that they will lose money in an investment. They are afraid of what they don’t know about money. They are afraid that they won’t survive bad times.

If you want to build a financial house of bricks, you need emotional intelligence to overcome your fear. Only then can you thrive in times of change and trouble.

Again, money is knowledge

This goes back to the first new rule of money: money is knowledge.

By knowing how money works and that it’s always flowing to new places, you can continually educate yourself about what is happening in the markets.

For instance, when the Fed began lowering interest rates, Robert knew that it would put pressure on the dollar, making it worth less and less. So he and Kim moved into commodities like gold, oil, and cryptocurrencies, which usually gain in value when the dollar’s purchasing power is less. They were then able to sell those investments at a high profit and move that money into multifamily properties as interest rates were at record lows and when property values were low. Today, those investments are paying off.

All of this was because they invested for years in their financial education, knew the new rules of money, and were prepared for the bad times to know only good times.

You can do the same. It starts with financial education and continues with putting what you learn into practice. The old rules of money, like saving and getting a solid job, will never hold up during the bad times. Today, it’s time to start building your financial house of bricks so you too can know only good times.

Original publish date:

June 14, 2016