Blog | Cryptocurrency

Bitcoin, Cryptocurrencies and the Stock Market

July 06, 2020

[June 2020 update] Though bitcoin and other cryptocurrencies are tracking with the stock market, a divergence could be in the near future.

Lifelong learning

Rich dad said, “The most successful people in life are the ones who ask questions. They’re always learning. They’re always growing. They’re always pushing.”

Conversely, rich dad said, “The losers in life think they have all the answers. They can’t learn because they’re too busy telling everyone what they know. They can’t grow because they’re too busy telling everyone else where they need to grow. They can’t push because they think they’ve already arrived.”

Over the years, I’ve taken rich dad’s lessons to heart and tried my best to always ask questions so that I can learn, grow, and push myself to become more successful. I do not take where I am in life for granted and I do not think I have all the answers.

This is why even though I hold financial education webinars, write books and articles, and speak with the media, I still watch YouTube, read many books, and pay attention to the news. I always have something to learn, and the world is full of teachers.

The reason for great success

My greatest teachers and mentors are successful for a reason. They’re willing to put in the effort required to always keep learning. They understand that financial success is not a sprint but instead a marathon. They get out there and put their feet to the pavement day in and day out. They stay humble. And they have an insatiable curiosity.

If you want to be successful in life, you could learn a few things from them. Because when it comes to investing, there are three methods to choose from:

-

Keep up with change.

-

Keep ahead of change.

-

Get passed up by change.

Why? Because in the financial markets, nothing stays the same. The rules are always changing. To be a winning investor, you’ve got to change as the markets change. And that means always learning.

One of the areas I find most important today, and most challenging, is in the area of cryptocurrencies. They are so new, so volatile, and mutating so fast that the learning is at the speed of light.

So when I study cryptocurrencies, I talk with Jeff Wang. I’ve asked him to explain the craziness the world just experienced in the month of June, 2020 and apply it to his incredible knowledge around Bitcoin and cryptocurrencies.

Jeff Wang on Bitcoin and Ethereum

Although hard to believe, the crypto market was overall very stable during the month of June. Bitcoin and Ethereum held their positions (with the exception of DeFi projects creating a new category for Yield Farming), but strangely, were tightly correlated with the stock market.

Before we get into the crypto action, I think it best to examine what’s happening in the broader world, because I think it is important as it affects crypto.

The overall stock market stayed up

>

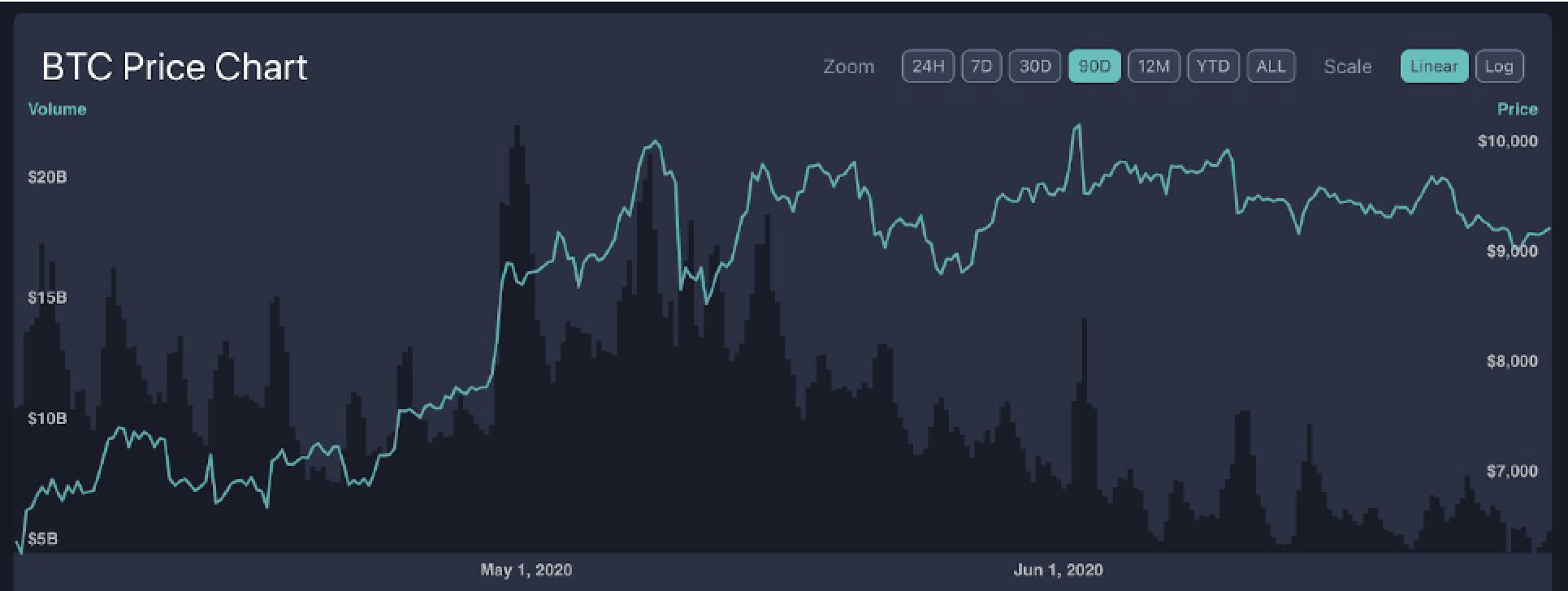

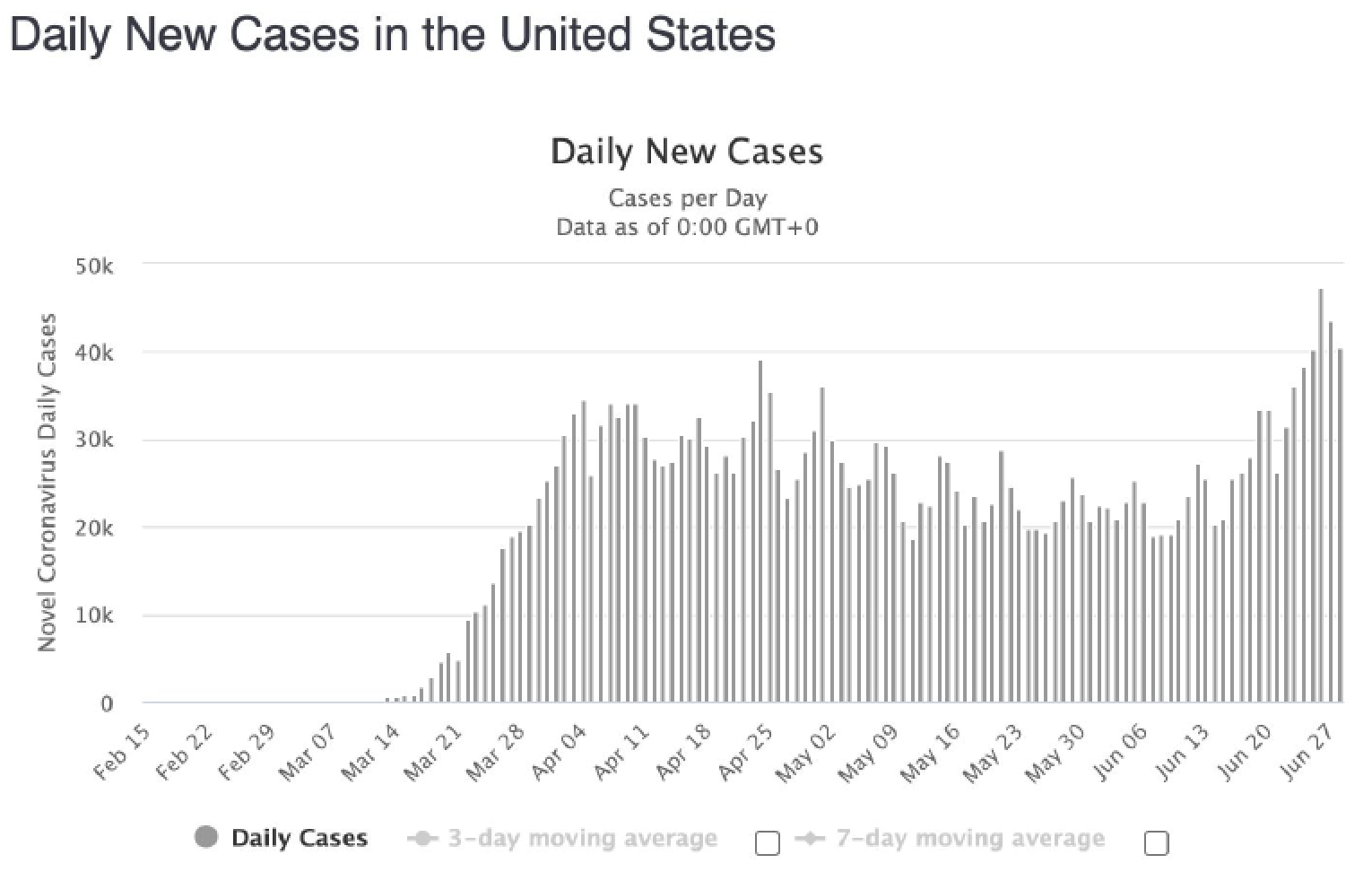

Despite record levels of unemployment and the uncertainty of how many job losses were permanent, the stock market kept going up (though not as much in June). The momentum was disrupted in June however, when coronavirus cases reversed in America:

The coronavirus is back

Notice how since June 10th, the reversal has been noticed in both charts. Why is this chart concerning? I’ll do the list a few reason style since it’s easier to digest:

-

We have slowly started re-opening, and this reversal means that we may not be prepared yet to open the economy. This may force a second shutdown, thereby extending the unemployment and stimulus needed to sustain the economy.

-

Finally, we really have no good outcome here, we either shutdown or we don’t, or we have some partial opening we can be comfortable with. Either way, travel, events, and hospitality industries are in trouble for a while longer with this chart reversal.

Now coming back to the stock market, why is it that the unemployment rate at 16% and concerns for the coronavirus second shutdown are not affecting prices? Here we go again:

There’s a lot of retail cash. For example, the recent surge of sign ups for stock trading app Robin Hood have pumped up some stocks more than crypto which usually moves in the past month.

-

The government will step in. We have seen this in previous recessions where the government will simply sell more debt (ie. print more money). This will prevent any collapse, but it gets fishy on how this affects the economy long term.

-

The stock market is skewed towards tech companies already. Which have not been as affected as other sectors, and earnings for tech companies are still rising in many cases.

-

It’s pricing in the future. This should only be “offset” vs. crippled (but by 6 months? Or more?)

-

Jobs will come back. However, there are projections that 40% of the jobs are permanently loss (so around 6% of all jobs)

-

There’s a lot of retail cash. For example, the recent surge of sign ups for stock trading app Robin Hood have pumped up some stocks more than crypto which usually moves in the past month.

However I’m still worried about unforeseen circumstances, like, what if we are not offset by a couple months, but a couple of years? Or what if things like evictions cause a domino effect of foreclosures? Or the effect of the United States never being able to overcome this debt (which was already very high)? Currently, the stock market hasn’t reflected any of those scenarios, but one could also argue that an expanded balance sheet from the Fed also means higher inflation. That is where crypto comes into the picture.

What happened to crypto?

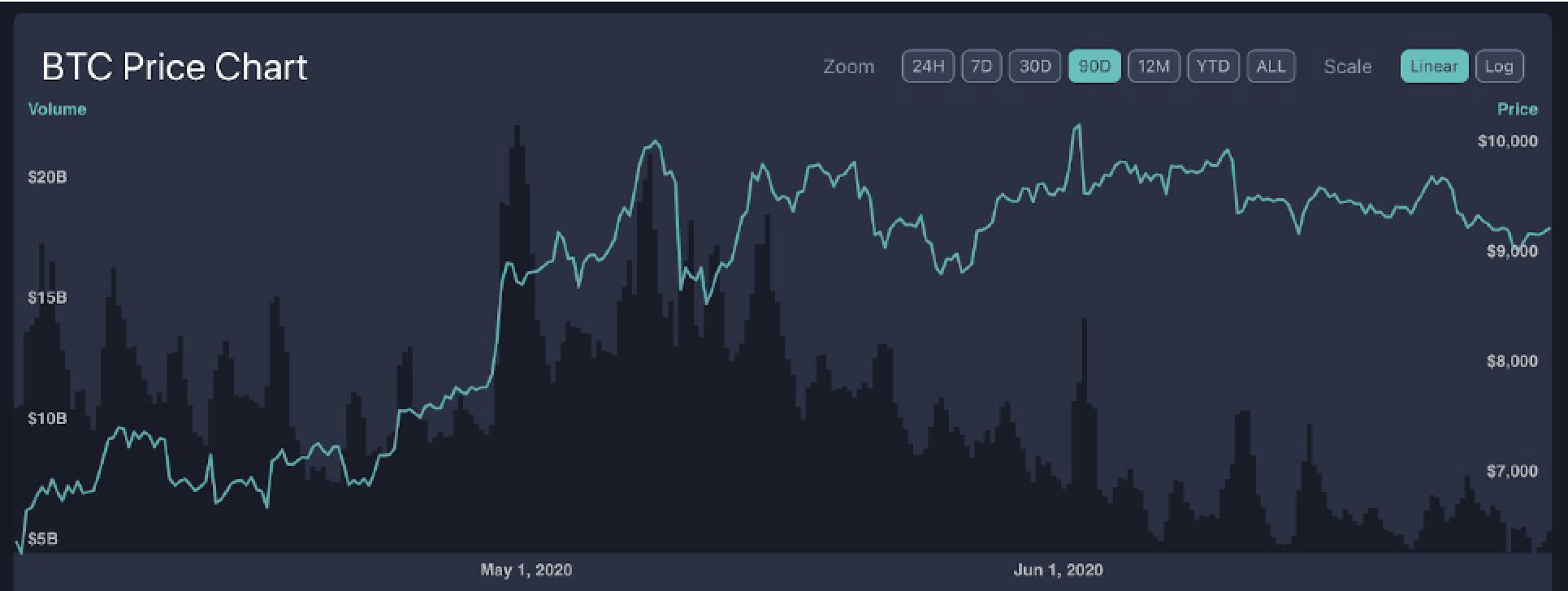

Strangely, cryptocurrencies are still tightly correlated to the S&P 500, which in turn, is inversely correlated to the coronavirus chart. That means as cases go up, the stock market goes down, and that crypto could potentially go down:

Notice how it looks like a mirror of the S&P 500. And even with Ethereum outperforming Bitcoin, it still suffered the same consequences:

If you are a member of my monthly newsletter you will recall that we avoided several major dip days by selling before the big drops in the stock market by looking at futures. This strategy still holds. So the question is, what will it take for crypto to break the trend from the S&P 500? It’s time for another list.

Positive factors

-

US Dollar experiences increased inflation pressures. This will cause Bitcoin and other crypto assets likely to rise in value as capital flees to assets that will not lose value (also Bitcoin is historically negatively correlated with the dollar).

-

Technology breakthroughs. Similar to how Ethereum 2.0 brings back spotlight projects that are more feasible on increased technology; however, even with other projects seemingly fixing a lot of scaling issues, we are not seeing a surge in product market fit.

-

Central Bank Digital Currencies become the norm. With so many countries relying on some form of blockchain to create their currencies, existing assets look more appealing as their technology is validated.

Possible negative factors

-

Regulatory issues increase. Countries are starting to make sure there are laws to govern decentralized technologies. In the broader sense, there is a growing distrust of technology companies. Facebook, for example, is running into ad companies dropping out. In addition, India is looking to be more aggressive with the recent Tik Tok ban.

-

A big market correction. This would have people take capital out of risky assets, including crypto, also why the market is tightly correlated to S&P 500, we are in a dangerous game of “what happens next”

-

Crypto technology never reaches the mainstream market. Meaning, who cares? And then crypto loses relevance. That’s a very real risk, though the overall market currently looks optimistic.

Robert Kiyosaki

Jeff just summarized why the prices behaved as they did in June.

Side note: If you would like to hear about some interesting events and future projects to be aware of in the cryptocurrency area, you will want to join Jeff’s newsletter where he creates videos for you to explain the latest happens in the cryptocurrency investing space and helps you understand where Jeff is looking to invest. You can access his newsletter here FREE for on week as Jeff is offering you a trial membership:

Making a difference

The Rich Dad Company's mission is to elevate the financial well-being of humanity. Kim and I have carried that mission with us from the moment we set out on our journey. We knew it was going to be a long road, but we knew that we could make a difference and help others achieve financial freedom.

There were many ways we could have gone about achieving our mission, but in the end it seemed clear to us that focusing our efforts on financial education was the best choice. After all, education is the first step to changing your life.

At Rich Dad, we believe you should always be learning. The world is always changing. New technology, new terminology, and changes in the political and economic arenas are always happening. In order to keep up, you have to always be learning. It doesn't matter what you're learning, as long as you are continually educating yourself and acquiring new knowledge and skills.

Learning is a habit. Your brain is a muscle, and like any other muscles you have to work it out by continually learning new things.

Is Crypto Legit?

Are you interested in protecting yourself from the dying dollar... but find yourself unsure about cryptocurrencies like Bitcoin or Ethereum? Take a few minutes to educate yourself from the only cryptocurrency guy Robert and Kim Kiyosaki trust.

Start Investing in Cryptocurrencies

Click Here

One last thing. Don’t trust your learning to the media. They are not teachers. And do not trust your learning to “teachers” who only teach but do not do. Guard your brain. It is the only thing that determines your success. Only listen to REAL teachers.

Original publish date:

July 06, 2020