If you’ve ever planned a party, chances are you relied on Party City as the perfect “one-stop shop.” Filled with seasonal decor (who could forget those Halloween costumes?), it’s hard to imagine the chain retailer could ever topple.

However, in early 2024, Party City filed for bankruptcy just a day after announcing mass layoffs at its headquarters. Here is an excerpt from CBS news:

“The filing was made in bankruptcy court in the Southern District of Texas, according to court documents obtained by CBS News. The company had liabilities of between $1 billion and $10 billion, according to the filing.”

Many young people who haven’t grown up with Party City as such an icon will have a hard time understanding what a big deal it is to see such a large company fall so swiftly, but they’ll certainly have the opportunity in their lifetime to see similar things happen. It is the way of big giants to fall when fast start ups come after them.

So, what happened to Party City?

Amazon.

When it comes to the fall of big giants, it often comes swift and fast, seemingly without warning…to those who aren’t paying attention.

This chart from Seeking Alpha shows the historic revenue of Party City. As you can see, their price had been steadily declining since 2018 – 6 years before filing.

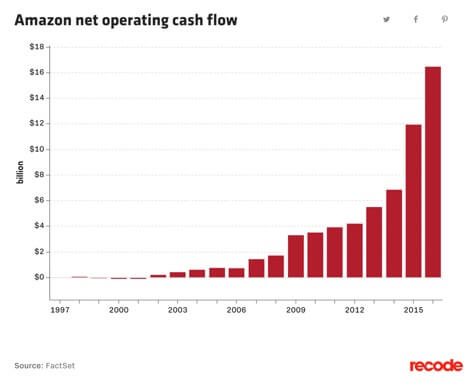

This next chart is the historic net operating cash flow of Amazon.

As you can see, their business starts really taking off in the early 2000s and their market share of the e-commerce sector did as well. Now as you can imagine, once it became simpler to purchase party supplies and costumes online (likely cheaper, we must add), combined with pandemic challenges, the inability to stay competitive was a likely culprit for Party City.

Hindsight is 20/20

Today, this probably seems like a no brainer look at what happened to Party City. But it didn’t seem that way twenty years ago, when Amazon IPO’d. At that time, no one thought an upstart online retailer was going to upend a giant of retail like Party City, and certainly no one was going to buy the fact that in twenty short years, Party City would be filing for bankruptcy.

But again, this isn’t new. Take Kodak for instance. As Robert Kiyosaki wrote a few years back:

- In 2012, Kodak filed for bankruptcy. For years they had ruled the photography world, but now they were failing. Why? In the face of the rise of digital photography, Kodak failed to respond to it as a threat. They thought they were too big to fail.

- Unfortunately, they were not. In fact, the worst part is that Kodak had invented digital photography years earlier and could have easily been first to market. Instead, they sat on the technology because they were afraid of cannibalizing their core business of physical photography…

- …While Kodak understood the need for digital technologies (the what), they failed to understand how people would use them (the why). Instead, they opted to rely on digital technologies that pushed people to printing photos—an Industrial Age way of thinking.

- Kodak was so focused on what they made, photos, that they failed to remem-ber why they made them, to be shared. Rather than focus on technologies that made sharing easier, they chose to focus on technologies that made creating photos easier while keeping up the roadblocks to sharing.

Of course, Instagram came in and stole the show. In 2012, they were bought by Facebook for $1 billion, with only 13 employees. Today, it’s projected to generate $32.03 billion in US ad revenue alone, more than Half of Meta’s US Ad revenues.

Party City, like Kodak before them, as well as many other businesses, simply got too big and too slow to keep up with the competition. At the time, they thought they were making the right moves to protect their market share and maintain the status quo, but when it comes to the markets there is never a status quo. There is only moving fast and adapting to change. If you fail to do that, you die. It’s now happening to GE, a 125-year old company.

The need for speed

A while back, Robert Kiyosaki wrote about the new rules of money. The fifth new rule of money was The Need for Speed.

With technology changing so rapidly, it becomes very important to understand that our time is a time where information is currency and knowledge is money. In order to survive you need to adapt and change at the speed of information.

The good news is that this means anyone can become extremely wealthy if they move fast enough and have the ability to understand the information they are processing faster than the competition. Instagram saw this. Amazon saw this. Many others did as well.

The Party Citys and Kodaks of the world falling is not a fascinating story because large giants were toppled. No, it’s fascinating because fast start ups did it. And anyone can start a company that does this, even you.

One thing is for certain, however, everyone who fails to grow and adapt at the speed needed will suffer financially in the coming years, not just companies but individuals as well. After all, they’re all employees of those large, slow giants.

So, if you want to thrive financially tomorrow, start thinking at the speed of information today.