Blog | Personal Finance

Want to be Rich? You Need a Money Mindset

New Rule of Money #1: Money is Knowledge...and what you know, not what you have, makes you rich

Rich Dad Personal Finance Team

May 18, 2023

Summary

-

You must have financial intelligence, and a money mindset to become rich

-

Those who are rich, have gone through a mindshift to adjust their mindset about money

-

Understanding the difference between information and knowledge is key to becoming rich

Have you ever heard anyone say they wish they had a million dollars? Then they'd be rich, right? How about someone wishing they'd win the lottery? Then they'd be set?

Of course the world is full of people who have made a million dollars or won the lottery and lost it all. They are not rich any longer. Why is that?

Fundamentally, it's because they misunderstand what makes you rich in the first place-and what money really is.

The good news about a cool million

As Yahoo! Finance reports, about 10% of retirees have $1 million or more in their savings. And though for many that feels like a stretch goal, the reality is that saving up a million bucks isn’t really that hard to do—especially if you start saving early.

Based on the median incomes provided by the Bureau of Labor Statistics, if at the age of 20, you start saving 13% of your income and assume a 7% return per year over a lifetime until age 63, you’ll be able to bank that million dollars.

Is this realistic?

But that’s a lot of assumption coming in at quite a lot of sacrifice.

For one, savings rates are at all time lows and not even near the 7% needed to achieve these savings goals. And two, the income/expense models used are simply not realistic.

As author Christy Bieber writes:

In fact, 46% of Americans save less than 5% of what they earn, according to a March 2017 survey commissioned by Bankrate of more than 1,000 households. Nineteen percent of survey respondents said they save none of their annual income, and only 25% of respondents said they save 11% or more.

But is it possible for the average person to actually meet the savings goals necessary to become a millionaire? Consider the spending of a frugal 20-year-old who needs to save 13.35% of a $2,288 median monthly income.

If that 20-year-old paid the median rent in one of the 10 cheapest U.S. cities, their monthly housing cost would be $632. Add on around $300 monthly in federal taxes, an average student loan payment of $242, a low-cost grocery bill of $206, average Internet and utility bills of $364, and average commuting costs of $216 -- and they’d be spending $1,960 monthly just for necessities.

If we reserved $305 for savings, it would leave our 20-year-old with just $22 in spending cash. And that doesn’t include a cellphone, clothing, or entertainment expenses.

Basically, it comes down to this: if from the age of twenty you live as cheaply as possible in one of the 10 cheapest cities in America, are more disciplined than 99% of the people in your age group, and don’t have any extra financial expenses like health issues or your car breaking down…you may get the point—after 43 years of toiling—where you’ll have finally saved enough to be a millionaire.

It doesn’t quite call for congratulations, does it?

The bad news about a cool million

Besides the fact that as you start saving for your million dollars later in life, the scenarios above get increasingly more fantasy-like, there is another reason why you may read this article and weep.

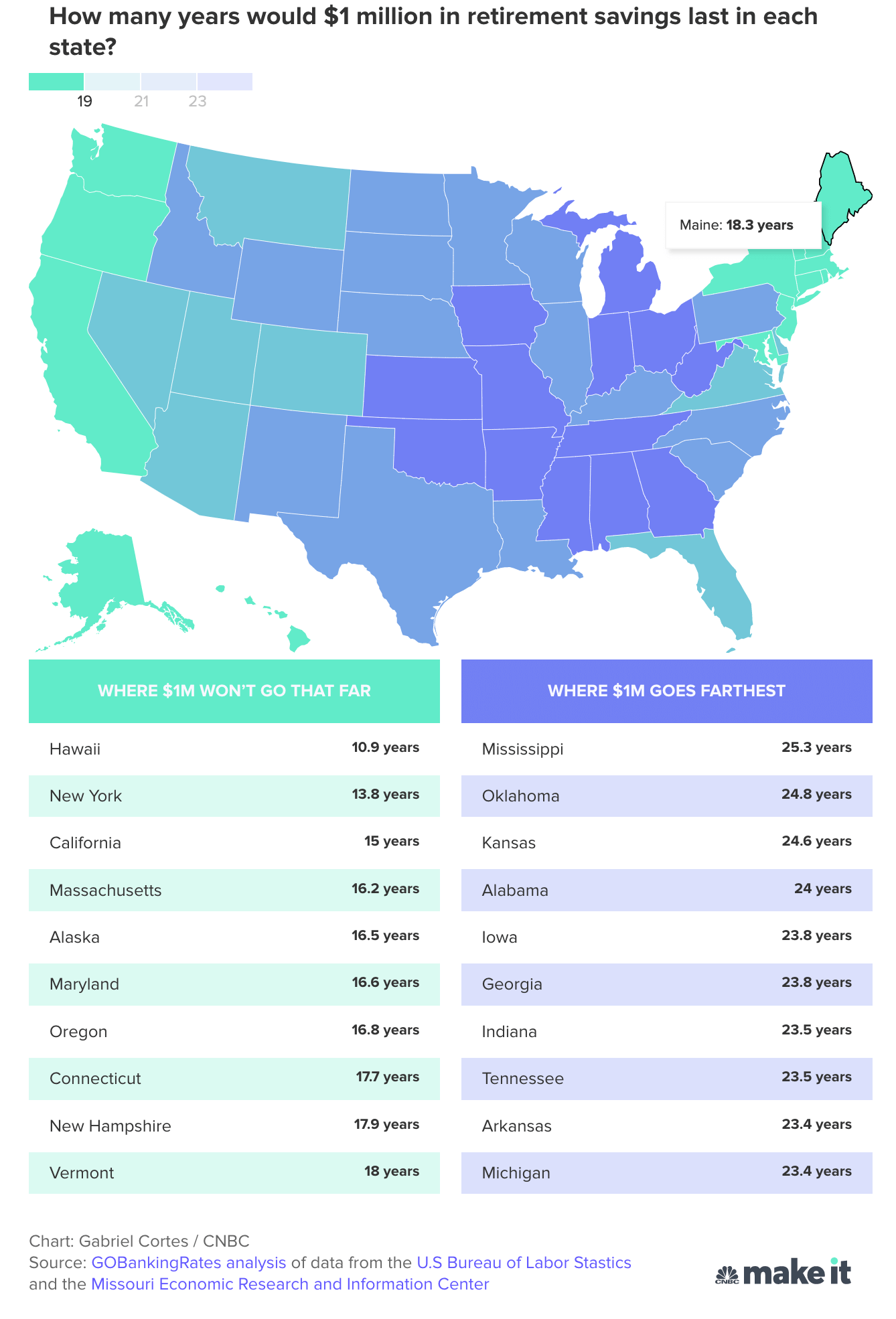

In some parts of the US, that $1 million nest egg will last just over a decade. The graphic below is according to a 2022 article by CNBC.

If you want that million bucks to last until you statistically might finally pass on, you’ll need to live in places like Mississippi, Oklahoma, Kansas, or Alabama.

Now, there’s nothing wrong with those places, but that leaves out a big part of the country, and the reality is that most people don’t want to move away from the places where they’ve built their lives just so they can retire comfortably.

All this goes to show a universal truth, money does not make you rich. Mindset does.

The mindset of the poor

Today, traditional assets do not make you rich or financially secure. Just ask all those "investors" who lost everything during the last Great Recession when their homes and 401(k)s were decimated. Today, you can lose money on business, real estate, stocks, bonds, and commodities. Any asset class can fail at any given moment. Just look at what has happened in the age of COVID.

This wasn't always the case. Older generations could count on the old rules of money to work. For the most part, the dollar was steady so saving made sense, houses rose modestly each year in value, and employers took care of you in retirement. Money, for all intents and purposes, was money, and you could count on it.

That is not the case any longer. If you trust in those things, you're in a world of financial hurt. Trusting in the old rules of money is the mindset of the poor.

The money mindset: That of the rich

The rich have a different mindset when it comes to money. They understand that there are new rules to money and that the old rules no longer work.

So, where the poor think that in order to be rich, the rich have a money mindset and know that savers are losers and that the magnitude of your wealth is relative to the velocity of your money.

Where the poor think their house is an asset, the rich know that your house is not an asset.

Where the poor think that you need a good education in order to be rich, the rich know that financial education is actually much more important.

How the mind works

John MacGregor wrote a book called “The Top 10 Reasons the Rich Go Broke: Powerful Stories that will Transform Your Financial Life...Forever".

In that book, he shares a helpful framework for how the mind works. It has the memorable acronym, B.E.A.R.

B - Beliefs, the fundamental thoughts that form the basis of all we do. These are almost completely subconscious. As Johns writes, “Our beliefs are our framework for how we think and act. But our beliefs aren’t reality; they’re our opinions of what we believe to be true. These opinions closely determine our actions.”

E - Excuses, the things we verbalize that stem from our beliefs, such as, “I don’t have enough time.” John writes, “Excuses create a cycle that return you back to your beliefs, no matter how flawed or inaccurate they are, and you rely on your built-in excuses (based on your beliefs) to keep you rooted in the same bad habits.”

A - Actions, the decisions we make based on our beliefs and excuses. With enough time, excuses lead to bad decisions, and these bad decisions are your actions (and yes, inaction is the same as action).

R - Results, the natural outcome of your beliefs, excuses, and actions. The just deserts.

As John puts it, if you want to change your results, you have to change your beliefs, which changes our excuses, and results in higher quality actions.

This is a mindshift. And if you want to be rich, you have to have a money mindshift, one that gives you the mindset of the rich.

Behind every great movement in history, and every great achievement on an individual level, is a great mindshift, a complete change in mindset, that changes the course of history—public or personal—forever.

The four mindshifts of humanity

In his book, Increase Your Financial IQ, Robert Kiyosaki writes about the four economic ages of humanity. When you think about economic ages, they are really global mindshifts, spurred by changes in technology and human thought, and what is possible because of that technology.

Four major mindshifts in human history are:

- The Hunter-Gatherer mindshift: In the Hunter-Gatherer Age, humans relied on nature to provide wealth. They were nomadic and went where the hunting was good and the vegetation plentiful. You had to know how to hunt and to gather—or you died. For the hunter-gatherer, the tribe was social security. Socioeconomically, everyone was even. They were all poor.

- The Agrarian mindshift: The Agrarian Age saw the rise of different classes of people. Due to the development of technology to plant and cultivate the land, those who owned the land became royalty, and those who worked it became peasants. The royals rode horses while the peasants walked. Socioeconomically there were two groups, the rich and the poor.

- The Industrial mindshift: While many people would place the beginning of the Industrial Age in the 1800s with the rise of factories, others might argue that it was actually in 1492 with Columbus. When Columbus struck out for the New World, it was to find new sources of valuable resources such as oil, copper, tin, and rubber. During this time, the value of real estate shifted from growing crops to providing resources. This led to the land becoming even more valuable. And three classes emerged: the rich, the middle-class, and the poor.

- The Information mindshift: Today, we are in the Information Age, where information leveraged by technology and inexpensive resources like silicon, produces wealth. This means that the price of getting wealthy has gone down. For the first time in history, wealth is available to just about everyone. There are now four groups of people: the poor, the middle-class, the rich, and the super rich.

But even though we live in the Information Age, it is not information that makes you rich. You must make the mindshift from information to knowledge.

The difference between information and knowledge

In classrooms all across the world, the Internet is readily available and technology is second nature to most kids. Regardless of socioeconomic class, information is largely free and abundant. For the first time in history, people can access information and learn about anything no matter whether they are rich or poor.

While all this information is valuable, it's not as valuable as knowledge. Knowledge gives you the ability to filter out unimportant information to find the important information. Knowledge gives you the power to act on information. Knowledge is what makes you rich-not information.

The knowledge mindshift

Robert’s rich dad, his best friend’s father, once said “Oil is valuable. Many people would love to own lots of oil. But owning lots of oil won't make you rich. It's making the mindshift to understanding how oil can make you rich that brings wealth. For instance, crude oil is of little value until it is refined. That is a complicated process that requires science and equipment. It takes knowledge to refine oil and make fuel. Fuel is valuable and will make you rich. But you can't have fuel without oil."

Today, it's no different in the Information Age. You could have all the information in the world, but without a mindshift to knowledge, you would still be poor. The reason Mark Zuckerberg, for instance, is such a success is because he has knowledge of what to do with information and knowledge of how to build technologies to leverage information.

Mark Zuckerberg's knowledge of internet technology enabled him to build Facebook. He also knows how to build a team and find people smarter than him to make Facebook bigger and better. Finally, he has knowledge that information is valuable for selling. Facebook excels at collecting your information, processing it, and selling it to advertisers who target their ads to make money off of you.

Will you make the money mindshift?

It is not the information that makes Mark Zuckerberg rich, it's his ability to process and leverage it-again, that is knowledge, and knowledge comes from education.

We live in an age where wealth is abundant and accessible by everyone—including you. But you have to be financially educated to be able to process and leverage it.

Today, knowledge makes you rich and a lack of knowledge makes you poor. In this brave new world, it's your knowledge that is the new money.

To begin building your money mindset, increase your financial IQ by increasing your financial education and connect with one of our mindset coaches to prepare for your future. Then you will be able to find the important information and have the knowledge to act on it.

Original publish date:

May 24, 2016