Blog | Personal Finance

Ring in the Holidays with the Gift of Budgeting

Want to be rich? Here are some holiday budgeting tips.

Rich Dad Personal Finance Team

November 25, 2024

Summary

-

There are three ways people budget; be sure to budget like the rich for the holidays

-

Financial security requires a good budget, especially during holiday season

-

Follow these holiday budgeting tips to set yourself up for a strong end of the year

The average American spent over $900 for the holidays in 2023. For most people, that’s a lot of money. But folks gladly do it every year.

So maybe it’s time to talk about budgets. That will make it a merry Christmas, right?

A good budget, holidays or not, is essential to financial security

One of the biggest indicators of financial intelligence is cash flow. But, it’s not just cash flow that counts, but how you get that cash flow.

The first step in knowing how you obtain your cash flow is to understand your personal financial statement. To learn more about financial statements and why they are so important, read the article, “The Financial Statement Foundation for Being Rich.”

But simply put, your personal financial statement has four components: income and expenses (income statement) and assets and liabilities (balance sheet).

If you learn how to read your personal financial statement, you can see where your money patterns are letting you down...and you can create a personal budget to address those poor money patterns.

Once you have an understanding of where you are financially, it’s crucial that you create a personal plan to become more financially secure and healthy. And, again, that means starting with your personal budget.

The problem is that most people have misconceptions about what a budget is and why it’s helpful.

Why these holiday budgeting tips are so crucial

Most people think budgets are static things. At worst people don’t have a budget, at best they generally set it and forget it, revisiting it once a month or so, often to see they’ve overspent.

But as you can find in the post 3 Ways Budgeting Can Make You Richer, a good approach to budgeting makes it a tool to help get you rich. This is done in three ways:

-

A budget shows you your monthly outflow: understanding where your money is going is the first step in understanding where you have problems. Once you know where you have problems, you can fix them.

-

A budget helps you understand what kind of cash flow you need: Once you see the deficiencies in your income to expenses, i.e., how much you need to cover if you don’t have income coming from the form of a salary, you can understand how much you need to bring in each month in the form of cash flow—and you can make that the very first and most important “expense” in your budget so you can acquire assets for that cash flow.

-

A budget inspires action to get your cash flow: Creating an investment “expense” each month, something we’ll cover a bit later, inspires you to get creative in how to make sure you meet that expense each month.

Based on what we’ve seen here at Rich Dad, there are three ways that people budget. And the way you budget has a lot to say about your financial mindset.

Budgeting like the poor

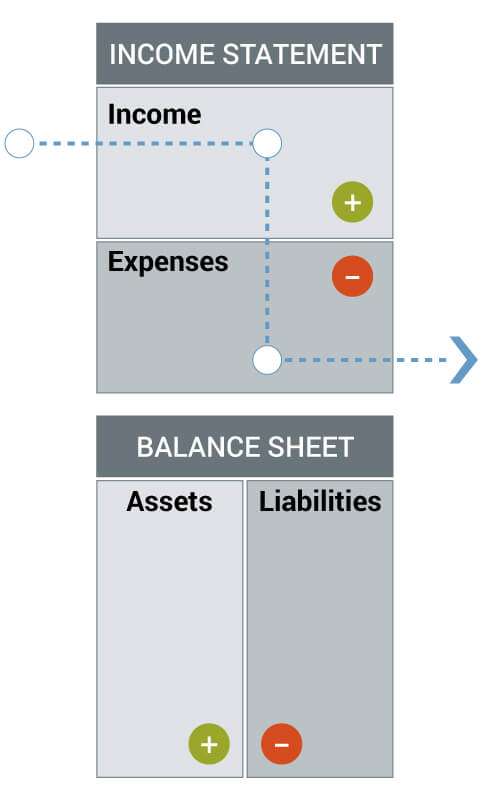

Those with a poor mindset often don’t use a budget. If they do, however, they use a very simple one. Why? Because they own no assets and no passive income.

For those that budget with a poor mindset, they simply track their earned income (i.e., salary) and their expenses each month. Whatever is left over, which is often nothing or less, is used for savings in case they run into a rainy day.

As you can imagine, this makes for a very difficult and stressful holiday season of gift giving for those with a poor mindset.

They treat a budget as a tool to make sure they’re not spending too much, but it is not a catalyst for financial insight, inspiration, or growth.

Budgeting like the middle class

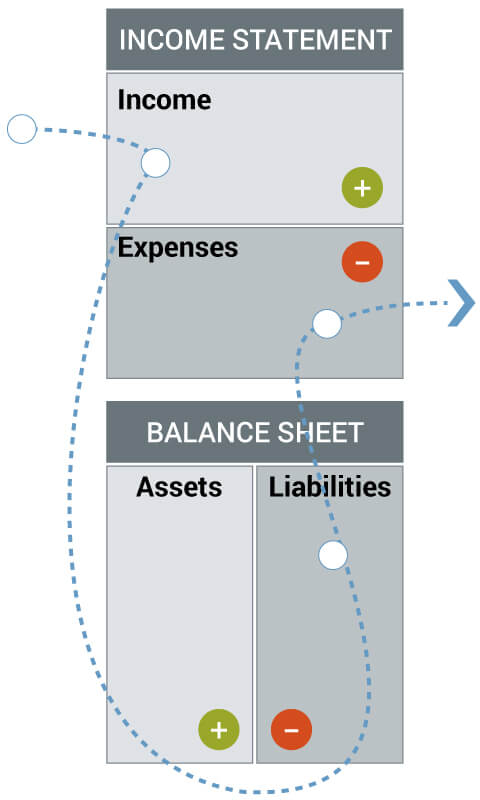

Those in the middle class often have more income than expenses (as long they have that high paying job!). They might have a few investments, but they are not a daily focus. Instead, they contribute to a 401(k) they rarely pay attention to. Mostly, they’re focused on keeping up with the Joneses, so they invest in liabilities like a house, a nice car, and vacations.

Those with a middle-class mindset have a financial statement that looks like this:

The middle class use a budget as a tool to understand how much money they will have left over each month. They then reward themselves for having extra money, which they often use as “discretionary spending.” More often than not, they splurge on vacations, cars, electronics, or something that brings them pleasure—little doodads. In the process, they create liabilities but don’t invest in assets.

For those with a middle-class mindset, a budget serves as a tool to make sure you spend less than you make, but also know how much “fun” money can be spent. Yet the source of that money is always earned income from a salary rather than passive income from investments.

So when the holiday season rolls around, they’ve been working and working just to save and to spend on gifts for loved ones.

Budgeting like the rich

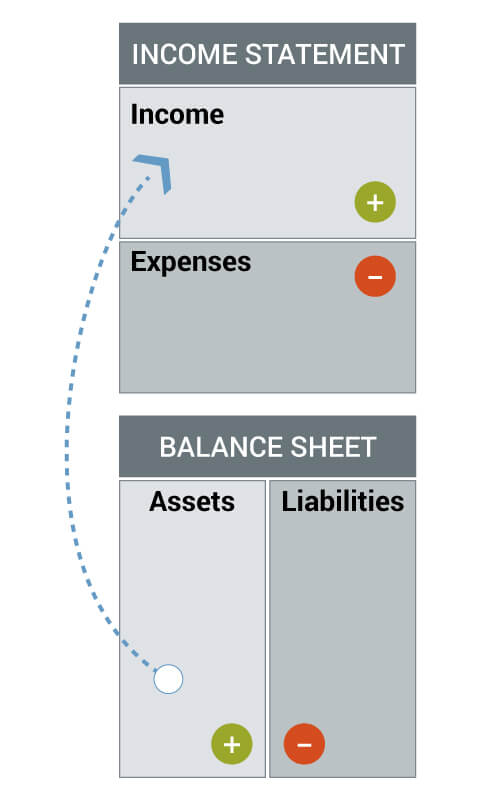

The rich don’t look at a budget as a way of comparing their income and expenses. Rather they look at it as a way to prepare for creating more money. In short, they ask, “How can I make more money?” rather than say, “I don’t have enough money” (the poor) or, “how much extra money can I spend?” (the middle class).

The personal financial statement of someone with a rich mindset looks like this:

If there are doodads that the rich want to enjoy, they don’t look at their existing income to determine if they can purchase them. Instead, they ask how much more they’ll need to make to cover the expense. Then they find investments and assets to cover the new expenses.

For the rich, the holiday season is a breeze.

In essence, the first expense in a budget is the expense of investing. That then creates passive income that covers the “fun” stuff in the budget later. In the process, the rich create more money and attain more assets. Their cash flow covers their expenses. It all stems from their mindset towards budgets.

This holiday season, don’t forget to ask yourself “ who am I budgeting like?”

Original publish date:

January 12, 2016