Blog | Personal Finance

The Personal Financial Statement: Your Foundation for Being Rich

The key to financial success is understanding your personal financial statement

Rich Dad Personal Finance Team

April 18, 2023

Summary

-

Understanding your personal financial statement doesn’t have to be difficult

-

The rich have mastered the craft of reading their personal financial statements

-

The first step to understanding your personal financial statement, is comprehending the relationship between an income statement, and a balance sheet

What does it mean to be rich?

This is perhaps the most important question you can ask and answer. For most people, being rich means making a lot of money. They think that if they can just make a little more each month, all their problems will be fixed. They’ll live like kings and queens.

Financial literacy begins by understanding your personal financial statement

The reality is that money doesn’t make you rich. What makes you rich is your financial IQ. Give the same $100,000 to a person with a low financial IQ and a person with a high financial IQ, and you’ll see a vast difference in how that money is spent and grown.

Central to the difference between those with low and high financial IQs is a simple but profound literacy: the ability to understand a financial statement.

What is a personal financial statement, you ask? It tracks your income, expenses, assets, liabilities, and cash flow — each of these is crucial to not only understanding your personal financial standing, but they are also a barrier to entry when it comes to any investment opportunities. In the Rich Dad personal financial statement, which you can download here, you can see the relationship between these concepts. If you do not understand these concepts, the only way you’ll succeed in investing is by sheer luck, not skill.

Many people who take accounting classes learn how to read an income statement and balance sheet separately. However, these classes don’t teach why one document is important to the other, or how they affect each other.

Robert Kiyosaki’s rich dad, his best friend’s father, felt that the relationship between the two was critical. “How can you understand one without the other? How can you tell what an asset or liability really is without the income column or the expense column?” he asked.

For rich dad, understanding the relationship between the two allowed you to easily see the direction of your cash flow to easily determine if something was making you money or not.

If something was making money, it was an asset. If not, it was a liability.

“Just because something is listed under the asset column does not make it an asset,” said rich dad. “The reason people suffer financially is that they purchase liabilities and list them under the asset column.”

It's not about what you make (income), but how much you keep (expenses)

For most people, the idea of a high income is a good thing. For the rich, it is bad. For most people, the idea of low expenses is a good thing. For the rich, again, it is bad. In fact, it’s only the financially unintelligent who think that “making a lot of money” in the form of earned income is a good thing. These are usually high paid employees like C-suite holders. They may seem rich, but they think like the poor.

As rich dad said, “Money is just an idea.”

Once you understand the idea that low income and high expenses are good, you will understand one of the most pivotal realities of this idea called money. Not understanding this fundamental concept is why many rich people go broke.

How money really works

Let us introduce the 90/10 rule. 90 percent of people earn 10 percent of the money in the world. How do they do this? By positioning their income and expenses properly. These, of course, are the same 10% that Ocasio-Cortez thinks she can increase taxes on and fund her political plans.

If you do not understand money or how it works, it will seem like a strange statement that the ultra-rich position themselves to have low income and high expenses.

You may be asking the question, “How can low income and high expenses make you rich?” The answer is found in how the sophisticated investor utilizes the tax and corporate laws to bring those expenses back into the income column of their financial statement.

KISS (Keep It Super Simple)

One of Rich dad’s greatest skills was to take complex things and make them super simple. It was one of his rules for investing—KISS, “keep it super simple.” He had a way of taking complicated financial subjects and making them easy enough for even a young boy to understand.

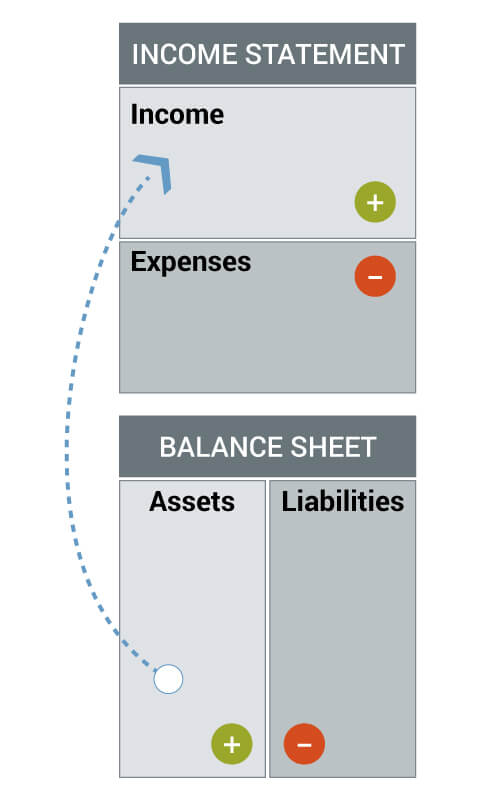

For example, rich dad used the following simple diagrams to teach a nine-year-old Robert Kiyosaki the relationship between the income statement and the balance sheet. He still uses them to this day by completing his personal financial statement.

If you can understand the following diagrams, you have a better chance of acquiring great wealth.

Cash flow patterns

An asset is something that puts money in your pocket. A liability, on the other hand, is something that takes money out of your pocket.

It’s that simple.

Rich dad pointed out that confusion happens for many because accepted methods of accounting allow for the listing of both assets and liabilities under the asset column.

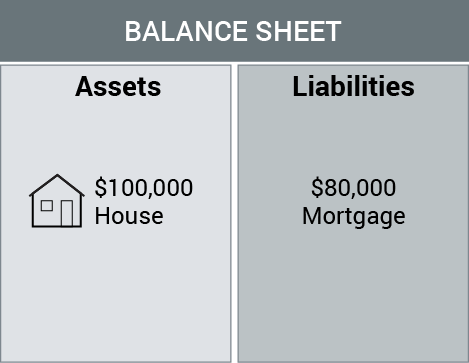

To explain this, he drew a simple diagram:

You’ve probably been told that your house is an asset; we’re sorry to burst your bubble, but your house is actually a liability.

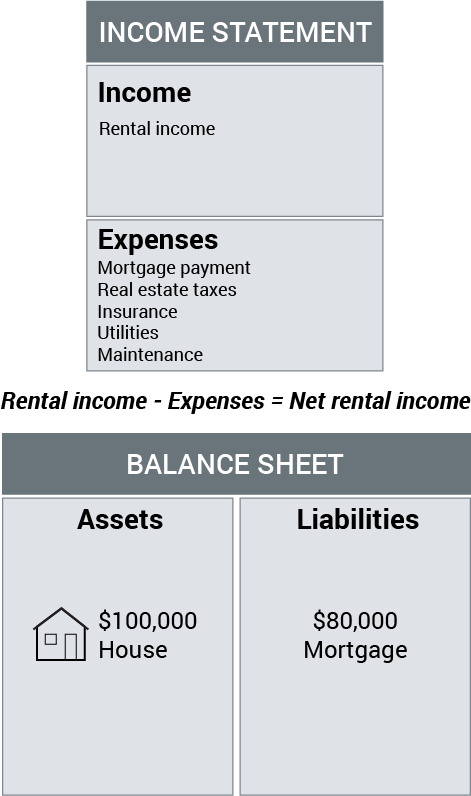

“This is why things get confusing,” rich dad would say. “In this diagram, we have a $100,000 house where someone has put $20,000 cash down and now has an $80,000 mortgage. How do you know if this house is an asset or a liability? Is the house an asset just because it is listed under the asset column?”

The answer is, of course, no. In order to know for sure, you would need to refer to the income statement to see if it was an asset or a liability.

The financial statement of a rich person

For example, this is a diagram of what a sophisticated investor is working to do:

When you start to understand what is happening in this diagram, you will begin to see a world of greater and greater financial abundance.

Essentially, what this diagram shows is that the rich use their income to purchase assets (and expenses) that then create more income for them in the form of cash flow. The reason for this is that the income these assets create is not earned income but rather passive income, the lowest taxed income. Additionally, these assets can be kept in entities that provide substantial tax benefits. In short, though they may be very rich, they do not have high income like a high-paid employee will.

Rich dad said, “One of the most important controls you can have is found in this question: What percentage of the money going out your expense column winds up back in your income column in the same month?”

By understanding the side of the coin that rich dad was speaking from, you’ll see a completely different world that most people who work hard, earn a lot of money, and keep their expenses down never see. A world of ever-increasing wealth rather than one of diminishing return

The financial statement of a middle-class person

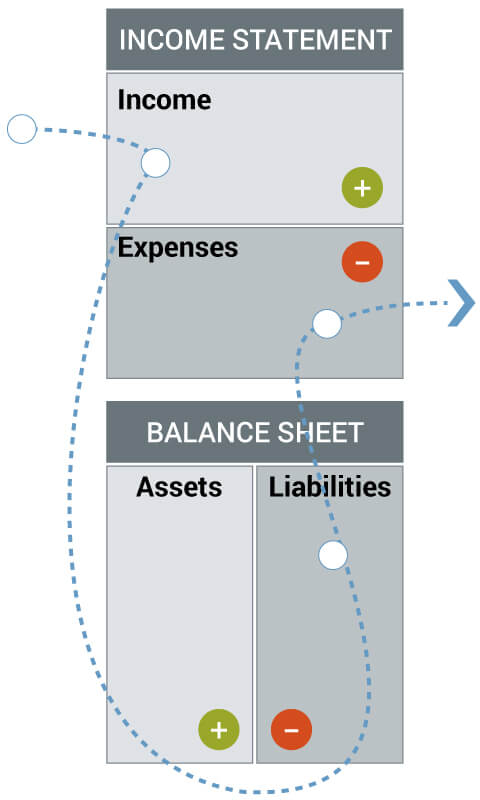

Compare the above diagram with that of the traditional way of thinking about the idea of money:

This is the financial diagram of most of the world’s population. In other words, the money comes in through the income column and goes out the expense column. It never comes back. That is why so many people try to create a budget to live below their means, to save money, be frugal, and cut back on expenses.

This is why most people will say, “My house is an asset,” even though the money goes out the expense column and does not return, at least not immediately. It also explains why people say, “I’m losing money each month, but the government gives me a tax break to lose money” rather than saying “I’m making money on my investment, and the government gives me a tax break to make money.”

Why your house is a liability

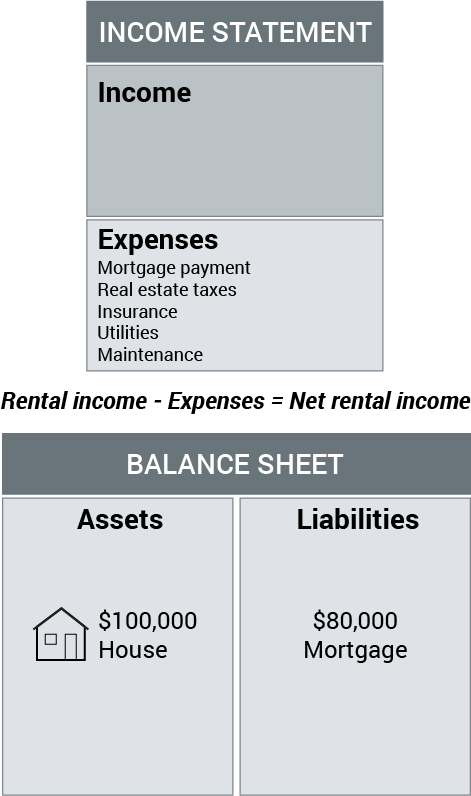

To illustrate that your house is a liability, rich dad drew this diagram:

How your house is the bank's asset

Rich dad then added to the diagram a line that read “rental income” and “net rental income,” the key word being “net.” That addition to the financial statement changed that house from a liability to an asset.

Very simply, rich dad explained, if the rental income of the house, minus the expenses of the house, equaled positive net rental income, the house is an asset. If not, it is a liability.

Your personal financial statement simplified

These simple lessons are profound. And they are the basis for building all great wealth. Going back to an earlier comment, a person with a high financial IQ and $100,000 would be able to know how to invest it in assets that are true assets—ones that put more money back in the pocket each month. The person with the low financial IQ would spend that same money on liabilities, but wouldn’t be able to diagnose what was wrong. Instead, they would try and work harder to make more money—a vicious cycle we call the Rat Race .

Understanding the relationship between the income statement and the balance sheet as seen with our personal financial statement template allows you to quickly understand if an investment is an asset or a liability—and this understanding will allow you to make the right investment every time.

Today, ask yourself the same question. What percentage of your wealth goes from your expense column back to your income column in the same month?

If you can understand how this is done, you too will find a world of ever-increasing wealth.

And for more tips to understand your personal financial statement, look at Part 1 and Part 2 of our Beginner’s Guide to Personal Finance.

Original publish date:

December 12, 2017