Blog | Commodities

The Rate Rise Era and the Dragon

As we enter a Bear market, we must understand the Dragon.

Rich Dad Personal Finance Team

May 20, 2022

According to released data, China is not facing the same inflationary pressures that Europe and North America are experiencing.

The common perception for the West is to not believe Chinese data because it’s from China.

But upon further research…

I will argue the government of China has done a much better job controlling inflation than the U.S. which is about 500% higher than China’s.

Let me explain…

As I discussed in The Rise of America last year, Xi Ping and the CPP took on the Chinese tech titans (like Jack Ma). And cracked down hard on companies and their profits.

In almost Putinesque fashion, you can keep the company, but half goes to the state.

And make sure your profits do not in any way put any pressure or risk on the National agenda.

This kept prices down.

The government also cracked down on shadow banking which slowed the velocity of capital within speculative sectors such as real estate and commodities.

Aggressive government intervention in releasing government stockpiles of commodities (oil, copper, etc.) has also tempered any supply issues and price inflation in the near term.

Chinese Food

Food makes up 20% of the Chinese CPI index.

This will be hard for most to understand, but food prices were lower in China during 2021 than they were in 2020. And thus far in 2022, food prices are lower than in 2021.

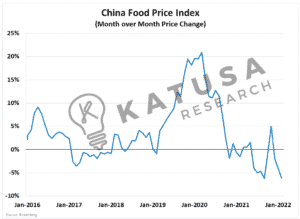

The chart below is the month-over-month change in food prices in China. As you can see, prices have been continuously falling and just last month fell 6%.

Pork is the main protein in China and pork prices are significantly lower than the 2020 pandemic highs.

Vegetables and eggs are higher, but overall, the decrease in pork has reduced food prices overall year over year.

The government of China also did not go as wild with monetary stimulus as the U.S., Canada, and E.U. Combine that with aggressive lockdowns and weak domestic demand, and the inflation situation is lower in China than in the U.S. or Europe.

Here’s Why China Matters to Resource Investors

When the Dragon sneezes, the resource sector goes into cardiac rest.

It’s all about the velocity of capital. And the government of China has really clamped down on Chinese companies purchasing and investing in foreign mining and energy assets.

That means less capital flowing into these sectors.

Now, let’s talk mining…

Cost increases have been dominant across almost operating mines. In 2020 I wrote about the coming Crossflation pressures we would see in many resource projects.

Almost all operating mines are experiencing building delays and many new mine builds are seeing cost blowouts which are not returning the expected shareholder returns.

Higher diesel prices and supplies are putting significant upward pressure and will continue to do so for the rest of 2022.

All of that has been known for the last 12 months—none of this was a surprise.

The market is currently risk-off when it comes to the precious metal equities (that means the actually mining companies).

The market sell-off and capital going risk off results in capital leaving the gold ETFs. This results in the ETFs selling their mining share positions to meet redemptions and rebalance their weights.

With all stocks getting hammered or stale…

There is no need to increase your risk exposure when advanced, producing companies are trading at a discount to their Net Asset Value.

But, I am very interested in getting shares of the top-quality mid-tier and majors that are trading at valuations near historic lows.

The only exploration gold stocks I want to own are ones with district-scale potential, advanced assets, management with skin in the game, and major near-term catalysts that re-rate the stock share price upwards.

I will detail in as much detail as I can what I plan on doing with my own money and show the value propositions.

The Era of Rates: Stormy Waters

The Fed will have to react to the higher-than-expected inflation while juggling market pressures and the looming 2022 midterm elections in November.

If inflation continues to rise and affects the bottom line to American citizens by mid-2022, the Fed will have no choice but to become reactionary at that point with multiple interest rate increases to tame inflation.

Some argue the fed needs to go heavy upfront with the interest rate hikes. Others are waiting for the Fed to ease slowly with their rate hikes.

With either option, the odds favor further correction in US equities.

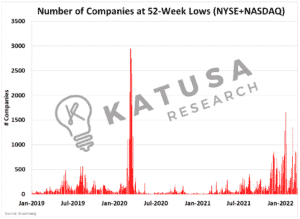

Currently, the market is seeing the most aggressive put buying and positioning since the depths of Covid in 2020.

In February, over 1,500 companies listed on NYSE and NASDAQ hit 52-week lows. That is the highest number since the covid lows.

More importantly, the flow of funds from the sub $100B to the +$500B is at its highest rate since the lows of Covid.

Since the start of the year, the Volatility Index (VIX), which uses S&P 500 option pricing as a gauge to determine volatility…

Has averaged a daily change of 0.87% while soaring over 10% in a single day on 9 separate occasions.

To put that in perspective, the 5-year average daily change is less than 0.42%.

This means that volatility so far this year is over 2x higher than normal.

This gauge suggests that investors are starting to get nervous about their over-leveraged positions, and for good reason.

There is no shortage of political turmoil, inflationary concerns, or loose money flying around.

I am not calling it a top on the markets, but I do believe there is more attention being paid today, than at any time in the past 12 months.

Investors have begun to realize that the US Federal Reserve is going to continue raising interest rates and taper their asset purchases.

Just last week the Fed raised their fund’s rate by 25 basis points to 0.50%.

The near-zero interest rate and high fiscal stimulus environment, (which I call financial heroin) are not coming to an immediate stop.

But governments are going to try to slow it down.

By slowing the injections of cash and rising interest rates, the U.S. Federal Reserve is going to try to contain inflation.

This is a situation faced by central bankers and governments of most developed nations.

It is safe to say that we are entering into the next phase of this “fiscal experiment”, and these are unchartered waters.

Rate Rise Ready

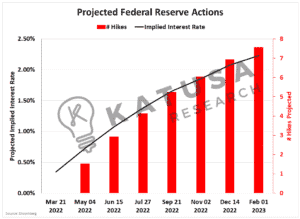

Over the next 12 months, market participants (based on the prices they are currently willing to pay for Fed Interest Rate Futures) are expecting up to 6 interest rate increases and potentially a policy rate of 1.70%.

Below is a chart which shows the current expectations for the US Federal Reserve policy rate.

While an interest rate of 2.2% may not sound like a lot, I believe it is going to impact trillions of dollars worth of assets and liabilities.

In turn, this rate decision will ultimately affect the decisions of other central bankers and the performance of nations’ currencies against the US dollar.

Back to the Future

If history is anything like the past, most of those other economies will not have the economic strength to absorb many interest rate increases.

In today’s world capital is very mobile and moves rapidly across different asset classes around the globe. Investors are always looking for the highest return on their capital from carbon to uranium.

· Nations with higher interest rates and strong economies attract investor capital, which in turn increases demand for the currency.

· Nations who cannot raise rates or see their economies falter in the face of these interest rate increases will ultimately see their currencies decline in value versus those who have strong economies and currencies.

This ultimately leads to a stronger US Dollar.

Focusing specifically on the interest rate movements over the next 12 months, I believe it is highly likely that most developed nations will attempt to raise rates.

This means the United States will lead the way and then Canada, Australia, and potentially the EU will have no choice but to follow.

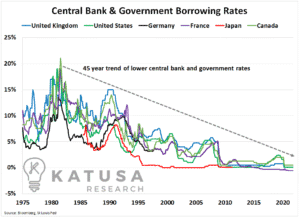

As you can see the downtrend in rates is very clear, but there are periods where there are consistent increases in interest rates.

I believe we are on the cusp of central banks implementing one of these steady sets of increases.

This will have a profound impact on asset valuations and the cost of capital associated with building and holding these assets.

What to Do?

Patience.

This will not be a quick correction like we saw in 2020 when covid shocked the markets and the U.S. Federal Reserve came to the rescue.

The Fed will not inject stimulus like it did during Covid.

Both mining and energy sectors are going to feel the impact of these rate increases.

The headwinds are here. Are you prepared?

Original publish date:

May 20, 2022