In 2016, USA Today reported “a survey of 1,600 U.S. adults found that 80% of taxpayers’ ages 18-34 (the millennial generation) who filed taxes last year and plan to file this year say they’re fearful about some aspect of preparing their taxes. That’s the highest of all age groups.”

But what if you didn’t have to worry about taxes at all?

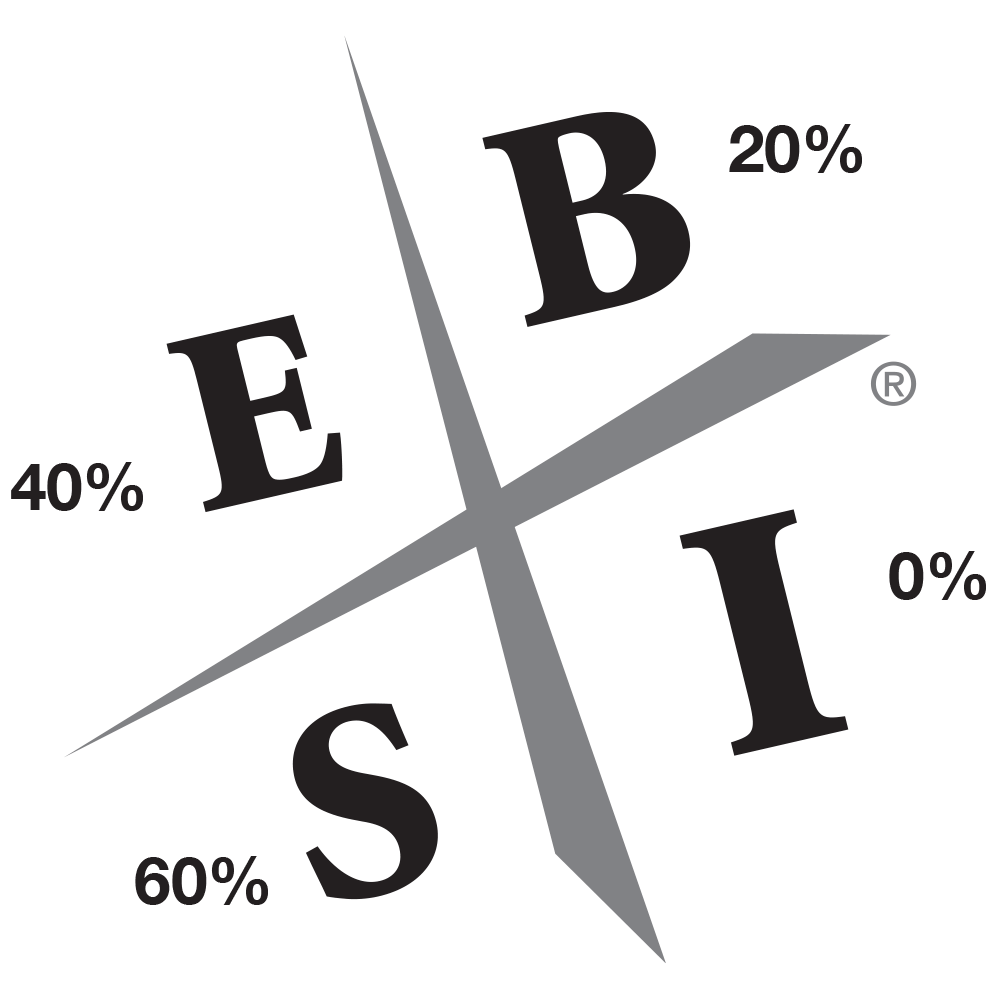

One of the first things you’ll come across when combing through Rich Dad content is the CASHFLOW® Quadrant.

The CASHFLOW Quadrant separates income earners into four quadrants. On the left side are the employees (E) and the self-employed individuals (S). On the right side are big business (B) and investors (I).

Tax advisor and Rich Dad advisor, Tom Wheelwright, shares his thoughts:

“When I first saw the diagram, my thoughts naturally went to the tax consequences (and benefits) of being in each of the quadrants. I quickly realized that those who earned their income from the left side of the quadrant pay much higher taxes than those who earn their income from the right side of the quadrant.

Over the years, since first learning about the CASHFLOW Quadrant, I’ve continued to look at the tax law and apply it to the diagram. The reason why those on the B and I side of the quadrant pay so much less in tax than those on the E and S side has become clear to me. It’s because that’s what the government wants.”

Below is the percentage of tax that each quadrant pays:

You might be wondering, “What does the government want?” The government wants people who create jobs and people to provide affordable housing—entrepreneurs and real estate investors.

It is because of these goals that the government gives entrepreneurs and investors all the tax breaks they get. Governments even get more specific about the types of investing and jobs they want the market to create by giving specific tax breaks for oil and gas investing, farming and other agriculture, green energy, and low-income housing.

It’s not really that those on the E and S side of the CASHFLOW Quadrant are punished. They just don’t get the rewards (i.e., subsidies) that are given to those on the B and I side of the quadrant.

Here’s Tom’s advice for starting out: Start small. Take a course in entrepreneurship. Start a home-based business—preferably dealing with something you know about. That’s how he got started.

Many years ago, after leaving public accounting and becoming the in-house tax advisor for a Fortune 1000 company, Tom decided to go back into public accounting. He missed the clients, and the challenge. But in that transition, he made a bad decision and took the wrong job with the wrong company. Seven months later, he was fired. He was faced with a first: he’d failed at a job, and the job had failed him. Little did he know, it would be one of the best days of his life.

“I suddenly realized that not having a job freed me up to do what I’d always wanted to do—start my own business. I had a master’s degree and 13 years of experience as a tax advisor. It was time to start my own firm. With the encouragement of my wife and two young sons, I did just that, starting my firm out of my house. I worked 10 hours a day to make contacts and build my practice. It took me nine months just to get my first four clients. Since then, I’ve never looked back. I’ve never been happier in my work. And I’ve never paid less in taxes.”

Obviously, the suggestion here isn’tto get fired or quit your job. Rather, consider some introspection; you probably have a set of marketable skills that you could use to start your own business. Start part-time. Set aside a room in your house for your business. Don’t spend money on a nice office and lots of advertising. Just start small and think big. Think about the freedom that will come when you can devote most, if not all, of your time to your business, your investments, and your family.

Become a Real Estate Investor

Now suppose that you don’t want to start a business but you still want to be a super taxpayer. What do you do? You become an investor. Remember that the right side of the CASHFLOW Quadrant includes both business owners and investors. But there’s one catch; you can’t be a typical investor if you’re going to enjoy the tax benefits of investing. You have to become an active investor. That means you have to be an investor who actively invests for passive income, not earned income. Very simply, passive income is income that comes from dividends, rents, and business. It’s taxed at a much lower rate than earned income, which comes from appreciation and capital gains, or from your paycheck. In order to become a super investor, you must find good, cash-flowing investments that produce passive income. You might be thinking that becoming an active investor sounds hard. It’s not. Becoming an active investor is actually quite simple. Just as with becoming an entrepreneur, it all starts with your financial education.

To learn more about paying less in taxes, grab Tom Wheelwright’s book,

Don’t fear taxes any more. Instead, get financially smart, and win the tax game.