Blog | Personal Finance

Why Playing The CASHFLOW Game Will Make You a Better Investor

CASHFLOW has been played by hundreds of thousands of families transforming millions of lives, making it one of the most popular board games ever.

Rich Dad Personal Finance Team

December 12, 2023

Summary

-

With the CASHFLOW game, investing isn’t scary; it’s fun!

-

Statistics show that games are a more effective method of learning

-

The CASHFLOW game teaches players how to navigate the complexities of investing scenarios and the effects of markets

A few years ago, Hasbro announced that they were removing the classic thimble game piece from the popular board game.

Of course, it's not really Hasbro that made the decision. They opened public voting on what piece to remove in order to make room for more modern game pieces "like the hashtag, the wireless phone, and the rubber duck." After four million votes, the thimble was gone—and everyone is still trying to figure out why a rubber duck would be considered more modern.

So why does this matter? Truth be told, the Monopoly pieces really don’t matter. But we hold a fondness for the game of Monopoly itself, here at Rich Dad.

When Robert Kiyosaki was just a young boy, rich dad told him that, "One of the great formulas for wealth is found in Monopoly: four green houses, one red hotel."

Monopoly and how money works

This one great formula rich dad spoke of was that of cash flow. Monopoly is a cash flow game. You purchase property, balancing cost and location, and collect rents when people land on your properties. In order to make more money, you develop and improve those properties, building houses and, eventually, hotels.

For example, having one green house on a property you own could make you $10 when someone lands on it. Then, two houses could make you $20. Three could make you $30. And a hotel could make you $50. Basically, more green houses and red hotels means more cash flow. It's a simple game, but an important lesson.

One of the most important lessons you learn from the game of Monopoly is that money—as it exists today—is really a currency. The word currency is derived from the word current. Think of an electrical current. If it stops moving, it will die. It will lose its power.

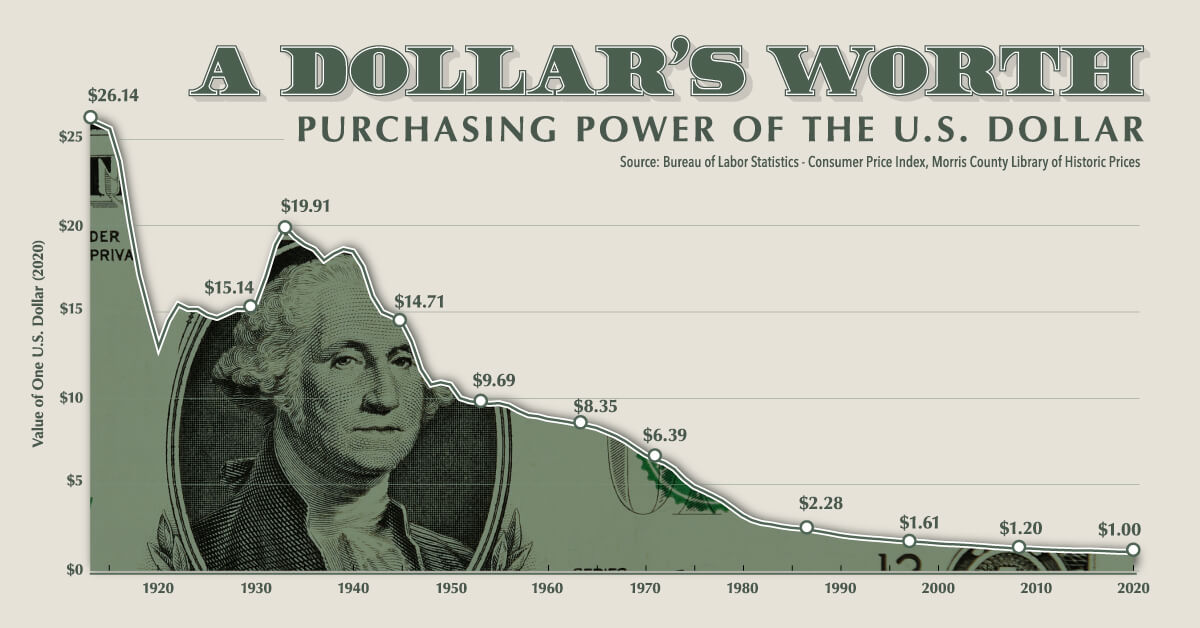

Money is like an electrical current. If you sit on your money, it eventually dies. This should be obvious to you these days since we’re facing record inflation. Each day you sit on your money, it is worth less and less. In order for money to keep generating value, it must move into assets that in turn create more money, both through cash flow and through appreciation.

But this is not a new phenomenon. The value of the dollar thanks to inflation is near zero over the last hundred plus years.

In Monopoly, just like in real life, those who hoard cash and never invest it in properties are those who lose the game.

Playing Monopoly in real life

Rich dad didn't just play Monopoly on his sunny patio. He also played Monopoly in real life. He built his fortune from the ground up, starting with some small stores and moving into more and more sophisticated investments. Eventually he did own his own hotel right on the beach—and then a few more. He did all this because he understood how money works, and he kept his money moving from asset to larger asset, building tremendous wealth in the process.

As you’ve probably read before, Robert learned four valuable lessons from rich dad by watching him play Monopoly in real life:

- Investing is not risky

- Investing is fun

- Investing can make you very, very rich

- Investing can set you free from the struggle of earning for a living and worrying about money

The CASHFLOW Game is Monopoly on steroids

The simple lessons around money that Robert learned from rich dad and Monopoly pieced together the foundation needed to eventually become rich. Along the way, he learned a lot of other lessons that led to being a successful investor. He wanted to teach the world these lessons, but to do so in a fun, engaging, and effective way. So, Robert developed the CASHFLOW game.

With the CASHFLOW game, Robert took the simple rules of Monopoly and applied the complexities of investing scenarios and the effects of markets. In Monopoly, you only play against other players. With CASHFLOW, you play against both other players, markets, and even nature.

The goal of the game is simple: escape the Rat Race of your 9-to-5 job by using a variety of investing strategies to build an arsenal of assets (and avoid liabilities, called Doodads) to help propel you onto the fast track, where real wealth is built.

In the process, you learn the valuable lessons rich dad taught Robert about money, as well as the lessons he learned over a career of investing and building great wealth.

Games like CASHFLOW make you a better investor

And this brings to mind a simple truth: games make you a better investor. A lot of people like to read or listen, but it's proven that you learn better by simulating than any other method of education.

It’s not that reading books or listening to lectures are bad or wrong, but if the knowledge you learn doesn’t translate to simulation, you’re missing out on a key component of learning.

A couple years ago, Gabe Zichermann conducted a wonderful TED Talk called "Changing the Game in Education.” As Robert wrote then:

Zichermann talks about how the modern education system is fundamentally opposed to our nature as humans. Asking us to sit down and pay attention does very little for our education, when in reality we learn more by trying, making mistakes, and achieving. Experiencing the chemical benefits of the pleasure we feel when dopamine is released through our achievements helps us remember and learn far more efficiently.

Kids playing cashflow for kids game. Buy CASHFLOW for Kids here.

Kids playing cashflow for kids game. Buy CASHFLOW for Kids here.

He then goes on to make the case for why gamification is the future of education-including an amazing example of a teacher using Monopoly at a school in California's Inland Empire to teach kids about money, among other things. The result: a jump of 40 kids in the top rankings of the California Math Test, up from less than 10 at the start of the program.

And as R.F. Mackay writes for Stanford University:

We may think we're pretty smart, but in fact we have very little notion of how humans learn. Kids know: They play games. Until, that is, they go to school. That's when the games stop. And often, so does the learning.

This is why, even though we have books and seminars, we've always said the best way to learn how to invest is to play our financial education board game, CASHFLOW. We've seen that those who devote themselves to mastering this game, in addition to reading and hearing great talks, go on to much greater success in investing.

Perhaps this is because as Dan Schwartz, who runs the AAA Lab, "a technology and learning lab" at Stanford, has discovered, "...one of the best negative predictors of performance was the act of walking away after failure." Games allow us to keep coming back to the table after we've failed, thereby improving our performance significantly over time.

CASHFLOW is about learning by doing, not hearing

In 1950, a nun who was a history and geography teacher in Calcutta was called on to help the poor and to live among them. Instead of just talking about caring for the poor, she chose to say very little and helped the poor with her actions, not just her words.

Because of this, when she did speak, people listened.

She had this to say about the difference between words and actions: "There should be less talk. A preaching point is not a meeting point. There should be more action on your part."

While playing CASHFLOW might not have the same level of sacrifice and risk as living with the poor in Calcutta, Mother Teresa’s point about focusing less on words and more on action is a fundamental principle on why we created the game. We knew that by giving people a chance to not only hear and read what we had to say about financial education, but to put it in action, we’d help them be more successful in investing.

The CASHFLOW Game is a meeting point

At Rich Dad, we made a conscious choice to incorporate games into our education methods because they require more action than a lecture. As Mother Teresa said, "A preaching point is not a meeting point." Our games are meeting points.

Games provide a social interaction for learning and helping someone else learn. When it comes to investing, there are too many people trying to teach by preaching.

Robert Kiyosaki on stage teaching about CASHFLOW.

Robert Kiyosaki on stage teaching about CASHFLOW.

We had a vision for CASHFLOW to build a community of like-minded investors across the world. Today, that vision is real with hundreds of CASHFLOW Clubs around the world dedicated to bringing people together to play the game, exchange lessons and advice, and build a strong community.

At Rich Dad, we’ve heard amazing stories about the power of these communities to grow wealth and networks. Rudy L. Kusuma, owner of Your Home Sold Guaranteed Realty in California used the community he built around the game to abandon ineffective cold calling and door knocking techniques to build a top-selling team and eventually strike out on his own.

He told “Real Estate” magazine:

Back in 2007, I started to figure out how to attract customers to me instead of chasing them. I was failing at prospecting and stumbled on this idea of reverse prospecting. I started hosting Cashflow game nights based on the book “Rich Dad Poor Dad” by Robert Kiyosaki. Every time people came to the office to play, I would always ask them, “How many are thinking about buying or selling?” By doing that, I would pick up three, four or five new clients. So instead of cold calling, I hosted the Cashflow game nights and created an investors’ club that taught people how to invest in real estate. By the end of my first month, I had picked up 20-25 clients.

The CASHFLOW Game creates understanding

Confucius once said: "I hear and I forget. I see and I remember. I do and I understand."

Ultimately, we believe that games like CASHFLOW create more understanding. And the more understanding people have, the more they can see the other side of the coin. Instead of seeing fear and doubt, the players begin to see opportunities they never saw before because their understanding increases each time they play the game.

There are many stories of people who have played CASHFLOW and our other games and have had their lives suddenly changed. They have gained a new understanding about money and investing, an understanding that pushed out some old thoughts and gave them new possibilities for their lives.

This is especially effective because CASHFLOW creates a low-risk environment to put into practice investing tactics that you would possibly shy away from in real life. If you're a saver, try aggressive investing. If you're a risk-taker, try slow growth. Win and Learn! By doing so, you gain the confidence to then translate those tactics into your actual investing activities.

A world of opportunity

Again, rich dad taught Robert how to be a business owner and investor by playing the game of Monopoly. He was able to teach him so much more after the game was over when Robert visited his business and real estate.

Robert wanted to create educational games like CASHFLOW that taught the same fundamental and technical investing skills that rich dad taught, far beyond what is taught in Monopoly. As rich dad said, "The ability to manage cash flow and to read financial statements is fundamental to success on the B and I side of the CASHFLOW Quadrant."

And when you’re successful on the B and I side of the CASHFLOW Quadrant, you will be financially free.

Original publish date:

September 02, 2014