Blog | Personal Finance

How Can I Afford That?

The One Simple Phrase That Changes Everything

January 25, 2022

How could it be that a couple could make $500,000 a year and still feel poor?

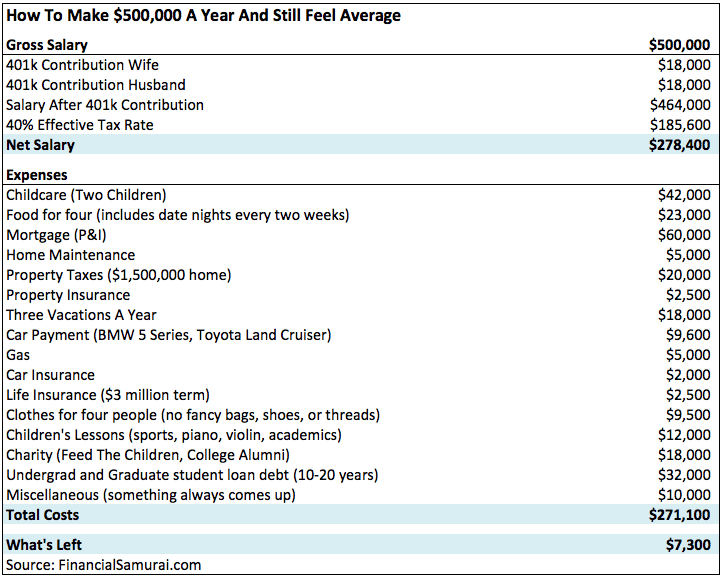

That is the question an article on CNBC tried to answer. Taking a close look at the budget of a power-couple in New York, both high-paid attorneys, we see that though they make a lot of money, they have only $7,300 left over at the end of the year after all their expenses.

Here is the budget chart that is shared in the article:

This is clearly the budget of a middle-class mindset, which I’ve written about before:

Those in the middle class often have more income than expenses (as long they have that high paying job!). They might have a few investments, but they are not a daily focus. Instead, they contribute to a 401(k) they rarely pay attention to and maybe own a house.

The middle class use a budget as a tool to understand how much money they will have left over each month. They then reward themselves for having extra money, which they often use as “discretionary spending”. More often than not, they splurge on vacations, cars, electronics, or something that brings them pleasure—what I call doodads. In the process, they create liabilities but don’t invest in assets.

For those with a middle-class mindset, a budget serves as a tool to make sure you spend less than you make, but also know how much “fun” money can be spent. Yet the source of that money is always earned income from a salary rather than passive income from investments.

High income does not equal rich

Taking a look at the budget of this high-income couple reiterates what I’ve said for many years, making a lot of money does not make you rich. This couple loses their money to many of the traps those who do not have a rich mindset fall into.

The first thing you’ll notice is that they max out their 401k, sending $36,000 to what is probably a mutual fund that provides meager gains, if any at all—especially after the brokerage fees are paid.

The second thing you’ll notice is that they lose 40% of their income to taxes. Only poor and middle class people lose so much money to taxes. The rich know how to prevent taxes from stealing their wealth (see: “Why I Hope Donald Trump Paid $0 in Taxes”).

The third thing you’ll notice is that what is left is eaten up by a lot of liabilities: three vacations a year, a BMW 5 series and a Land Cruiser, a very large house payment, and a hefty food budget. Though they’re clear to point out they don’t do anything fancy when it comes to clothes.

Finally, they live in one of the most expensive cities in the world, which doesn’t help either.

They make a lot of money, but they are far from rich.

The difference between the rich and poor mindset

Where I grew up in Hawaii, there were two schools across the street from each other—Union School and Riverside School.

Union School was for the kids of poor families and was originally founded for those who worked on the plantations, thus its name. Riverside School was for the rich families and was originally founded for those families who owned the plantations.

Growing up, I attended Riverside School, not because we were rich but because our house happened to be just within the district borders. Until I started school, I never knew my family was poor, but once I began classes, it was clear that there were two very different types of people, the rich and the poor…and that my family was poor.

Though I was only a small child, I was aware that my classmates at Riverside School lived at a higher standard of living than my family. Many of my friends at Riverside lived in a wealthy community connected by a bridge that crossed the river. Every time I went to play with my friends, I crossed that river. It felt like crossing into a different world. My friends lived in stately mansions; I lived in a house built for plantation workers. My friends' parents owned their homes; we rented ours. My friends played at private beaches; I went to public ones. My friends belonged to the yacht club; I worked at it.

Perhaps many of these families were like the power-couple from New York…having the appearance of being rich but not really being so. I’ll never know since I was just a kid, but I’d bet in many cases that would be true.

But I did notice some families were quite different in their approach to life and money. Beyond the obvious material differences, I noticed that families like my friend Mike, whose dad became my rich dad, had a different mindset about life than my family did.

This was best summed up in the differences between two phrases.

"How can I afford that?" vs. “I can’t afford that.”

When my poor dad wanted something that wasn't part of the budget, he would deny himself that item, saying, "We can't afford that." When we kids wanted a special toy or to go on a trip, my poor dad would deny us that, saying, "We can't afford that." When my mother wanted a fancy dress, my poor dad would deny her that saying, "We can't afford that." My poor dad had a mindset of scarcity.

Conversely, when my rich friends and their families wanted something nice, they would get it—maybe not right away, but eventually. What was the difference?

Though they didn't always have the money sitting around to buy whatever they wanted, my rich friends' parents were financially intelligent. Instead of saying, "I can't afford that," they looked at the things they wanted to buy as motivation to help them put their money to work so that they could afford to buy them.

Rather than let their finances defeat them, they looked at their finances as a game that they would win. As a result, they nearly always found a way to get what they wanted, even if it took a little patience.

The reason it took some time was because families like my rich dad’s would invest in assets that then gave them monthly cash flow. They used this cash flow to buy the nice things they wanted. In the process, they not only made more money and got what they wanted, but they also kept their money that they originally had. That was financial intelligence on display.

Being rich is not about how much money you make

Rich dad said, “Anyone can make a lot of money, but only the rich person keeps it.”

By this rich dad meant that being rich was more about mindset than about what you made. Being rich is about understanding how money works and how to make it work for you.

Rich dad was adamant that if you wanted to be rich you had to have both a plan to make a lot of money—and a plan on how to keep that money. Because when you make a lot of money, you experience new problems that you may not be equipped to tackle unless you take it upon yourself to understand them.

Just like the power-couple from New York at the beginning of this article, you have much higher taxes, have to manage money in multiple accounts, lose wealth to inflation, and face a lot more temptation to buy liabilities, thinking you deserve to treat yourself.

The simple starting point for being rich

Being rich is not rocket science. There are some simple rules you must follow though. The primary rule is to invest your money in cash-flowing assets, like real estate or business.

There are many advantages to investing in cash-flowing assets.

One, they protect you from the wealth-stealing forces of taxes and inflation. This is because the income made from assets is passive income, which is the lowest taxed income.

Two, you can use expenses and phantom income like depreciation to lower your tax bill. In many cases I pay nothing in taxes at all through my investments.

Three, assets can act as hedges against inflation, rising in value as prices rise in the economy—something savings can’t do.

Four, you can use the continual income from your cash-flowing assets to invest in even more assets, as well as to fund your liabilities, like new cars and vacations.

Five, you’re in control a lot more than if you rely on a paycheck every month.

None of this is possible if your default mode is to say, “I can’t afford it.”

Only those who ask, “How can I afford it?” learn how to operate at this level of financial intelligence.

The rich mindset makes all the difference

Looking back at the power-couple from New York, you can easily imagine how different their lives would look if they took the $36,000 a year they invested in 401k’s and instead used that money over the years to invest in cash-flowing assets that provided these benefits.

They would severely reduce their $185,600 tax bill. They would create additional income on top of their large salaries. They could write off their vacations if they used them to also look for more investments. And that’s just the beginning.

Instead of feeling poor while making $500,000 a year, they’d truly be rich and on the path to never saying, “I can’t afford it,” again.

In short, their lives would be completely transformed. A rich mindset makes all the difference.

How can I afford it unlocks your dreams

In today's world, with high inflation and a seemingly never-ending pandemic, it can be easy to feel financially defeated. Many people are simply getting used to the phrase, "I can't afford that."

Many years ago, The Wall Street Journal even encouraged its readers that "It's Really OK to Say, 'I Can't Afford That,'" with tips on prep for telling friends and kids.

The problem with the phrase, "I can't afford that," is that it's a soul-killing phrase. There is no hope in a phrase like that. It kills dreams rather than stoking the fires of possibility.

Rather than say, "I can't afford that," I encourage you to begin thinking with a new money mindset and to begin asking, "How can I afford it?" Asking that question is life-giving. There is hope in that question. Asking, "How can I afford it," allows you to dream as big as your desired goal. It may take some time, but with the “How can I afford it?” mindset, you can achieve your dreams.

To be clear, what I'm not saying is to spend money when you don't have it on liabilities. What I am saying is to begin thinking how you can make more money so that you can afford some of the fine things in life. I'm asking you to start thinking with a mindset of abundance rather than with a mindset of scarcity.

I'm asking you to start thinking like the rich

Because, the first step to becoming rich is to change your mindset about money and to start thinking like the rich.

So, what are you wanting in life? And how can you afford it?

To increase your financial literacy, start thinking like the rich with our free, financial education community here.

Original publish date:

September 25, 2012