Blog | Personal Finance

The Real Reason You Feel (and Are) Poorer

May 17, 2016

The difference between the old and new rules of money

If you're in the middle class or lower, do you feel richer or poorer? My guess is most people reading this would say they feel poorer. Turns out that's not just a feeling-it's a fact.

As Narayana Kocherlakota writes for Bloomberg in an article entitled "The Fed Made the Poor Poorer":

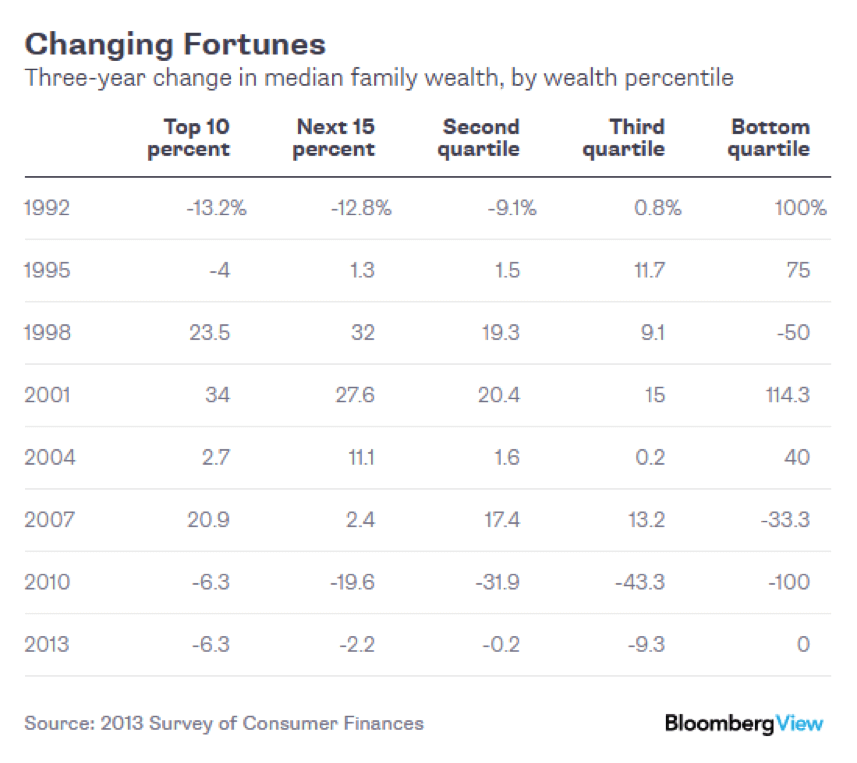

All told, Americans have slid backwards in time in terms of their economic capabilities -- and the poorer families have lost the most. Specifically, the typical family in the bottom half of the wealth distribution was worse off in 2013 than it had been in any of the years covered by the Survey of Consumer Finances, going back to 1989. The following table shows this "time reversal" effect for different wealth categories.

Statistics on 3 year change in median family wealth, by wealth percentile (Source: Bloomberg)

Statistics on 3 year change in median family wealth, by wealth percentile (Source: Bloomberg)

Lawrence Mishel, Elise Gould, and Josh Bivens writing for the Economic Policy Institute confirm this with their data:

Over the entire 34-year period between 1979 and 2013, the hourly wages of middle-wage workers (median-wage workers who earned more than half the workforce but less than the other half) were stagnant, rising just 6 percent-less than 0.2 percent per year. This wage growth, in fact, occurred only because wages grew in the late 1990s when labor markets got tight enough-unemployment, for instance, fell to 4 percent in 1999 and 2000-to finally deliver across-the-board hourly wage growth. The wages of middle-wage workers were totally flat or in decline over the 1980s, 1990s and 2000s, except for the late 1990s. The wages of low-wage workers fared even worse, falling 5 percent from 1979 to 2013. In contrast, the hourly wages of high-wage workers rose 41 percent.

Of course the rich got richer during this time. As you can see from the chart above, "those with very high wages saw a 41% increase."

In his Bloomberg article, Kocherlakota makes pains to show that the Fed's policies of loose money and propping up the housing market in the early 2000's haven't hurt the poor, but rather their policies were too tight:

What drove this increase in inequality? It wasn't the result of the Fed propping up housing or stock markets, which declined sharply from 2007 to 2010. Rather, it seems that the poor would have been better off if the Fed had done more to support asset prices -- and particularly home prices. In other words, inequality rose because monetary policy was too tight, not because it was too easy.

Of course, it's true that if the Fed had done everything in its power to prop up the housing market, the poor would be less poor-for now. But that would have been pushing the problem down the road and most likely would have made a horrible problem a catastrophic one. At the end of the day, bad economics is bad economics, and having the majority of people's wealth reliant on artificial housing prices is about as bad as economics can get.

The efforts Kocherlakota makes to defend the Fed's policies towards banks as somehow not detrimental to the middle and lower classes is laughable. He focuses on one specific three-year period where the rich saw modest losses and glosses over many decades where the ultra rich clearly benefited from Fed policies while not having to take responsibility for the dire financial consequences their decisions had for a majority of the world.

No matter what the Fed did policy-wise to prop up assets, it was their policies that allowed the banks and the ultra-rich to create such a bloated housing market in the first place, and it was the collapse of that market-based on the poor bets of the banks that created the financial crisis-that most Americans are still reeling from.

The numbers are the numbers. The rich are substantially better off in America than the poor. So, the question remains, "Is it the Fed's policies that are making the poor poorer?"

The answer is yes and no.

Yes, in that the policies contribute to the problem, but no in that what really makes the poor poorer is their lack of financial education.

For many years, I've said that the system is built to benefit the rich. So, those who play by the old rules of money-go to school, get a good job, save money, buy a house, and invest in a balanced portfolio of stocks, bonds, and mutual funds-are at a disadvantage. It just doesn't work any longer. In fact, I'd wager that the top 10% of those high-wage earners that saw a decline in income from 2010-2013 were simply high-paid employees who play by the same obsolete rules of money.

Of course I don't have to make that bet, since this chart from the Economic Policy Institute shows that the top 1% of earners (i.e., your business owners and entrepreneurs) were actually up around 4% in income between 2010 and 2013:

Why is this? Because the ultra-rich know how to play by different rules when it comes to money. In fact, I wrote about those new rules in Conspiracy of the Rich over six years ago. The rich who play by these rules still prosper today.

Rule #1 - Money is Knowledge

Rule #2 - Learn how to use debt

Rule #3 - Learn how to control cash flow

Rule #4 - Prepare for bad times and you will only know good times

Rule #5 - The need for speed

Rule #6 - Learn the language of money

Rule #7 - Life is a team sport. Choose your team carefully

Rule #8 - Since money is becoming worth-less and less, learn to print your own

For those of you who have been struggling financially and wondering why, perhaps it is time to do a refresher course on these new rules of money. Over the next eight weeks, I'll do a post on each one. If you want to get out of the rat race and start playing the game of money like the rich, it will be worth your time to check in each week.

See you then.

Original publish date:

May 17, 2016