Blog | Personal Finance

Who Stole My Pension?

January 28, 2020

How systemic corruption by local governments and financial institutions mismanaged the pension plans of tens of millions of people around the world—and how it will affect you.

My newest book, Who Stole My Pension? was just released on January 14th and it is probably the most important book I’ve released to date.

Along with former SEC Attorney, Edward “Ted” Siedle, Who Stole My Pension? is our attempt to unveil the wealth stealing forces at work on employees across the world.

To give a brief overview of the book and why we wrote it, it’s important to understand a few things. First, even if you don’t have a pension or a 401(k) plan, you are about to have your financial life severely disrupted by forces outside of your control. And second, regardless of whether you’re a Baby Boomer who is about to retire or a Millennial just starting out in life, this systemic crisis will affect you.

What is a pension plan?

To better define a pension plan, you first need to know the differences between the two types of retirement plans.

First there is a Defined Benefits (DB) plan. DB’s include pensions as the primary component. DB’s were considered to be one leg of the Three-Legged Stool of Retirement Planning philosophy. The post-World War II generation used the Three-Legged Stool metaphor to represent the defined benefit plan, along with traditional savings and Social Security. When combined, all three “legs” would provide a comfortable retirement for almost everyone.

However, a few things challenged the strength of that plan.

First, President Nixon took the U.S. (and therefore the world) off the gold standard in 1971. As I go into great detail in my books Rich Dad’s Prophecy, and more recently, FAKE: Fake Money, Fake Teachers, Fake Assets: How Lies Are Making the Poor and Middle Class Poorer, before President Nixon closed the gold window, the dollar was backed by gold.

Nixon did this because the US was increasing its trade deficits with other countries. In other words, we were importing more than we were exporting.

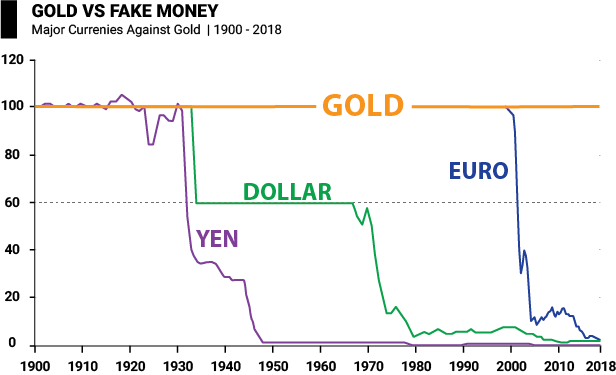

Look at the chart below to better understand how taking the dollar of the gold standard turned the US dollar into “fake” money.

When a currency like the dollar, yen, or peso is not tied to real money like gold or silver, governments are able to print more and more money out of thin air. This leads to the devaluing of purchasing power of that currency.

Referencing the chart below, you can see how the printing of dollars out of thin air has impacted the dollars purchasing power.

The second event that weakened the Three-Legged Stool philosophy was the slow migration from DB plans into the second type of retirement plan: the Defined Contribution (DC) plan like 401(k) plans in the United States, the Super in Australia, and the RRSP in Canada.

In 1974, the Employment Retirement Income Security Act (ERISA) was passed in the United States that set minimum requirements for private companies to provide retirement and health plans for its employees. This lead companies to change from a pension plan (which guaranteed money to its employees) into Defined Contribution plans instead.

Kim and I recently had Ted on our podcast, The Rich Dad Radio Show.

You can listen to the eye opening interview here.

Ted expands on how ERISA didn’t cover public pensions.

“... believe it or not, state and local pensions aren't governed by any comprehensive federal law or any comprehensive law at all. Corporate pensions are governed by something called ERISA. The employee retirement income security act, which has a lot of requirements for corporate pensions. Public pensions are not subject to a ERISA.

And what you find across the country is the boards of these public pensions are made up of politicians, school teachers, firefighters, cops, sanitation workers. So there's no one on these boards that has experience managing pensions and there's no law that requires. So if you, if you're thinking that the person running the board overseeing your pension knows what they're doing, that's just plainly not true and all you have to do is look up the biographies of these people and you'll see that they are typically either elected officials or state employees.”

For example, Ted continues to explain the looting of Rhode Island pensioners.

“Rhode Island was a crazy situation. About seven years ago, a little known so-called money manager, a woman named Gina Raimondo ran for state treasurer. And with the support of a lot of major Wall Street firms with the financial support of a lot of major Wall Street firms actually got herself elected to run the $8 billion state pension.

“So this woman who had had virtually no experience in investing got control of this $8 billion pension fund that basically controls the state economy. And this is, that's the big honeypot of money in the state and wall street, uh, political contributions helped her do that. So the first thing she did was she told people that they needed to cut the benefits, paid the workers by 3%. That's an austerity plan to improve the financial health of the pension. But what she didn't say was that she was going to pay wall street 4% on the riskiest gamble the state had ever taken a gamble in hedge funds and high risk private equity funds that ultimately cost the pension a half a billion dollars. And so for a small states like Rhode Island losing a half a billion dollars of the $8 billion pension is devastating. How do you make up a half a billion dollar?”

Rhode Island is not alone. Half of all state and local pensions have cut pensions since 2008 and more will be facing cuts in the future. The widespread looting Ted has been investigating is global in its reach. Everywhere from Croatia to the UK and Australia to Japan are feeling it’s effects.

For example, Japan has an aging population of roughly 30% that will need financial assistance. Who’s going to pay for it?

The 401(k) vs Pension Plans

Returning to the 401(k) and other Defined Contribution plans, Ted continues to explain that these new company sponsored retirement plans were slowly gaining popularity with companies as a cost saving measure to replace the pension.

As Ted sees it, the truth is that the 401(k) will never provide the level of retirement security that a pension provided. The average 401(k) account for a 65 year old is only $50,000. For most people, that will barely cover expenses for a full year.

Take the police force of Atlanta, for example.

Ted was recently hired to sit down with their city council to migrate their failing pension plan into a 401(k)-type plan. As he sat in a room with a few hundred armed policemen, he had to inform them that the proposed 401(k), regardless of its performance, was never going to outperform their current pension. According to Ted, the public servants were having their gold ripped away and replaced with a lump of coal.

This looting is happening everywhere.

I just turned on the TV the other day to see rioting in Paris, France. It wasn’t over Donald Trump or anything he said, it was over pensions.

Pension Crisis Takes Flight

But the pension crisis isn’t limited to government sponsored Defined Benefit programs.

Ted was asked to investigate why the United Airways and US Air pensions were turned over to the Federal government. The Fed called these pension benefit guarantee corporation or PBGC. Pilots who flew for these airlines lost 50% of their pensions. As Ted recalls, many of the pilot’s children who were pilot’s in the military, instructed their children to stay in the military because the benefits were better than could be found in corporate America.

The Death of the Pension Plan

On a Tuesday morning, Kim and I entered the local offices of a national and well-regarded accounting firm. They were expensive and came highly recommended. Rather than one accountant, there was now a team of “expert” accountants, all graduates of top-tier universities. My ego was flattered just having these A students from great schools focused on our little business.

Smiling confidently at Kim and me, the Washington DC expert started his presentation by saying: “I have reviewed your financial status and have the following recommendations...”

In a confident and authoritative tone, the preppy accountant said, “I recommend that you sell all your real estate investments and invest in a well-diversified portfolio of stocks, bonds, mutual funds, and ETFs.”

Needless to say, I burst out laughing.

The accountants (and a few attorneys) around the conference table were not laughing.

“You’re kidding me, right?” I asked. “Who put you up to this?” I was sure it was a practical joke. But no one was laughing.

It took me a moment to realize this was not a joke. These experts were serious.

Surely, I told myself, they had read my book Rich Dad Poor Dad before the meeting.

Surely, they knew that in the book I wrote about Ray Kroc, the founder of McDonald’s, formula for investing.

Surely, they understood what Ray Kroc meant when he said, “McDonald’s is not a hamburger company. McDonald’s is a real estate company.”

And surely, they knew that Kim and I used debt for leverage and that we paid zero in taxes, in large part because we followed the McDonald’s formula of business.

While working with Ted on Who Stole My Pension?, Ted reminded me about the “expert” advice Kim and I received over two decades ago.

“Every pension death I’ve witnessed involved multiple experts responsible for monitoring the deceased’s ‘vital signs’ i.e. soundness of the plan, including the calculation of future liabilities and assumed rates of return, allocation of assets, and fees paid to investment managers.

"The judgments of these so-called experts are rightfully called into question by the unexpected death. To the extent they may have contributed to the demise of the plan, they should be held accountable.

“Pensions don’t just implode overnight. There are always warning signs or ‘red flags’ that have been disregarded for decades. Why?

“Pension deaths are almost always foreseeable. Likewise, pension deaths are almost always preventable. If not foreseen and prevented, then someone was not doing their job.”

After listening to Ted explain how the death of pensions occur, I realized my poor dad, an academic and a teachers’ union executive, would have loved the “expert’s” presentation. Their offices were plush, each expert a graduate of a big-name school, many of them Ivy League, and each had an alphabet-soup after their names...Masters of something, Doctorate of this, and PhD of that.

Poor dad would have swallowed the presentation, hook, line, and sinker.

If not for the education from my rich dad, Kim and I might have been robbed blind by “experts”.

What to do with your pension plan now?

To illustrate exactly how pervasive my poor dad’s way of thinking is, let me wrap this up a quick story.

Kim and I were recently driving to the airport when the driver was telling us about his parents. He proudly explained how his mother was a teacher and his father was a blue-collar worker, both with great pensions. He boasted about how they are both wonderful, hard working people, well deserving of their impending benefits.

I proceeded to warn him that a lot of pensions could default leaving their recipients left with nothing.

Our driver was adamant, “oh no, no, that can’t be. They cannot be in crisis.”

And for those paying attention, we were not in the United States.

Want More Financial Security?

Quickly learn exactly how to think like the rich and then do what the rich do to achieve financial independence.

Choose to Be Rich—Click Here

So what does this pension crisis mean to you?

Regardless of whether you have a Defined Benefit or Defined Contribution plan is irrelevant. As I’ve discussed numerous times before, the looting of our individual wealth is well underway and it isn’t going change anytime soon.

The only thing you can do is continue to increase your financial education, by reading books, watching videos and listening to podcasts that provide information every side of the coin.

If you want to learn more about how your pension plan is under attack, grab a copy of our new book Who Stole My Pension? here .

Original publish date:

January 28, 2020