Blog | Personal Finance

The Beginner's Guide to Personal Finance from Rich Dad - Part 1

How—and why—the Rich Dad way is different than the so-called financial experts

Rich Dad Personal Finance Team

March 28, 2023

Summary

-

The Rich Dad approach to succeeding in personal finance is like no other.

-

Truly understanding personal finance is the key to becoming rich.

-

Paying yourself first is the secret to starting your journey to financial freedom.

Personal finance is a big deal. Seems like at every corner you turn in the information age, you run into somebody giving you financial advice.

Personal finance is about more than managing your money so you can meet your financial goals. Rich Dad defines personal finance as the path to financial freedom.

There are many things that go into this, from having your dream house, to having enough money for the kids to go to college, to retiring early… and everything in between.

Unfortunately, most of the so-called financial experts are giving out bad money advice.

In 1997, Robert Kiyosaki published his book Rich Dad Poor Dad. With over 32 million copies sold, it is the best-selling personal finance book of all time. But true to his nature, it was contrarian and went against the standard financial advice of the time—the same financial advice that is prevalent today like go to school , get a good job , save for retirement , get out of debt — the list goes on and on.

In this beginners guide to personal finance, we’ll share with you the knowledge Robert’s rich dad, his best friend’s dad, shared with him about money, how it works, and how it can work for you to help you become rich.

We will cover the following topics, which are the foundations of personal finance, but a take you won’t hear anywhere else.

The Beginner's Guide to Personal Finance

-

Part 1

-

The Rich Dad way to budget

-

Paying yourself first

-

Budgeting with the personal financial statement

-

The Income Statement of a personal financial statement

-

The Balance Sheet of a personal financial statement

-

Assets

-

Liabilities

-

Why savers are losers in the Rich Dad philosophy

-

Clarifying the difference between assets and liabilities

-

Cash flow and capital gains

-

Why investors are the real winners in personal finance

-

Part 2

-

How the rich use debt to improve their personal finances

-

Your credit score

-

Three types of income and how they’re taxed

-

Retire young, retire rich

-

The rich don’t work for money

-

The rich don’t save for retirement

-

Your wealth number and retirement

-

The rich use the three piggy banks to retire

-

Rich Dad’s personal finance budgeting tips

Let’s get started

A. The Rich Dad way to budget

Building and maintaining a budget is an essential element of personal finance success. It is the roadmap for your finances. Most financial experts make budgeting all about balancing your income and your expenses. But at Rich Dad, we prefer to talk about budgeting as a way to generate more income and expand your means.

Here’s how most financial experts suggest building a budget.

A.i) Paying yourself first

Robert achieved success through a simple method called Pay Yourself First. Essentially, this is a way of prioritizing your financial savings and investing, making it an expense item on your budget… the most important one.

Here’s how it works. With every dollar that comes in, place 30% into three accounts, or piggy banks.

-

Savings Account (10%)

This account is a cushion for unforeseen emergencies.

-

Investing Account (10%)

These funds are allocated for a great investment opportunity, so you can be ready to make a move once one comes to your attention.

-

Charity or Tithing Account (10%)

As the saying goes, “Give and ye shall receive.” Another saying we’ve heard is that, “God doesn’t need to receive but humans need to give.” Charity is a powerful tool with many benefits to everyone involved.

Here’s how to put this philosophy in practice. Allocate 10% into a general savings account, another 10% into an investing account and a final 10% into a charity account. This seems very practical and easy to do, however, like most things in personal finance, it’s easier said than done.

A.ii) Budgeting with the personal financial statement

Many people begin to budget their finances using a template spreadsheet that tracks their monthly income and expenses. While this is helpful, it doesn’t show you the entire financial picture.

Instead, learn how to use a personal financial statement. Very simply, here are the elements of a personal financial statement.

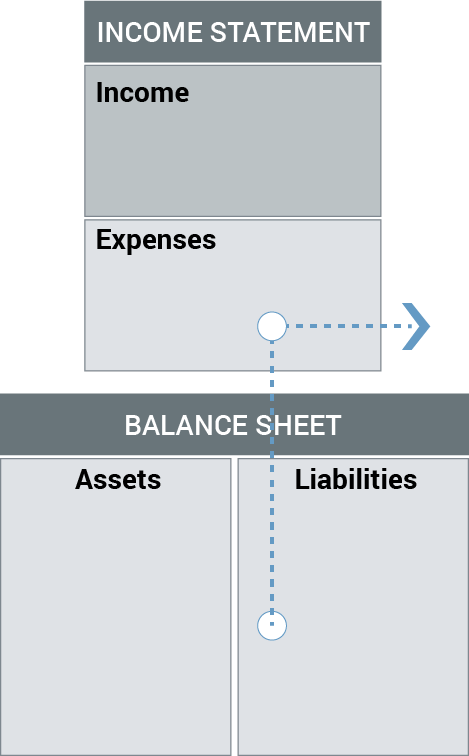

The first part of the diagram shows the income statement with two rows labeled income and expenses. This is where most template spreadsheets stop.

Rich dad completed the personal financial statement by including the second part of the diagram, the balance sheet. The balance sheet consists of two columns labeled assets and liabilities.

By understanding the relationship between the income statement and the balance sheet of your personal financial statement, you see the direction your money is moving and whether it is making you rich or not.

A.i.a) The Income Statement of a personal financial statement

Any money hat comes into your household flows through the income column of your income statement. This includes the three types of income:

-

Ordinary income

This includes money you work for such as wages, tips, salaries, and commission from your job or business.

-

Portfolio income

Portfolio income includes profits from the sale of any investments. These are also called capital gains which include the sale of stocks, businesses, and real estate.

-

Passive income

This income includes income from rental properties, limited partnerships in which you invest money but are not actively a participant, and other similar enterprises. Passive income, or positive cash flow, can also come from interest on your savings accounts, bonds, CDs, stock dividends, patent royalties from things you created, patent royalties from books, songs, and other original works.

It’s important to note that it’s not only how you acquire your income from the three types of income but how you’re taxed on the money you make. We’ll discuss taxes later in this guide.

A.i.b) The Balance Sheet of a personal financial statement

The balance sheet consists of assets and liabilities. Simply put, assets put money in your pocket. Liabilities take money out of your pocket.

A.iii) Assets

The conventional accountant will tell you that an asset is “something of monetary value that is owned by an individual or company.” By that definition, your alarm clock and everyday dishes could be considered assets.

Rich dad disagreed. Where most accountants want to classify your shares of stock, jewelry, personal residence, your cars, your mutual funds assets, rich dad did not. Rich dad didn’t believe they had any value until the day you sold them.

Using rich dad’s definition: An asset is something that puts money in your pocket, whether your work or not.

A.iv) Liabilities

To confront the traditional definition of a liability, most accounting professionals will tell you that a liability is “an obligation to pay an amount you owe to creditors, be it an individual or an organization.”

Rich Dad defines a liability as something that takes money out of your pocket.

You can see the dilemma. Most people (and bankers) would consider their Mercedes an asset because it has value. However, the Mercedes is a liability because it takes money out of your pocket every month.

“But it’s paid for,” you contest. The car loan may be paid for, but what about gasoline, maintenance, repairs, and insurance?

The biggest point of confusion is when we say your house is not an asset. Especially when times were booming and people were taking loans out against their homes. It wasn’t until the real estate market crashed that people found out they owed more on their house than it was worth that they realized their home was not an asset.

That is why understanding your balance sheet is so important.

People call their liabilities, assets, and vice versa. When the economy turned, many people were faced with that harsh reality.

Simply put, if all you own is liabilities (and that includes your house since it takes money out of your pocket each month), then you will have a hard time getting rich, even if you balance your budget.

If, however, you have assets that produce cash flow each month, in addition to your other sources of income, you will have a much easier time getting rich.

This is why the Pay Yourself Method comes in handy. Using the money you paid yourself to purchase assets provides more and more passive income each month. That is the money that you’ll use to purchase your liabilities - not your earned income from salaries. This is how you’ll get rich, and it’s a very different approach than other financial advice.

If you want to use the Rich Dad financial statement for your own budget planning, you can download it here.

B) Why savers are losers in the Rich Dad philosophy

Yes, you read that correctly. Savers are losers. Not personally, but financially.

This may be confusing because we just covered the three piggy banks philosophy where we advocated for saving 10% of your income. However, make note that this account is a cushion for unforeseen emergencies or special opportunities that improve your life. It is not something to be relied on for financial security or retirement. It is a last stop gap liquid account only.

Most financial “experts” advise people to save as their primary means of retirement. Saving comes in many forms. You can save money in a savings account with a minimal interest return, put your money into a 401(k) with the hope of some market gains, or put a big portion of your liquidity into your personal home.

Regardless, most financial advisors are big proponents of compounding interest, whereby each year the interest paid on your money includes the previous interest you made before. It is powerful with the right circumstance, mainly high interest rates and frequent compounding. However, most people have low interest rates or infrequent compounding.

Also, most people are not aware of compounding inflation. This simply means that over the same time your savings grows, the cost of buying goods grows as well. Essentially, you may have more dollars from saving, but the buying power of those dollars is less—a losing situation. You need to make money at a much faster rate than inflation to be rich and retire comfortably.

So, by saying ‘savers are losers’, that doesn’t necessarily mean all savers. It means a certain type of saver. That is, those whose primary financial activity is saving, hoping it will get them rich or prepare them for retirement.

To understand this, it is important to understand another Rich Dad personal finance essential: how to leverage assets to afford your liabilities.

B.i) Clarifying the difference between assets and liabilities

Many years ago, Robert wanted a giant 60-foot sailboat. He didn’t have the money for it, and he knew it was a huge liability. Rather than simply save for the boat, as many people would do, he wanted to find a more creative and financially intelligent way to afford it.

So, he did some research, found out how to contract the boat with a charter company, and the income from the charters covered the liability in the boat. He got to own a luxury liability, and it also became an asset. That is winning at money. Saving and then buying is not.

B.ii) Cash flow and capital gains

The second Rich Dad personal finance essential to understand in regards to why savers are losers is the difference between cash flow and capital gains.

As we mentioned in the previous section on budgeting, cash flow is income that comes without you working for it from an asset like an investment property, a business, a product like a book, etc. It is called passive income, and it is the lowest taxed income; it is steady and reliable.

Capital gains is income that comes based on the relative price of something going up. You do not recognize a capital gain unless you sell something, and only then does it put money in your pocket—if you were lucky enough to sell at a profit. Capital gains can be taxed very high.

B.iii) Why investors are the real winners in personal finance

Remember, our simple definition is if it puts money in your pocket, it’s an asset. If it takes money out, it’s a liability.

Your personal home is a liability because it takes money out of your pocket. Only if you sell it for a profit does it produce capital gains, again, if you’re lucky.

With an investment property, however, you can get income each month in the form of rent, depreciation each year that reduces your tax liability, and all maintenance costs are tax deductible. That is the power of an investment vs. saving, which owning a house is basically a form of saving, albeit with more risk.

Not only that, you can refinance an investment property to remove the equity cash free and deploy it into even more investments in assets. That is a concept called the velocity of money, and it is how to become rich in today’s economy, which rewards smart users of debt (investors) and punishes savers of money.

Your first step towards financial freedom

So far we’ve explained how achieving financial freedom all begins with knowing where you are. Completing a personal financial statement is the first step of discovery. Understanding the differences between assets and liabilities, cash flow and capital gains, and why savers are losers, conclude the first part of our personal finance guide. Be sure to check out part two of our plan when we help you understand that all debt isn’t created equal, how taxes can make you rich, and why the old rules of money won’t help you retire happily ever after.

Original publish date:

January 24, 2012