Blog | Cryptocurrency

Bitcoin and Ethereum Crash

February 07, 2022

Is it time to get rich?

If you're serious about getting rich, now is the time. We've entered a period of mass-produced pessimism, when bad news is everywhere, and the best time to invest is when optimists become pessimists.

Here is the cycle of pessimism, optimism and the professional investor.

Journalist Hunter S. Thompson used to say, "When the going gets weird, the weird turn pro." That's true in investing, too: At the height of every market boom, the weird turn into professional investors.

I remember in 2000, millions of people became professional day traders or investors in dotcom companies. Mutual funds had a record net inflow of $309 billion that year, too.

Many times, I’ve stated that I knew it was time to sell my nonperforming real estate when my checkout girl at the local supermarket, handed me her real estate agent card. She was quitting her job to become a real estate professional. Weird.

As a bull market turns into a bear market, the new pros – the weirdos - turn into optimists, hoping and praying the bear market will become a bull and save them. But as the market remains bearish, the optimists become pessimists, quit the profession, and return to their day jobs. This is when the real professional investors re-enter the market.

This trend is not just in the real estate market and the stock market. What about the crypto market?

If you are entering now because prices are great, then you might be one of the “weird”. But, if you go in now with financial education, it might be the best thing you can do. The most money I’ve ever made was in the real estate bear market, but remember I was financially educated.

Do not take any of this blog as advice. This is for education only. You and only you can make your investing decisions.

Here is what my Rich Dad cryptocurrency team says about the current bear market.

From my Rich Dad Cryptocurrency team:

Bear Markets Back Alright

We speculated that in Quarter 1 we would have a major correction, and now we are already in the middle of it. Funny how time horizons seem to catch up sooner than you think. If you are new to the crypto investing, this could be quite unsettling. If you are financially educated you know what this has meant in the past. Let’s look at history.

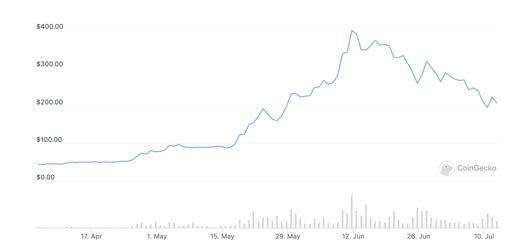

Here’s take a random chart:

As you can see, this asset dropped from $400 to $200, -50%, kind of similar to what happened to the current markets.

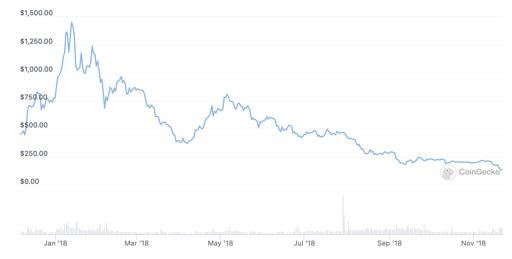

What about this one? This went from $1500 to $250, ouch that’s like -85%!

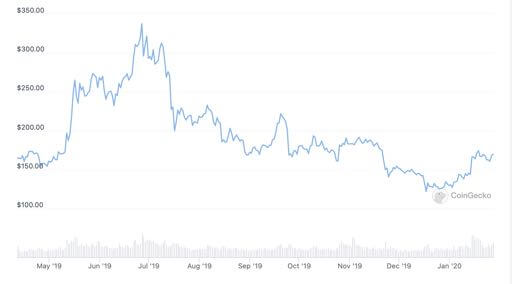

Okay one more bearish chart, this one shows an asset going from $340 to $125! Another example of -50%

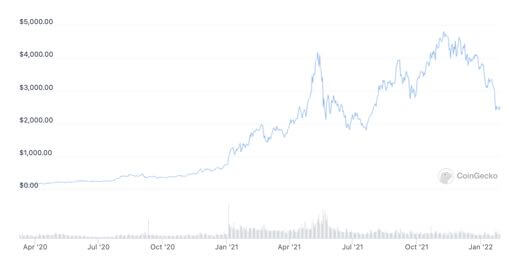

Last chart promise, from mid 2020 to today, from $100 to $5000 back to $2500:

Has anyone guessed the asset yet? These charts show Ethereum for the past 4 years, which has been up 250x in that time period (500x at the height, how we wish we had stacked $10 ETH in 2017).

The point is every year had huge bear market moves. What we are trying to say is, most people wish they bought an asset early, or think that assets can only go up in value. What we want you take away from this is, volatile assets can move in either direction. If you’re not looking at the macro level and not taking profits or shifting profits into other speculative investments, you will have to ride the waves up and down each time they hit.

This isn’t meant to discourage, but rather to just set expectations on how to navigate cryptocurrencies. We’ve had people super bummed when AVAX went from $33 to $10. It would later hit $150. Or when LUNA fell just 6 months ago from $15 to $5, people were cursing our Rich Dad Crypto investing program for bringing it up early as a potential high performer with a great ecosystem…only to have it go on to $100, a 20x move.

Now people think the sky is falling and the project is dead hitting $50. People will only see the short term, they’ll only see red, and never appreciate seeing green.

This is why we created a video in our program specifically teaching exercising good habits when taking profits. It may be the video that changes your habits the most.

Finally, remember how much capital is on the sidelines. When markets eventually recover, it can recover very fast, but don’t get caught in a panic buy where you buy into a peak that falls again.

In summary: Bear markets are where you have the highest upside. But you better make sure you are financially educated before you attempt to take advantage of this.

Original publish date:

February 07, 2022