Blog | Personal Finance

The Three Personal Cash Flow Patterns

Where is your personal cash flow pattern leading you?

Rich Dad Personal Finance Team

September 26, 2023

Summary

-

The poor, the middle-class, and the rich all have different personal cash flow patterns

-

Understanding the components of your personal financial statement will help you develop strategic cash flow patterns

-

It’s never too late to change your cash flow pattern and become rich

A common question people ask is, "Where does all my money go?" Though they mean it as a joke, it's said with a sense of sadness. But the reason they don't know where their money goes isn't because they lost it or forgot the pin number to their bank card. They don't know where their money is going because they don't control the cash flow pattern of their money, their money controls them.

Rich Dad Poor Dad and cash flow

In Rich Dad Poor Dad, Robert Kiyosaki introduces three cash flow patterns: one for the poor, one for the middle-class, and one for the rich. Understanding the differences between the three types of cash flow patterns will help you know where your money flows.

In order to understand the different types of personal cash flow patterns, however, it's important to first understand the personal cash flow statement. At Rich Dad, we call the personal cash flow statement your personal financial statement.

The personal financial statement consists of two parts: the income statement and balance sheet. The top part is called the income statement which consists of your income and expenses. The bottom part is called the balance sheet which displays your assets and liabilities.

It's the relationship between the income statement and balance sheet of your personal cash flow statement that ultimately determines your personal cash flow pattern.

Cash flow pattern of the poor

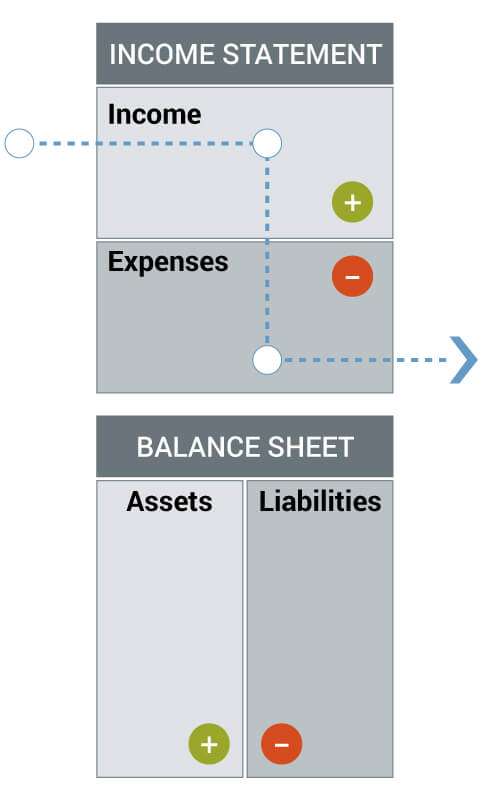

The first cash flow pattern we need to discuss is that of the poor. You'll often hear those who struggle with their finances say things like, "I'm living paycheck to paycheck." They then tell their children to "Stay in school and study hard." The unfortunate reality for those who follow that advice is that they barely make enough money to pay their monthly expenses.

The cash flow pattern of the poor looks like this:

They are hard workers, often doing two jobs just to make ends meet, but they have a hard time getting ahead because they are treading water simply trying to stay afloat.

They often think more money will solve all their problems. But money rarely solves the problem, rather it accentuates their spending habits.

But poor spending habits aren't exclusive to the poor.

Cash flow pattern of the middle-class

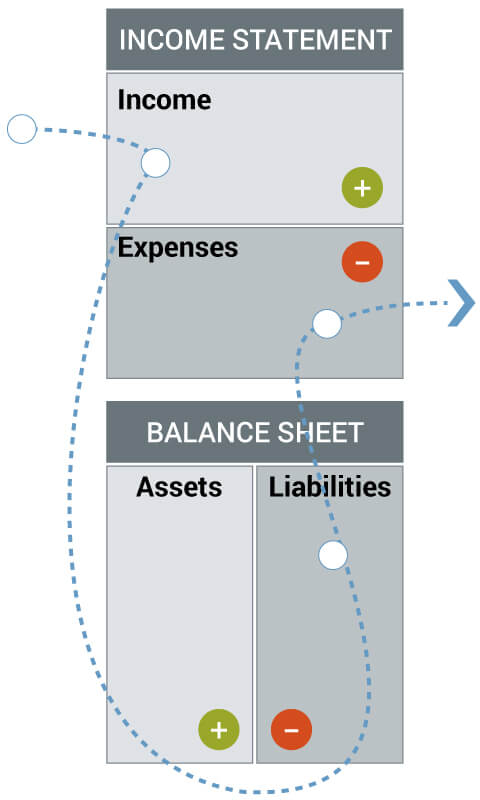

Most of the middle-class also live paycheck to paycheck, but for different reasons and through different means. The following is the cash flow pattern of the middle-class:

The cash flow pattern of the middle-class is considered typical and even smart. People who follow this cash flow pattern probably have high-paying jobs which afford them nice doodads like big homes, fast cars, and any number modern-day comforts. And what they don't buy with cash, they gladly charge with their credit cards. This is what rich dad called the "working-class dream."

A doodad, if you are unfamiliar with the term, is another name for a liability. The difference between the cash flow pattern of the poor compared to that of the middle-class can be found in the liabilities in their balance sheet.

If you look at the personal financial statements of the poor and middle-class you'll notice they are very similar but also have a very big difference. Both groups of people have jobs that ultimately pay for their expenses. However, where the poor spend all their money on expenses, the middle-class spends their hard earned money on bigger liabilities first.

So while a poor person might spend 30% of their paycheck on rent, someone in the middle-class will spend 30% on the mortgage for their home. In both cases, the money earned from their job covers their expenses. The only difference being how much.

Over time, the middle-class builds a lifestyle that must be maintained by either getting a higher paying job or working longer hours to afford more expensive doodads like a bigger house, premium education for their children, or luxury vacations.

The house, the education, and the vacation isn't paid for in cash, however. Why pay in cash when you can use credit and pay for it later?

This is the vicious cycle the middle-class finds itself in. They might make more money than someone who is poor but they will never get rich because of the middle-class cash-flow pattern they follow. They might find a higher paying job or get a big bonus or earn a raise but instead of following the cash-flow pattern of the rich, they continue to run around in the Rat Race.

Cash flow pattern of the rich

So while the poor work for paychecks that pay for their monthly expenses and the middle-class purchase bigger liabilities with their larger paychecks, what about the rich?

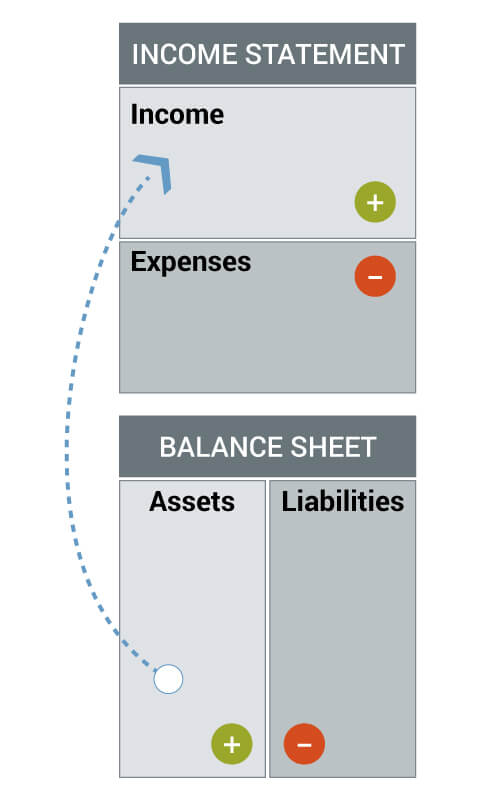

The following diagram shows money going from the asset column of the balance sheet into the income section of the income statement. That is the cash flow pattern of the rich.

The rich don't work for money

Take a look again at the three different types of cash flow patterns we've discussed. Do you notice what's missing from the cash flow pattern of the rich?

A job!

"The rich don't work for money" is the title of the first chapter of Rich Dad Poor Dad . See, while the poor and middle-class go to a job and earn their income through a paycheck, the rich make passive income by acquiring assets.

Three types of income

It's worth noting that there are three different types of income.

As we discussed previously, the poor and middle-class go to a job and make earned income. They exchange their time for money.

The second type of income is called portfolio income. When people invest in the stock market and buy a stock at $10, they do so in hopes of selling it at a higher price in the future. Their goal is to make portfolio income, also called capital gains.

The third type of income, passive income, is shown in the cash-flow pattern of the rich. The rich don't have a job. They don't receive a paycheck, rather they spend their time in exchange for acquiring assets.

Game play reflects real life

Robert Kiyosaki learned about real estate investing for cash flow through the board game Monopoly. As a kid, he would play it for hours with his best friend, and his rich dad (his best friend’s father). Later, when he and his wife exited the Rat Race, they developed their own board game, CASHFLOW 101 (now called CASHFLOW the board game). They took the experiences they learned to become financially independent and developed their own version of Monopoly.

In addition to CASHFLOW the board game, they also developed CASHFLOW Classic, the free online version of the game. The goal of our CASHFLOW games is to exit the Rat Race and enter the Fast Track. The Rat Race simulates the daily routine the poor and middle-class find themselves in. The Fast Track, however, is where the rich live. It's where truewealth is created.

The avatars designed into the game closely resemble professions found in everyday life. The purpose of the game is to teach players their own tendencies regarding their personal finances.

Inevitably, when people play CASHFLOW, the player's gameplay often reflects how they "play" in real life. Many people come to realize that the cash flow pattern they follow is similar to that of a poor or middle-class person, not the cash flow pattern of the rich.

How to change your personal cash flow pattern

Everyone has a personal cash flow pattern and it's important to note that there isn't anything wrong with which pattern you currently follow. But if you feel you need to make a change, here's a short list of what you can do.

- Play CASHFLOW

We have seen incredible changes in people's lives after playing just one game of CASHFLOW. Whether playing the board game with a group of friends or complete strangers from across the world, the lessons learned can make immediate, life long changes to how you view money.

If you want to start making changes today, register to play CASHFLOW Classic —for free—now.

- Complete a personal financial statement

After playing a few games of CASHFLOW, it's important to put those lessons into action. If you haven't already, download your copy of our personal financial statement (xlsx) here. Complete the personal cash flow statement with your financial information and compare it to the cash flow patterns we discussed in this post.

After reading this post and following the steps provided, you’ll be on your way to making life-long changes to your cash flow patterns and develop the mindset of the rich.

Original publish date:

December 24, 2013