Blog | Cryptocurrency

Goldmine Backed Crypto: The Quest to Replace Fiat

Cryptocurrencies were initially intended to replace the existing financial system. The issue however, is that they were not as easy to use as traditional fiat currency and payment structures.

Jess D., Rich Dad Crypto Team

August 17, 2022

Cryptocurrencies were initially intended to replace the existing financial system. The issue however, is that they were not as easy to use as traditional fiat currency and payment structures. Unlike cash, which is debt-backed—meaning that it is connected to debt owed by a government—Bitcoin was not backed by anything. That means in order for it to be a store of value it requires the use of complicated mathematics underlying its blockchain technology and controlled supply.

Bitcoin was created during a time when people worried that if they left their money in a bank and their country's currency either became devalued or experienced hyperinflation their money would be worth less and affect their security and financial survival.

The Purpose

Over the past year-and-a-half, I feel that we have lost sight of the true purpose of cryptocurrency and how it could be used as a tool to help mitigate inflation. The primary problem with crypto (especially in DeFi) as it currently stands is that they are highly volatile. Due to this many altcoins rely heavily on large-investors providing liquidity to their tokens to create their dollar value. When the large-investors exit with their funds this lowers the overall value of the crypto, this is due to the “backing” being the initial large-investors who use newer investors for exit liquidity. This is where a cryptocurrency backed by a physical asset can provide a stabilizing element.

Gold-Backed Crypto

The advantage of cryptocurrencies secured to physical assets like gold is that they are much closer to providing a financial system that is rooted in something with real value instead of being rooted in debt. Paper money created a money printing system drives people further into debt. By saving and keeping fiat dollars in our bank accounts, we are essentially holding onto debt notes.

This debt-based currency system is inherently inflationary, robbing us of the purchasing power of our own money through the hidden tax of inflation. When we put our money into a bank, bank regulators only require banks with more than $127.5 million on deposit to hold about 10% of the dollars in accounts for withdrawal requests, which means 90% of those dollars can be loaned out.

Banks collect interest on these loans thanks to fractional reserve banking and the central bank's ability to have printed off as many dollars as it wants. The dollar is essentially created out of thin air when the Federal Reserve goes to its member banks for short-term loans. The FED can make as many dollars as it wants and use them for any purpose it desires, causing the supply of dollars to increase.

This is why I see the value of privacy-based crypto tokens and tokens backed by physical assets. These allow us to have the same purchasing power to buy and sell in the fashion cash provides, but the security of knowing the currency we are using has real-world value.

Chasing Value Instead of Chasing the “Moon”

During a three-year period, from 2020 through 2022, while confusion spread around the planet during COVID-19 pandemonium, many investors were dazzled by the idealistic dream that they could invest cryptocurrency and become millionaires or billionaires in a fairly short amount of time.

People eager to get rich from cryptocurrency invested in projects that looked to be lucrative but did not have strong fundamentals. These people felt pushed by social media, news and influencers.

These new investors were primarily fueled by a small group that became affluent due to their early involvement in crypto. Some of these individuals chose to seek promotional deals and to be whitelisted. They often received promises of access to initial coin offerings (ICOs) before they were open to the public, profiting and exiting out of position shortly after launch.

Disclaimer

The tokens and companies listed below are being provided for educational purposes only. Personally, I invest with small amounts that I can afford to lose and wait when I am evaluating anything related to a crypto protocol because time reveals value. If I feel my experience has been positive and is worth placing more into it, then I do a risk assessment and plan out a course of action.

I have received no promotions or endorsements. All information is based solely on my own research.

AABB Gold Token (AABBG)

When I began looking into crypto-backed by gold for one of the previous newsletters I released for Rich Dad Crypto earlier this year I found services such as Kinesis Money and Paxos Gold. This time I wanted to find a business that not only provided a token, but stock as well, and shareholder value.

This led me to discovering Asia Broadband, Inc. They bring something new to the table in terms of crypto backed by gold. Most gold-backed tokens purchase the metals from the mint. Asia Broadband is a gold mining company listed on the stock exchange. For every 0.1 gram of gold that they mine this equates to one of their AABB tokens. This makes them a hybrid between a stable and utility token at a smaller price point.

According to the aabbgoldtoken.com website:

“Asia Broadband, Inc. (OTC: AABB), is a high-margin resource company focused on the production, supply, and sale of precious and base metals to primarily Asian markets. Through its subsidiary, Asia Metals Inc., Asia Broadband focuses on the acquisition of highly prospective gold projects in well-established mining camps around Mexico.” - (source aabbgoldentoken.com/about-us/)

While their token has only been available since 2021, the company itself has been around since 1996, with over $100 million dollars in assets.

Their mines are located in different secured locations on the western coast of Mexico, with each location processing over 150 tons per day in their facilities.

Amenities and Future Plans

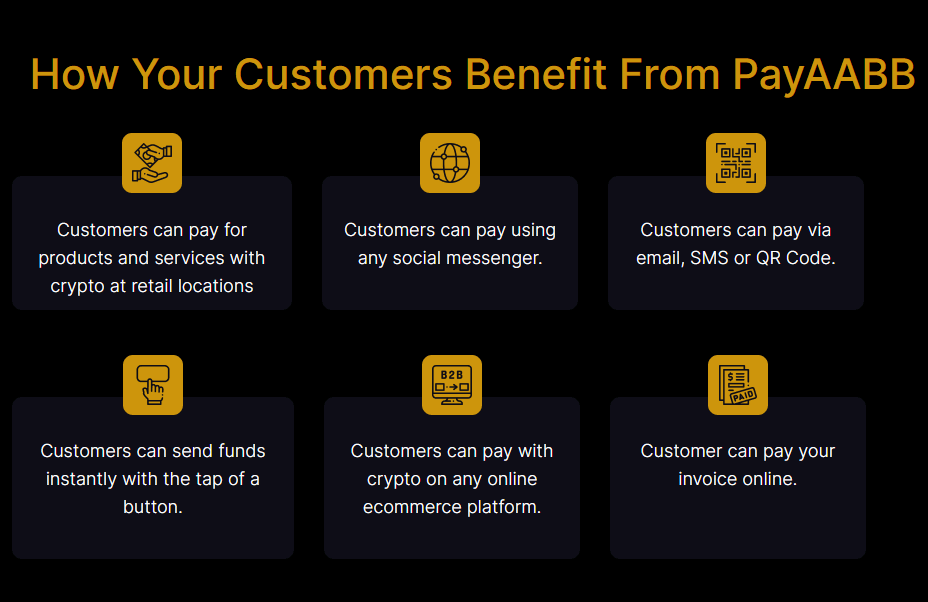

AABB will be setting up a payment feature that will allow holders to use their AABB tokens like cash and even use them as an option for receiving payments.

How Can AABB be Useful

AABB provides their token as a tool to be an intermediary option for placing dollars out of fiat and into a cryptocurrency backed by gold.

Example: Helen is concerned with only having her savings in the form of dollars in her bank account, she wants to have diversity for other types of assets that can be used in the way she uses cash without having the same inflation risk cash poses.

In this scenario, Helen wants to have a “just in case” option in the event of being denied access to her bank funds, she has an alternative that has its value tied to precious metals.

AABB Pros and Cons

Here are the benefits of AABB:

PROS

-

AABB rewards its loyal shareholder base for their continued support and interest in sharing the success and growth of the Company with a restricted common share dividend based on 1 dividend share for every 45 shares owned. - (source: https://aabbgoldtoken.com/about-us/)

-

Developed on the Ethereum Blockchain, AABB is an ERC-20 token.

-

AABB tokens are backed by $30 million in physical gold

-

They provide their own proprietary exchange system and wallet that can be used on iPhones, Androids and on desktop.

-

No data collection, and transactions are private.

-

60 trading pairs, including Ethereum, Litecoin and Bitcoin.

-

The wallet can send out funds to friends, family or businesses.

-

No deposit fee, and low transaction fees.

-

Their crypto payment system can be used via email, SMS and QR code.

CONS

-

AABB cannot be exchanged for physical metals.

-

Isn’t available on other exchanges.

-

Requires a basic understanding of the Ethereum network and gas-related fees.

-

KYC is required and must be approved prior to being able to use the exchange. This is not really a con and is required by most crypto exchanges already, but some can find KYC to be an inconvenience.

Conclusion

I encourage anyone interested in diversifying their investments in crypto to consider the tokens that are backed by hard, physical assets. Because cash was originally created for convenience, not for its own intrinsic value, it is too cumbersome to carry around large amounts of gold and silver. Cryptocurrencies like AABB, KAG/KAU(Kinesis Money) and PAXG(Paxos Gold) provide essentially the same function that cash was meant to have–a value tied to gold.

It is important to remind ourselves of the purpose and the reason behind crypto. I have stated in previous articles my belief in the value and the potential of crypto as a whole, but as we’re faced with dazzling meme coins, and influencers making hefty promises, we shouldn’t lose sight of what the goal should be–an alternative to cash. We need options outside of the current constructs and we need the change that is coming. That requires good fundamentals and a focus on assets with real value.

Original publish date:

August 17, 2022