Blog | Personal Finance

America's Income Divide: How Income Inequality is Crushing the Middle Class

Rising healthcare costs, lower incomes, and the old rules of money

Rich Dad Personal Finance Team

February 06, 2024

Summary

-

Income inequality is the great moral issue of our time, but you don’t have to live it

-

Solving income inequality in America is possible

-

The key to overcoming income inequality? Self improvement

In a 2016 Wall Street Journal article entitled, "Burden of Health-Care Costs Moves to the Middle Class," Harvard healthcare economist David Cutler talks about "a story of three Americas."

These three “Americas” are:

- The rich who can easily afford healthcare

- The poor who can access public programs to cover healthcare costs

- And the middle class who are screwed

As the article states: "A June Brookings Institution study found middle-income households now devote the largest share of their spending to health care, 8.9%, a rise of more than three percentage points from 1984 to 2014. Brookings defined 'middle income' as those households with incomes between the 40th and 60th percentile of the income distribution."

In a nutshell, that shows the problem of inequality in America: the rich are getting richer, the poor are getting poorer (but have government safety nets), and the middle class are screwed.

Rising costs and income inequality

It’s rising costs like health care that are eroding the middle class in the first place. In another post, we uncover "The 4 Wealth-Stealing Forces that Make You Poorer... and Others Richer", which are taxes, debt, inflation, and retirement. Of course the global pandemic has only accelerated those forces, augmented by millions losing their jobs and income.

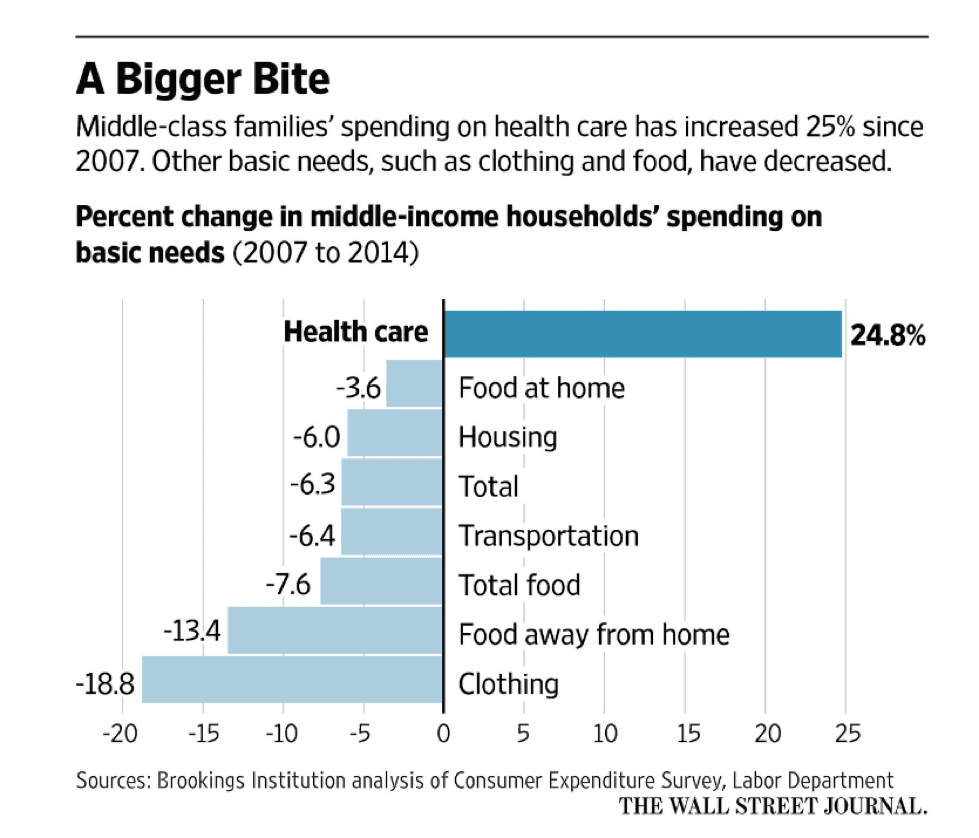

While sources like the BBC are trying to paint a rosy picture of the US economy, and saying things like, "US economy accelerates as recovery continues," real people dealing with real big financial problems are suffering. Take a look at this alarming chart from The Wall Street Journal.

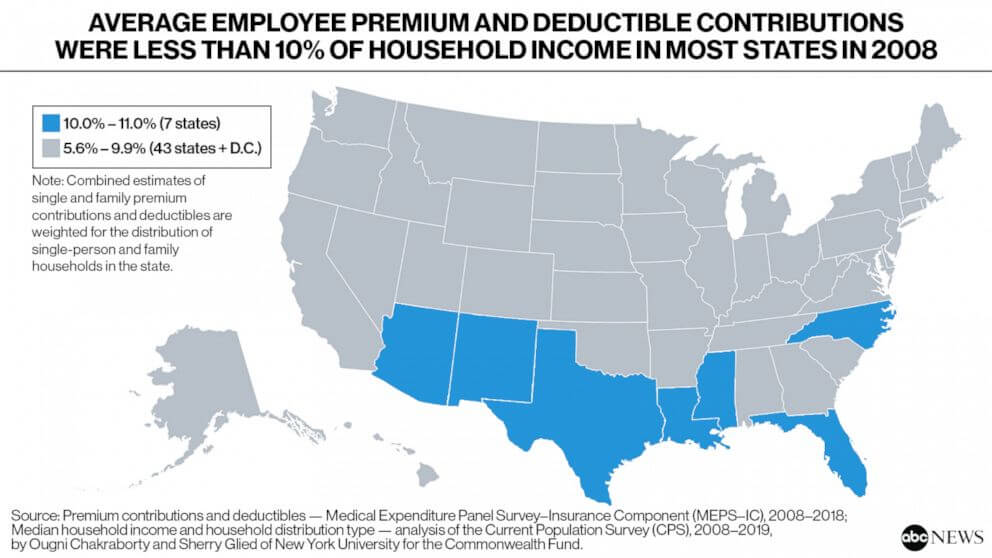

And then look at healthcare costs for the middle class as a percentage of monthly expense in this chart from ABC News :

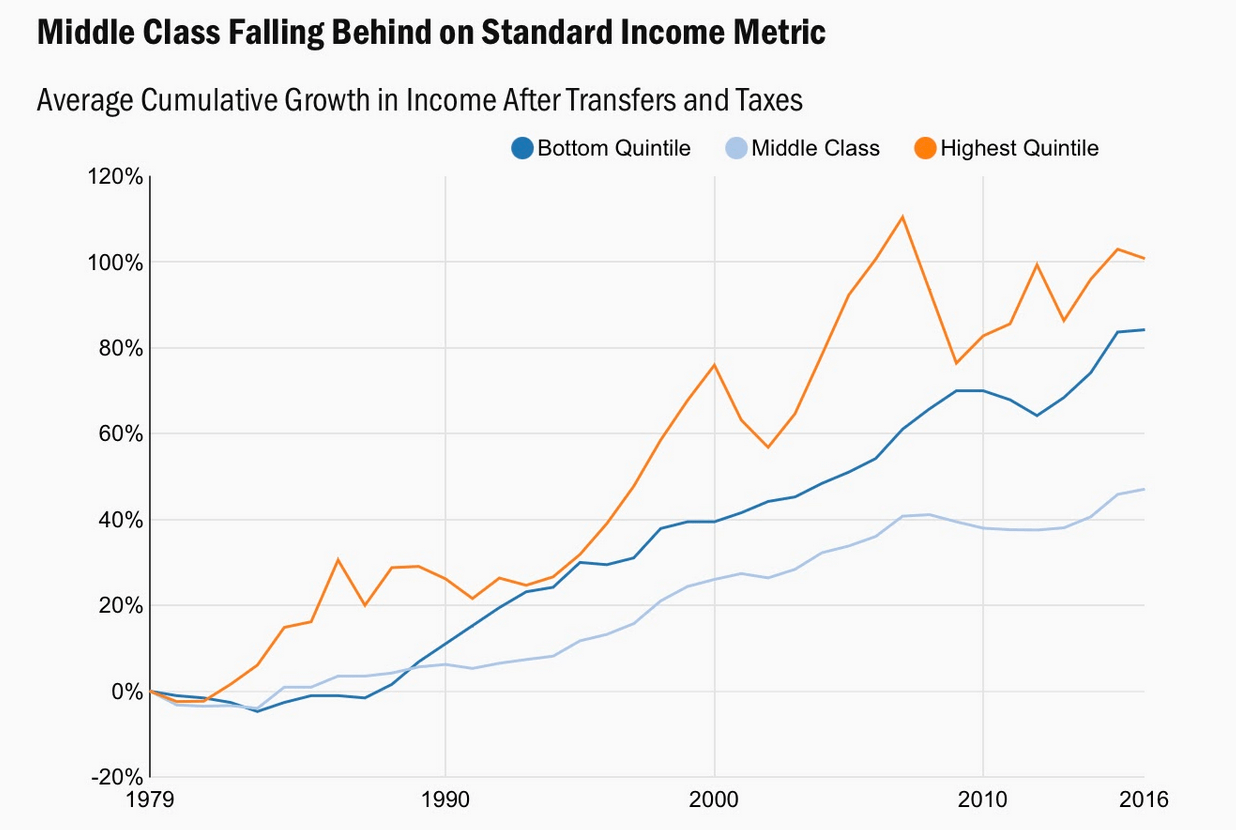

And as Brookings reports, the middle class income is rising at a much lower rate than the rich and the poor, while their costs are going up much faster. Look at the state of income inequality on this graph they share:

As written a while back in the article "The Real Reason You Feel (and Are) Poorer," the middle class not only feels poorer but actually is poorer. The economic recovery, if we can call it that, has not helped average folks.

People are not spending less on basic needs to be frugal. They're spending less because of growing income inequality.

Income inequality is the great moral crisis of our time - Bernie Sanders

Though we generally don’t agree with Bernie Sanders, the above sentiment is undeniable.

This is also why anti-establishment politicians like Bernie Sanders and Donald Trump have gained so much prominence. They understand that the status quo is not working and they appeal to large groups of people who don't share the optimism about the economy.

In 2016, Robert Kiyosaki spoke at a TEDx event on income inequality and what “little people” like you and me can do about it. You can watch that talk below.

The basic tenets of his talk came from, again, the shared belief that income inequality is the great moral crisis of our time, but gave very different answers on what we can do about solving it in America. Here’s a hint: it starts with self improvement.

How we can start solving income inequality in America

A while back, when Robert was live on Facebook with MarketWatch, the first question he received was about why he wrote Rich Dad, Poor Dad. Robert answered that it was because he saw the financial crisis of today coming and he wanted to help as many people as possible to get out of the rat race.

Rich Dad Poor Dad was a book about what Robert’s rich dad, his best friend’s dad, taught him about money and getting rich. From rich dad, Robert learned that financial education was the key to eliminating poverty the right way in America. But a proper financial education won’t be found in our schools, and it will look a lot different than what schools teach our kids about money.

Learn by playing games and simulation

For many years, rich dad taught Robert about money through the board game Monopoly. The formula was simple: four green houses, one red hotel.

He was terrible at the game at first, and failed a lot. But the key to learning was doing and failing. Without failure, Robert would have never learned the lessons he needed to become rich in the real world. Simulation and playing games create an environment where it is safe to fail.

Later, when they founded the company Rich Dad, Robert and Kim Kiyosaki also created a game called CASHFLOW that taught people about the foundations of financial literacy. Today, tens of thousands of people play that game in CASHFLOW clubs across the globe on a daily basis.

Understanding a financial statement

The rich have words and a language around money. They make it more complicated than it needs to be. Why? Because language creates barriers and the rich don’t want to have more people become rich.

Core to the CASHFLOW game is learning how to read a financial statement. In the real world, a financial statement is your report card. If you don’t have a financial statement or don’t know how to read one, you will find it extremely difficult to get rich.

At Rich Dad, we make it very simple to understand a financial statement. You can learn a lot more about financial statements in the post “The Personal Financial Statement: Your Foundation for Being Rich.” Simply put, the financial statement shows you the four most important words in finance: Assets, liabilities, and cash flow.

Robert’s poor dad, his natural dad, who was highly educated but didn’t know much about money, focused on the income column of the financial statement. Rich dad focused on the asset column. That was the difference between rich dad growing his wealth and eventually owning a hotel on a beach in Hawaii, and poor dad begging his children for forgiveness for having nothing to leave his kids.

Words can help eradicate income inequality

Poor dad would say, “I can’t afford it.”

Rich dad would say, “How can I afford it?”

The difference in those words is the difference between being rich and poor. Here is a fundamental principle of Rich Dad: change your words, change your life.

Our words become our reality. If you change your words, you can change your mindset, which will change your situation. Ask yourself enough times how you can afford something (vs. saying you can’t afford something), and you will figure out a way.

The best part? Words are free.

Stop playing by the old rules of money and grow rich

In 2002, Robert wrote Rich Dad’s Prophecy. He wrote about the coming stock market crash and retirement crisis as baby boomers began pulling money out of their paper-asset-stocked retirement plans in order to live. One reason why the gap between the poor and the rich is growing at such a fast pace is because so many people are still playing by the old rules of money.

To know, understand, and play with the new rules of money, you first have to have a financial education. The rich are getting richer because they understand the rules of money and how to use them to their advantage. One of the reasons Robert wrote Rich Dad Poor Dad was because he knew that money was not being taught in schools and felt he had a calling to teach people all the things rich dad had taught him.

Going forward, the middle class will continue to shrink and the divide between the rich and the poor will only grow.

You need to grow richer. Thus, you must continue your financial education; learn how to profit from taxes, debt, and inflation rather than allow them to make you poorer.

There is a way for everyone to become rich. It’s up to you to take action.

Now, more than ever, it is imperative to stop playing by the old rules of money. The middle class is dying, and the government won't save it. The rules have changed and the cards are stacked.

If you want to not only survive but also thrive financially, it's time to take matters into your own hands, to educate yourself financially, and to play by the new rules of money.

Original publish date:

August 30, 2016