If you are thinking of starting a business or have recently started a business, one main issue to consider is whether to hire employees or utilize independent contractors. Both have benefits that should be carefully considered.

But first, it’s important to know that each state has its own laws regarding the classification of independent contractors and you should seek help from a professional in your area to make sure you are classifying both employees and contractors appropriately. There are major financial consequences if they are classified improperly.

Now that we’ve got that out of the way, let’s take a deeper look into the pros and cons of hiring employees or contractors.

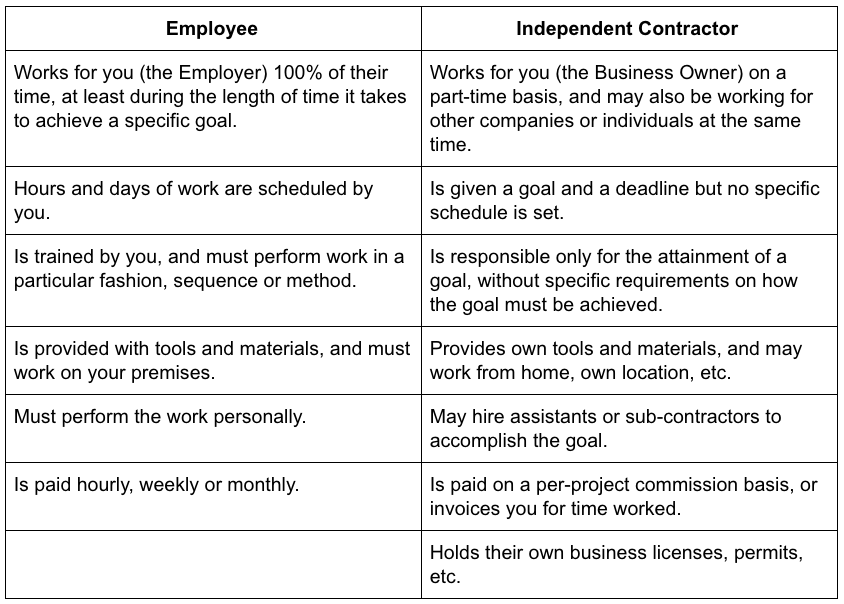

Differences between an employee and independent contractor

First, look at the chart below. This will help you understand the criteria used by the IRS to determine employee vs. independent contractor status:

Now that you understand the difference between the two classifications, let’s look at the major considerations in owning a business and which classification might be best for you.

Salary and other benefits

If you look back at our initial litmus test, an independent contractor invoices you on a per-project or time worked basis. Traditional company benefits are not extended to these workers. Stock allocations or options, medical and dental health plans, pension schemes, profit-sharing, paid vehicle allowances are all benefits afforded to employees. These benefits can be huge expenses to consider if you’re just starting out but also keep in mind, they are benefits and not required to be offered.

Hours of employment

This topic is very sensitive when it comes to employees—be sure to check with your state employment laws to ensure compliance. With employees, there are considerations like full-time or part-time, hourly or salary, exempt or non-exempt statuses that will affect things like payroll taxes, tracking hours and even mandated breaks. Be very careful if you decide to use employees and seek advice from an expert on how to navigate this sensitive topic.

Termination

If you have employees, termination is inevitable. The best way to protect your company from future wrongful dismissal lawsuits is to set out a termination clause, identifying the circumstances under which an employee can be terminated, how much notice is required, or what appropriate payment in lieu of notice will be. Be aware that many states in the U.S. have laws that allow employers to terminate employment “at will.” Be sure to understand your state laws before telling an employee, “you’re fired.”

Work with your controller or CPA to be certain you are properly classifying workers as either employees or independent contractors. If you decide to hire employees you might consider using an employment agreement with provisions for things like confidentiality or non-competition.

Employee vs independent contractor – which is better?

Employers are obligated to think of all the inner workings of their organization: payroll, taxes, workers compensation, health care and benefits, pensions, salary, etc. This obviously requires a dedicated individual – so either you’re in the trenches, or you’re hiring someone else to be in the trenches for you. While this hire can be valuable, this can be a costly solution if you’re in those early stages of starting a business.

The alternative, however, is to enter into a business relationship with an independent contractor. In this case, the contractor is someone who is contracted to perform services for your business under a written or oral agreement. By being “independent,” this means that you as a party to the Service Contract, pay the individual a flat fee based on your negotiated terms. The independent contractor is responsible for their own well-being (including all of those little details discussed above: taxes, health care, benefits, etc.).

By law, an independent contractor is specifically designated notto be an employee, meaning your business takes on none of the obligations, liabilities, or responsibilities attached to the employer/ employee relationship.

Independent contractor best practices

If you’re looking to work with individuals on an independent contractor basis, be sure to, at the very minimum, enter into an Independent Contractor Service Agreement.

This contract should contain all of the key points mentioned in the above chart, and ensures you stand a better chance successfully arguing that you are not an employer.

Additionally, all independent contractors should submit invoices to your company to cover any work that you perform.

To learn more about these classifications and which will work best in your business, read Run Your Own Corporation, written by legal expert and Rich Dad Advisor, Garrett Sutton now!