Blog | Personal Finance

Your Cash Flow Patterns Determine How Rich You Will Be

New Rule of Money #3: Learn How to Control Cash Flow

Rich Dad Personal Finance Team

July 29, 2023

Summary

-

There are three different cashflow patterns; the one you follow determines your financial future

-

Learning how to control your cashflow requires patience, and due diligence

-

Establishing the right cashflow pattern provides limitless opportunities for passive income

Rich dad said, “The most important words in business and investing are ‘cash' and 'flow.’”

You can have the best ideas in the world. You can offer amazing products. You can have an impressive balance sheet. But if you don’t have cashflow, you’ll quickly lose it all.

You can determine the financial health of a business or a person, by first assessing their cashflow.

By cashflow, we mean passive income that comes through business or investments. Money you don’t have to work for by trading your time. Cash flow is not a salary. Cash flow is not the extra money you make busting your butt on the weekend driving people around for Uber. Cash flow is money that flows into your pocket, automatically, on a regular basis.

An enlightening exercise is to list out all your expenses in one column and your income in another. Then cover up all the income that doesn’t come in the form of cashflow, and see how many beats your heart skips. If that income went away, what would you do? What would happen to you?

Now you know the importance of cash flow.

Rich dad’s three patterns of cash flow

Today, many people are in financial trouble because they have too much cash flowing out of their pockets and very little money flowing into their pockets. If you’re going to be financially secure, however, you need to learn to have more cash flow into your pockets.

Rich dad taught that there are three cash flow patterns. Those of the poor, the middle class, and the rich.

Because he liked to show things as simply as possible, he created simple examples of cashflow statements in the form of illustrations, which we’ll share in this article.

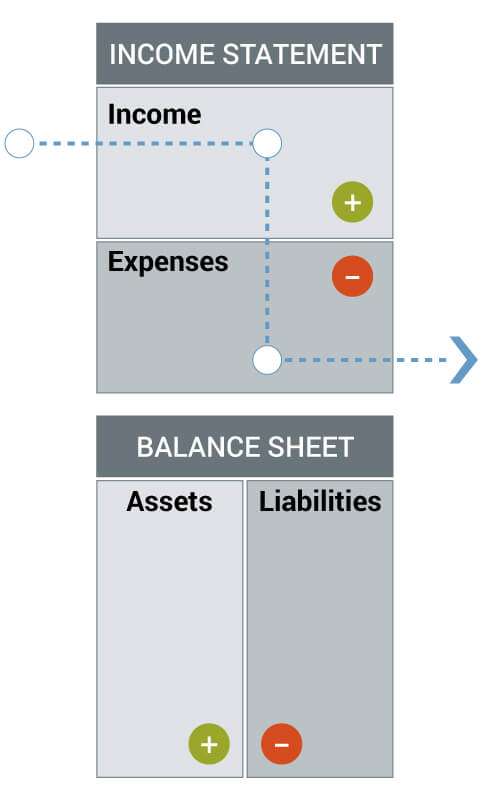

Rich dad’s cash flow pattern of the poor

You'll often hear those who struggle mightily when it comes to finances say, "I'm living paycheck to paycheck." The unfortunate reality for those who are poor is that they hardly make enough to pay their monthly expenses. They are hard workers, often doing two jobs just to make ends meet, but they have a hard time getting ahead because they’re simply treading water.

As the image of the cash flow statement shows, money comes in and immediately goes out the door to pay for expenses. If a poor person loses a job, they have little-to-no cushion to carry them. Often the results are financial devastation.

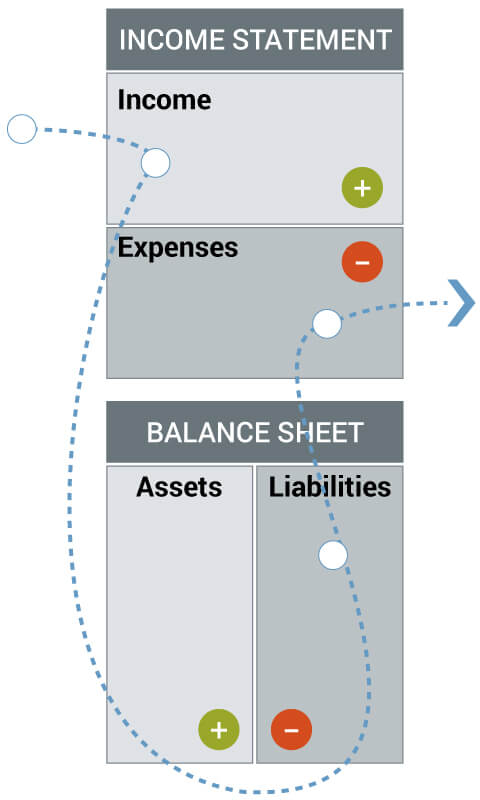

Rich dad’s cash flow pattern of the middle class

The middle class also often live paycheck to paycheck, but for different reasons and in a different way. This is the cash flow pattern of the middle class:

Their pattern on the cash flow statement is considered typical and smart by our society. After all, the people who have this pattern probably have high-paying jobs, nice homes, cars, and credit cards. This is what rich dad called the "working-class dream.” But really, it’s just the Rat Race.

After putting aside some money into a 401(k), the middle class cash flow pattern involves using spare money for all sorts of toys and liabilities that don't put money in your pocket but instead take money out. Hey are continually trying to keep up with the Joneses.

Over time, you build a lifestyle that must be maintained by either getting a higher paid job or working longer hours. And if you get fired or laid off, because there is no cash flow, everything comes crashing down.

Often, when people play the CASHFLOW board game, they see this for the first time. As they struggle through the game because they are learning financial literacy for the first time, they begin to realize that they are in financial trouble, even though they look wealthy from an outsider's perspective. After playing the game, some people begin to change their thinking patterns about money to that of the rich.

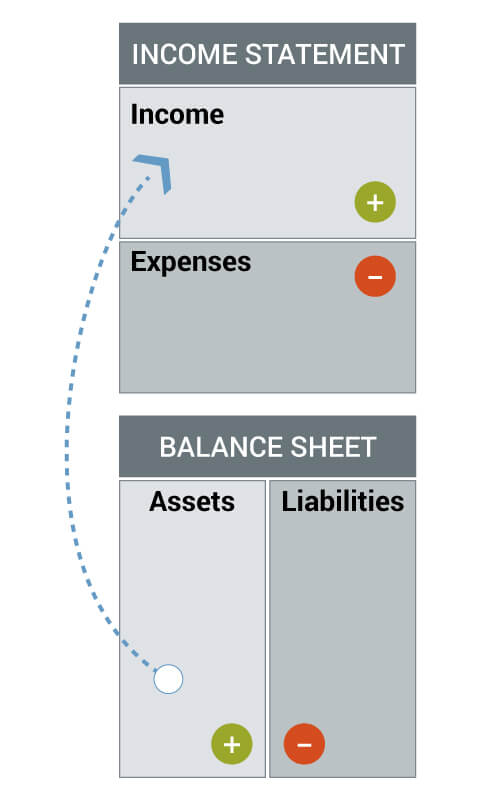

Rich dad’s cash flow pattern of the rich

This is the cash flow pattern of the rich:

The rich make most of their money from assets that produce cash flow. They do not fear losing a job, because their salary, if they have one, is icing on the cake. Those who are truly financially free have assets that produce enough cash flow each month to cover their expenses. If they wanted to, they could never work a day again.

This is the thought pattern rich dad wanted Robert Kiyosaki to have as a young child; to never become addicted to the idea of a high-paying job, but instead, to develop the thought pattern of thinking only in assets and income in the form of capital gains, dividends, rental income, and residual income from businesses and royalties.

As the ages have changed, so has how you become rich

In a recent post on making the money mindshift you need to be rich, Robert discusses the four economic ages, or economic mindshifts.

He wrote:

Four major mindshifts in human history are:

-

The Hunter-Gatherer mindshift: In the Hunter-Gatherer Age, humans relied on nature to provide wealth. They were nomadic and went where the hunting was good and the vegetation plentiful. You had to know how to hunt and to gather—or you died. For the hunter-gatherer, the tribe was social security. Socio-economically, everyone was even. They were all poor.

-

The Agrarian mindshift: The Agrarian Age saw the rise of different classes of people. Due to the development of technology to plant and cultivate the land, those who owned the land became royalty, and those who worked it became peasants. The royals rode horses while the peasants walked. Socioeconomically, there were two groups, the rich and the poor.

-

The Industrial mindshift: While many people would place the beginning of the Industrial Age in the 1800s with the rise of factories, some actually think of it as beginning in 1492 with Columbus. When Columbus struck out for the New World, it was to find new sources of valuable resources such as oil, copper, tin, and rubber. During this time, the value of real estate shifted from growing crops to providing resources. This led to the land becoming even more valuable. And three classes emerged: the rich, the middle-class, and the poor.

-

The Information mindshift: Today, we are in the Information Age, where information leveraged by technology and inexpensive resources like silicon, produces wealth. This means that the price of getting wealthy has gone down. For the first time in history, wealth is available to just about everyone. There are now four groups of people: the poor, the middle-class, the rich, and the super rich.

In each economic age, you had to change your mindshift to be rich, but the strategy was always the same…cash flow.

In the hunter-gather age, you wanted to be the chief. Then others would hunt and gather for you. They would bring goods to you. That was a form of cash flow. Unfortunately, only one person could be the chief.

In the agrarian age, you wanted to be a landowner. You then had peasants work for you and produce wealth off your land. Unfortunately, if you weren’t royal, you had a hard time getting land.

In the industrial age, you wanted to own the means of production. If you had control of natural resources and factories, you could hire people to work for you. The resulting goods produced cashflow for you. Unfortunately, it took a lot of smarts and capital to build an industrial empire. Only a few could be rich.

In the information age, the advent of the internet means that you can build a business with little capital or easily find investments. The bar to entry is the lowest it has ever been in history. But you have to think differently.

The CASHFLOW Quadrant and the cash flow patterns of the poor, middle-class and rich

Rich dad taught that cash flow patterns of the poor, middle-class, and rich are often tied to different mindsets about money. He illustrated this with the CASHFLOW Quadrant.

The CASHFLOW Quadrant is divided into four types of people, two in each category.

E - Employee

S - Self-employed

B - Business owner

I - Investor

Those on the left side of the CASHFLOW Quadrant, employees and the self-employed, think about money as something that needs to be earned, often by trading time. They think it is most secure to have others take care of them. They trade skills for money.

Those on the right side of the CASHFLOW Quadrant, business owners and investors, think about money as something that should be generated. They think it is most secure to own assets that provide passive income. They build systems that create money.

If you want to be rich, you need to have a money mindshift to the right side of the CASHFLOW Quadrant.

Velocity of money and the cash flow pattern of the rich

The beauty of making the money mindshift to the right side of the CASHFLOW Quadrant is that is where not only cash flow happens, but also where the velocity of money takes hold.

Velocity of money means growing your money by using the cash flow from an asset to acquire more assets that produce more cash flow. If you want to go in-depth on the velocity of money, read this article.

But simply put, there is a formula business owners and investors utilize to create velocity of money.

- Invest in an asset

- Get their money back

- Keep control of the asset

- Move their money into another asset

- Rinse and repeat

As the rich increase the velocity of their money, the cash flow from their assets far outpaces their expenses. And their purchasing power for more assets grows. They are financially free.

A cash flow pattern of the rich requires financial and emotional intelligence

If you want to operate on the right side of the CASHFLOW Quadrant, then you need to have both high financial intelligence and high emotional intelligence.

Developing a high financial intelligence means investing in your financial education. This means understanding the language of money, how to think differently, and specializing in the way you want to create cashflow. For instance, if you want to enjoy real estate cash flow, you need to have a depth of knowledge about real estate and how to make money with real estate.

To have the discipline to build your financial intelligence, and to put it to work in the world, requires investing in your emotional intelligence. This is no get-rich-quick scheme; building cash flow through the velocity of money takes patience and commitment. Those with low emotional intelligence will simply quit when things get too hard. One of the best ways to develop emotional intelligence is to enlist the help of a coach.

Thinking like the rich

In a world with less and less job security, the cash flow pattern of the rich makes more and more sense. And to achieve this pattern, you need to see the world from the perspective of a business owner and investor, not an employee or self-employed person.

One of the most important things rich dad taught was to control personal cash flow and to monitor the world’s cash flow. Monitor global cash flow by observing three things:

- Jobs: For years jobs have flowed overseas from the US. Many jobs that used to pay a lot, no longer exist in America.

- People: The flow of jobs out of the US has led many to find new careers. This often means moving to a new city or even country where certain industries are thriving.

- Cash: During the great recession, we saw cashflow out of the stock market and into savings, mattresses, bonds, and gold—in other words, safe havens. Today, money is flowing back into the stock market, but for how long? In order to be rich, you must be on top of where the cash is flowing and move accordingly, before others get there.

This is why it’s also important to realize the power of good debt. Learning how to use debt is one of the most important skills a person can learn. And an important lesson is that debt is only as good as your cash flow. Debt that causes cash to flow into your bank account is good. Debt that takes money out is bad.

Today, Robert and his partners create cash flow by watching the global movement of cash. For instance, they invest using debt to purchase apartment buildings in areas where there are good jobs, areas where people are flowing and money is moving to. In simple terms, real estate is not worth much if there are no jobs. Jobs attract people. And where people are moving, cash is flowing. It’s simple, but most people are not trained to look for these things.

Are you ready to be different than most?

Original publish date:

June 07, 2016