Blog | Personal Finance

Assets vs. Liabilities: The Difference is Life Changing

A brief education on assets and liabilities

Rich Dad Personal Finance Team

August 22, 2024

Summary

-

Key to getting rich: don’t work for money!

-

Understand the difference between assets vs. liabilities to generate passive income

-

Cash flow is the way to become truly wealthy

A lot of people ask themselves “how can I get rich quick?” This question is a clear indicator that “they” don’t have the foundation of financial intelligence required to use their money well if they get rich.

The question shouldn’t be about how quickly one becomes rich. It shouldn’t even be about how much money you make. It’s about how much money you keep.

Poor dad used to say “You need to read books.” Rich dad always said “You need to be financially literate.” Both are true, and equally important to navigating the world productively. But when it comes to becoming rich, nothing trumps a solid financial education.

Want to be rich? It’s about assets vs. liabilities

Robert Kiyosaki’s rich dad had a way of putting things in very simplistic terms.

“An asset, whether you’re working or not, is something that puts money in your pocket.”

Period.

Why this is important to understand

If you stopped working today, meaning you stopped receiving a salary, from where would money flow into your pocket? Lots of people reply with “Nowhere.”

There’d be no money.

Here are some examples of the differences between assets and liabilities:

An asset may be a rental property that has a positive cash flow. It may be a business in which you invested that gives you cash flow every year. It could be a stock that pays a dividend. The key is that it is an investment from which you receive money on a regular basis— so it provides positive cash flow. To give it to you straight: unless something is putting money in your pocket, it’s not an asset.

By understanding how they work, you can establish a way to generate passive income with these assets that provide continuous cash flow.

Rich people focus on building their assets.

Contrary to an asset, a liability is something that takes money from your pocket. So, if you stopped working, chances are your car would take money from your pocket each month through car payments, gasoline, and maintenance. Your home would take money from you each month in the form of a mortgage payment, property taxes, insurance, and upkeep. These all provide negative cash flow.

If you look at the budget of a poor person, you’ll see that it is full of liabilities and has no assets.

The interesting thing is that people often mistake assets and liabilities. This is because they don’t have high financial intelligence and they take at face value the advice of so-called financial experts.

The rich don’t work for money

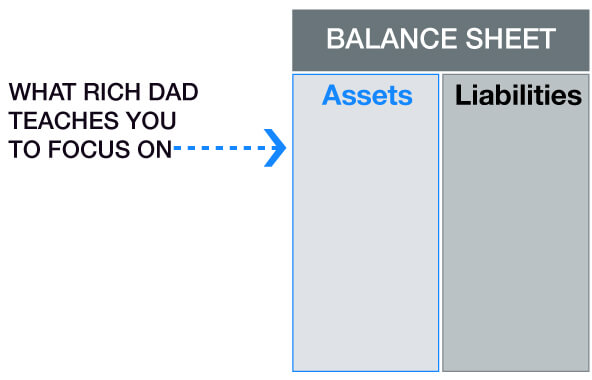

The difference between an asset and a liability is best understood by looking at the following pictures.

Simply put, the rich don’t work for money in the form of income like employees do. Rather, the rich invest their money in assets that put more money in their pockets, such as real estate, stocks, bonds, notes, and intellectual property.

Adjust your focus

That means it’s time to shift focus.

Here’s something you might notice when looking at your income statement and balance sheet.

Most people are taught to look at their income.

But the key to financial freedom is to focus on acquiring assets.

Get a job, work hard, and keep getting pay raises. Or, if you worked on an hourly basis, you should probably put in more hours or increase your hourly rate. The focus is always on income, specifically ordinary earned income — increasing salary, wages, or commission. The truth is, as long as you put your focus and attention there, you’ll be working hard for that income all your life.

The lights come on when you realize that the key to financial well-being is not to focus on acquiring income but to instead focus on acquiring assets.

You’ll also begin to ask the important (and right) question: What new assets am I building today?

It’s a different way of looking at the world.

Thinking differently about enjoying the finer things

How many times have you wanted something — a bigger house, a nicer car, a designer outfit — but told yourself, “No, I can’t have that” because you couldn’t afford it? Perhaps you’ve consoled yourself with reminders that “nobody gets everything they want in life” or “maybe someday.”

Understanding how to utilize assets to your advantage can change all of that.

For example, years ago, Kim Kiyosaki found something she really wanted: a beautiful, 60-foot long sailboat. There were two problems: 1) she and Robert didn’t have the money for it, and 2) they knew that owning a boat was a giant liability! Or, at least that’s what they thought.

But she really wanted that sailboat, so she began to investigate ways that would allow them to purchase the boat and turn it into an asset. Instead of just letting it sit in a dock in Hawaii and writing checks every month to pay for the maintenance and the loan on it, they put the boat into a charter company. When they’re not enjoying the boat, it’s chartered throughout the Hawaiian Islands; and, when they do want the boat, it’s all theirs for the taking. As a result, the cash flow from the charter business pays for the expenses of the boat. This is the beauty of assets and liabilities merging!

Change your mindset; change your life

When adjusting your mindset, keep the financial golden rule: any money in the asset column stays in the asset column. Another rule to stick by, especially when looking at something fun, like a sailboat, never say “No.” Instead, ask “How?”

By shifting your mindset from, “I can’t afford this,” to “how can I afford this?” you can literally change your life.The liabilities you want can actually make you richer as you get creative with finding ways to afford them by creating or investing in cash-flowing assets.

The most important takeaway

The reason people get into trouble financially or never get ahead in life is because they have liabilities that they have been led to believe are assets.

One of the most important lessons you’ll learn while strengthening your financial literacy is the difference between an asset and a liability.

Once you’ve got that down, you’ll realize that the strategy to achieve infinite wealth, where the cash flow coming in is equal to or greater than your monthly expenses, is very simple: Stop focusing on income and start acquiring assets that give you cash flow.

It’s no secret that wherever you put your time, energy, and focus will grow in your life. So if you want to achieve your financial dreams, you may want to put your time, energy, and focus on acquiring assets.

The CASHFLOW board game was designed to teach you how to think differently about money and wealth. The more familiar you become with standard assets and liabilities, the more creative your solutions will be for ensuring you have everything you want in life.

Today is the day to change your mindset about money. What is it that you really want and how are you going to get it?

Original publish date:

May 07, 2015