Blog | Cryptocurrency

Is Bitcoin Back from the Dead?

August 04, 2021

As many of you know, I believe in Bitcoin. I was very excited when the prices dropped so I could buy more. Unlike most, I am not using Bitcoin to make millions. I’m using Bitcoin to protect my millions as insurance from the collapse of the dollar. I see Bitcoin as digital gold.

What is interesting is how most crypto follows in the path of Bitcoin. If Bitcoin is falling, most coins will fall too. As Bitcoin rises, most coins will rise with it. This is why tracking Bitcoin is so useful; it signals when the crypto market will be entering a Bull or a Bear market.

However, before my crypto team explains how to analyze a crypto market, I think you need to understand a very important concept, even in a bear market there are great investments to be found. That is why I have a crypto team. I believe this team offers the best solutions in any crypto market.

One question for you, did you take advantage of the downturn, or did you cower in fear? When you are reading below pay attention to the “Fear and Greed Index”.

Did we survive the worst corrections in the history of crypto?

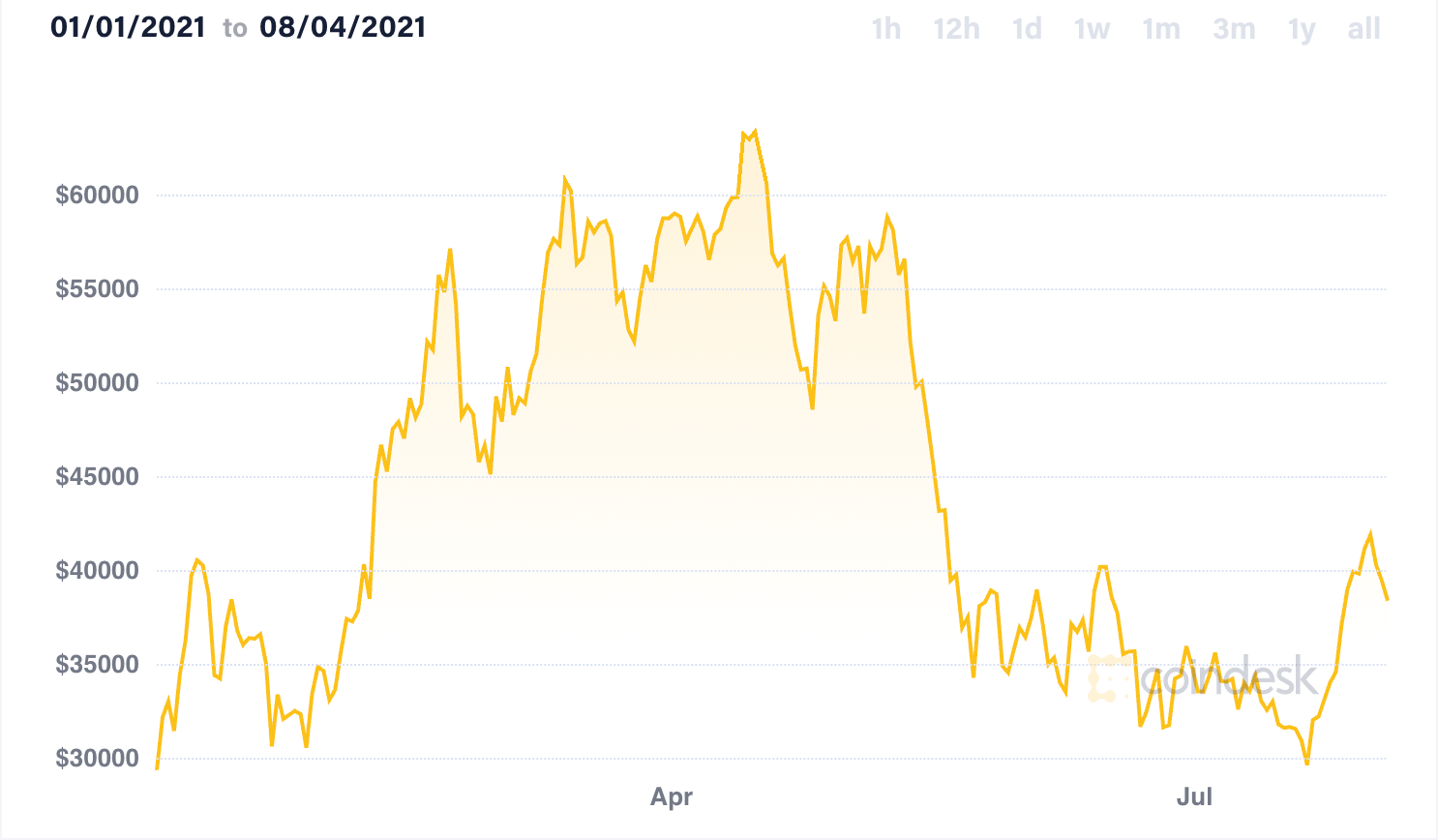

If you recall, this year’s bear market started when Elon Musk tweeted that Tesla would stop accepting Bitcoin due to environmental issues and China banned Bitcoin mining.

However, this month Elon outlined a path for Tesla to start accepting Bitcoin again. While this wasn’t the main reason for the current crypto market recovery, it definitely was one of the first catalysts.

Another huge catalyst was China’s relaxing their attack against crypto. This gave everyone a calming effect that the worst was behind us, which also gave reason for many investors to step back in. With China’s huge mining force back online, we are seeing a huge uptick in Bitcoin. Remember, last month Bitcoin’s mining power dropped in half, which sent Bitcoin’s price in a downward spiral.

Bear/Bull Market Indicator – Fear vs Greed

If you look at the fear and greed index (https://alternative.me/crypto/fear-and-greed-index/) last month you can see the entrance of the bear market as crypto price dramatically declined. Fear exploded as China’s crackdown began and public figures support waned.

Coindesk

Coindesk

We saw maximum fear last month (the best time to buy). The bottom of the market was when the Fear index hit 9 (single digits are bad as it means high fear)! As of this writing, the fear and greed index is at 60, which is “greedy”. This greed is healthy after coming back from such lows. This greed is a positive indicator that the worst could be behind us.

Another positive sign is that Bitcoin bottomed out multiple times but never below $30k. Why is this a good sign? With Bitcoin’s floor at $30k it appears to be rock solid, having multiple failed attempts to break through.

July Bear

While June was a very bearish market, July started that way too. July almost bottomed out to June level until the rest of the market reversed, and activity began to rise.

One of the reason July recovered was China’s softening. As the mining machines were being turned back on and new miners in other countries emerged (ramping up to fill the Chinese void) Bitcoin began to recover. Add to that Elon Musk’s public endorsement, and the Fear/Greed indicator turned heavily to “Greed”.

We think we are seeing extremely positive signal that things are coming back. While we’re not out of the water yet, the trendline is positive that we are past the bottom, but not enough validation yet for the longer term.

One interesting point of note is that this recovery has not infected the overall retail component of Bitcoin. It could mean that retail hasn’t returned yet, so it looks like there is more upside coming.

Crypto Team Summary

In summary, by nearly all our metrics from last month, it appears that we’ve crawled out of a bear market. If you were monitoring these metrics closely, when the Fear and Greed index was 9, that was the best time to buy.

Congratulations, you’ve just made it past one of the worst corrections in the history of crypto. Now remember, these happen every few years, and shouldn’t be taken as a rare occurrence. One of the first things you should know about bear markets is to expect them, and you should be able to plan your strategy accordingly. That being said, welcome back to the positive crypto news cycle and we can see some major trends forming this month that can lead to even more of a transition into mainstream.

Did you see it? My team said it twice,

“If you were monitoring these metrics closely, when the Fear and Greed index was 9, that was the best time to buy.”

When everyone else was afraid, that was the time to buy. Maybe you had a strong belief in Bitcoin and crypto so you were not afraid that it would not bounce back. Maybe you were just afraid you would buy it below the very bottom. You were afraid to lose pennies when you could have made dollars.

This is fear based out of greed. I do not know of an index to measure that. This is called Emotional IQ. Were you able to control your fear and greed enough to profit from the crypto bear market?

Don’t worry, as my team stated above,

"These happen every few years and shouldn’t be taken as a rare occurrence."

Get yourself financially educated and crypto educated now so you can profit from the next bear cycle. Knowledge is the best, and possibly only, tool to overcome emotion.

Original publish date:

August 04, 2021