For most people, the idea of a high income is a good thing. For the rich, it is bad. For most people, the idea of low expenses is a good thing. For the rich, again, it is bad.

As rich dad said, “Money is just an idea.”

Once you understand the idea that low income and high expenses are good, you will understand one of the most pivotal realities of this idea called money. Not understanding this fundamental concept is why many rich people go broke.

Error: Campaign not found.

How money really works

As you learn more about money, you’ll discover the 90/10 rule: 90 percent of people earn 10 percent of the money in the world. How do they do this? By positioning themselves to have low income and high expenses.

If you do not understand money or how it works, this will seem like a strange statement to you. You may be asking the question, “How can low income and high expenses make you rich?” The answer is found in how the sophisticated investor utilizes the tax and corporate laws to bring those expenses back into the income column of their financial statement.

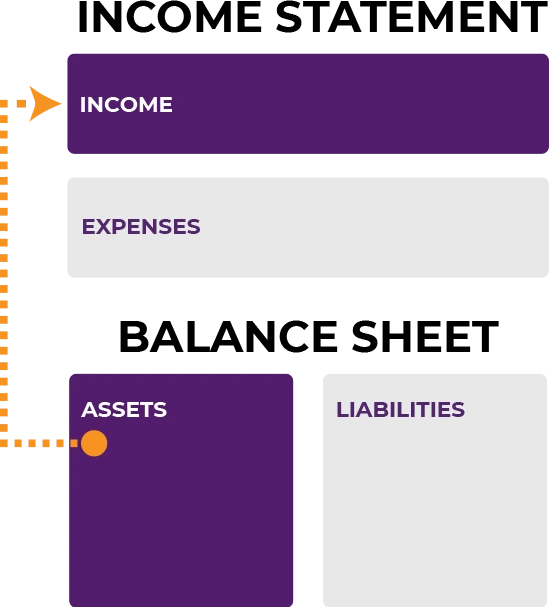

The financial statement of a rich person

For example, this is a diagram of what a sophisticated investor is working to do:

When you start to understand what is happening in this diagram, you will begin to see a world of greater and greater financial abundance.

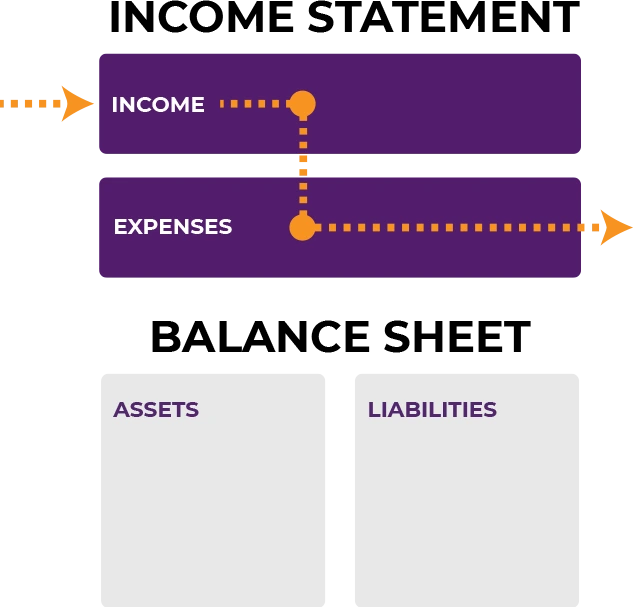

The financial statement of a poor person

Compare the above diagram with that of the traditional way of thinking about the idea of money:

This is the financial diagram of most of the world’s population. In other words, the money comes in the income column and goes out the expense column. It never comes back. That is why so many people try to create a budget to live below their means, to save money, be frugal, and cut back on expenses.

This is why most people will say, “My house is an asset,” even though the money goes out the expense column and does not return, at least not immediately. It also explains why people say, “I’m losing money each month, but the government gives me a tax break to lose money.” They say that rather than, “I’m making money on my investment, and the government gives me a tax break to make money.”

Seeing the other side of the coin

Rich dad said, “One of the most important controls you can have is found in this question: What percentage of the money going out your expense column winds up back in your income column in the same month?”

By understanding the side of the coin that rich dad was speaking from, you’ll see a completely different world that most people who work hard, earn a lot of money, and keep their expenses down never see; a world of ever-increasing wealth rather than one of diminishing returns.

Today, ask yourself the same question. What percentage of your wealth goes from your expense column back to your income column in the same month?

Error: Campaign not found.

If you can understand how this is done, you too will find a world of ever-increasing wealth.

If you can’t see this, find someone you trust and discuss how it might be possible. You can start by reviewing the post, “Budget Like the Rich – 4 Money Tips for Financial Freedom.”

Once you crack the code, you will move from a world of “not enough money” to one of “too much money.” And your life will never be the same again.