People often ask “How can I get rich in real estate?”

Behind this question is a different question, “How can I get the money I need to invest in real estate?”

More often than not, the people asking these questions have had ingrained into them, from an early age, that saving and buying a house was a means to getting rich and that if they wanted to invest, they needed to use their own money. Both are myths that we’ll discuss as a foundation on how the rich use debt to get rich in real estate—and how you can too.

Myth: savings is the means to get rich

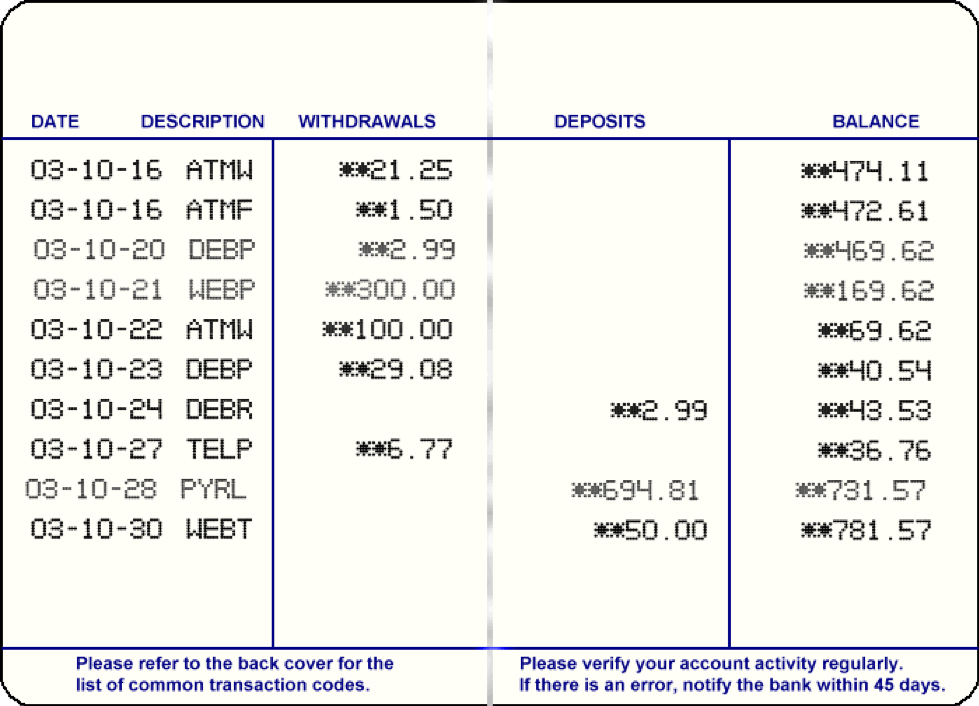

Is there anything more symbolic about teaching kids about money than this image?

Or perhaps if you were of an older generation, you think of this:

There’s no doubt about it, from an early age, children are taught the value of saving money. “A penny saved; a penny earned,” we chime. And when they are a bit older, we spin tales of the magic of compounding interest. Save enough, children are told, and you’ll be a millionaire by the time you’re ready to retire.

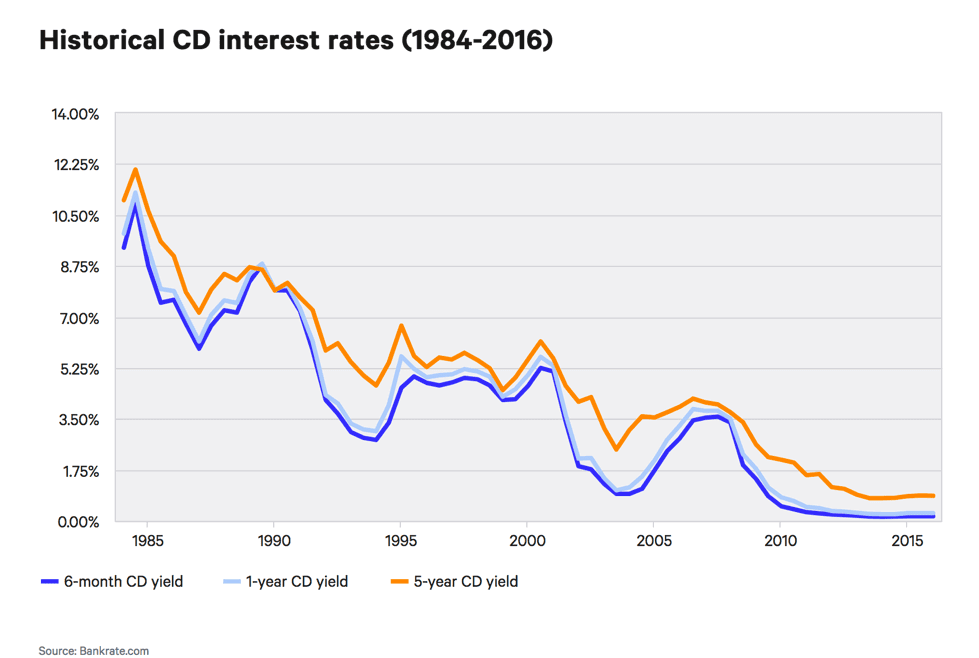

Of course, we don’t tell them about historically low interest rates.

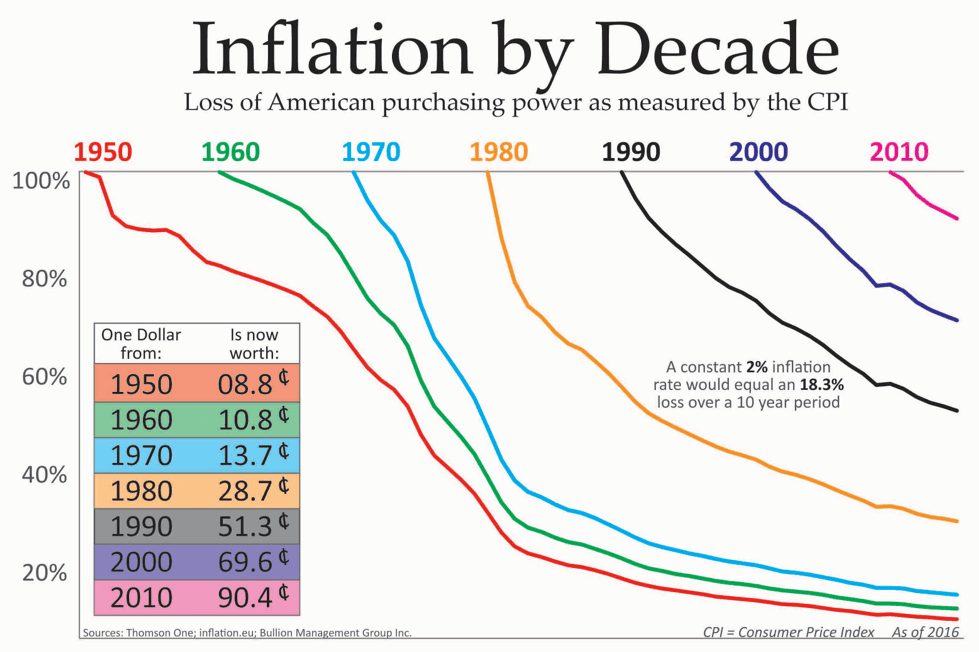

Or the power of inflation to eat away at the value of money over time so that being a millionaire is worthless by the time you retire.

Those are inconvenient financial truths.

It seems as if the “wisdom” to save your money is timeless, in that it won’t go away, even though it’s proven to be wrong. Even today you find “financial experts” who push the save to be a millionaire myth.

Myth: your house is an asset

Another myth people buy into is that their house is an asset and their best means to generate wealth.

In 2010, two years after the Great Recession, The New York Times published an article on real estate entitled, “Housing Fades as a Means to Build Wealth, Analysts Say.”

Some interesting statistics and predictions from the article included:

- It could take up to 20 years to recoup the $6 trillion loss in housing values since 2005

- Housing values had dropped over 30 percent since the bubble popped around 2008

- Sales figures for the month preceding the article, July, were expected to show a drop of 20 percent over last year

- The supply of housing was predicted to rise 12 months—more than twice what’s considered normal and healthy

- Despite all that dire news, when surveyed, people felt that housing was going to rise by as much as 10 percent a year over the next decade

That last statistic is a frightening one, as it speaks to the high financial ignorance in this country: people still believed that a house was an asset and a sure way to build wealth.

As many found out, the housing market didn’t rise 10 percent per year. It continued to drop for a couple more years after that. Many people were financially ruined.

Repeating housing history

Robert Kiyosaki has written many times before that economies are cyclical…and that people have short memories.

With any luck, we won’t see another housing bubble like the ones our country has experienced in recent history, but that entirely depends on whether people have learned their lessons.

Traditionally, when housing prices rise, so do home equity loans. People use their house as an ATM, assuming it is an asset that will always rise in value. And they quickly forget that’s not true.

As U.S. News & World Report writes, “Rising home values and low mortgage rates spurred many U.S. homeowners to refinance and cash in some of the equity in their home last year. Homeowners pulled out $152.7 billion in equity, an increase of 41.7% from 2019 and the highest refinancing cash-out dollar amount since 2007, according to mortgage buyer Freddie Mac. Homeowners also tapped into the equity in their home via a home equity line of credit, or HELOC. The volume of HELOCs more than doubled in 2020 from a year earlier to $74.9 billion.”

So perhaps, before things get really bad, it’s time to remember, yet again, that your house is not an asset.

Your house is a liability

Just to reiterate: your house is not an asset. It’s a liability. Very simply, an asset is something that puts money in your pocket. A liability is something that takes money out of your pocket.

The common misconception is that a strong housing market generates wealth for the middle class. In reality it doesn’t. It generates debt. People don’t sell their homes to pay for things like college educations and vacations; they borrow against them, growing a liability by taking on more and more bad debt.

How a house can be an asset

As mentioned earlier, an asset is something that puts money in your pocket.

To a sharp investor, it only matters if a little property appreciates in price, and whether it provides cash flow every month. It’s the only sure way to build wealth and assure a secure retirement in terms of real estate investing—and it’s the only true way to appreciate real estate as an investment.

The key is to make your money on the buy, not the sell. Meaning, by doing proper due diligence you can find deals that will provide substantial cash flow for years to come. As such, you don’t have to worry about the price of your asset. If it goes up, that’s a bonus. If it doesn’t, you still have a great property that puts money in your pocket every month.

Your house is not an asset. But a house can be an asset—if it produces cash flows.

Myth: you need money to invest in real estate

The other side of the “save to get rich” myth is that you need to use your own money (and a lot of it) in order to invest. This is a byproduct of the cultural belief that debt is bad and savings is good. Often, people will say that investing in real estate is risky but if you’re going to do it, try to keep your debt as low as possible. Use your own money and pay off the debt as fast as you can. Nothing could be more wrong. And it stems from a fundamental misunderstanding about debt, which can be both good and bad.

Let’s elaborate the difference between bad debt and good debt.

Bad debt is money that takes money out of your pocket. It makes you poorer. This can be credit card debt from purchases for things like clothes or TVs. And it can even be the mortgage for your personal home. In short, if it’s not making you money, it’s bad debt.

Good debt is another story, and most people aren’t even aware that it exists. Good debt puts money in your pocket month in and month out. “How can this be?” you might ask. Glad you asked. Let’s talk about a concept called OPM or Other People’s Money.

How you can use good debt (OPM) to get rich in real estate

Those who are the most successful in investing in real estate understand that the best way to get a high return is to have as little of their own money in a deal.

Rich real estate investors spend their time finding the best deals and then present them to other investors who are willing to use their money to fund the deal. When structured right, OPM allows a real estate investor to secure a valuable, high return, cash-flowing asset for little-to-nothing.

As an example, let’s talk about Rich Dad advisor Ken McElroy. Ken is a real estate mogul specializing in apartments—a real estate class called multi-family housing.

- Find a real estate deal with significant upside

What Ken and his partners do is find apartment buildings that underperform. Because the value of a commercial real estate asset like an apartment is based on the Net Operating Income (income after expenses), any opportunity to increase NOI is an opportunity to see a healthy return.

For Ken and his team, a variety of factors could help with this. For instance:- The current landlord could be renting units well-below market rates. Turning those units and raising the rent could dramatically increase NOI.

- Retrofitting units with washers and dryers, as well as a cosmetic facelift could increase rents by anywhere from $25 to $50 a month. Multiply that by hundreds of units and you’ll see a big lift in your passive income.

- In many markets it was common to pay for utilities as part of the rent. Changes in the market now make it easier to charge tenants for utilities, which is a huge income opportunity.

- Package the deal and find investors willing to give you money to be part of it

Once they have a solid business plan in place, Ken and his team form a legal entity called an LLC for the property and create an investor prospectus. They then go out to investors and raise the capital they need to purchase the property (OPM) by selling shares into the LLC. Once the asset is secured, they execute on their plan, as well as bring their considerable management expertise to the table.

Already, both Ken and his investors enjoy a good return from the property income since they only purchase cash-flowing assets. This can often be in the double digits. But here’s what separates the rich mindset from the poor one. - Refinance the property, give the money back, and do it again

Once the property is substantially increased in value from the business plan, say over a course of three years, Ken and his team refinance the property, pay back all the investors their original capital plus a generous return on that capital, and still have ownership in the building that cash flows each month. And the beauty for Ken and his team is they create this wealth with a little bit of their capital and a bunch of capital from other people. So their returns are higher the whole way through.

At this point, Ken and his investors are enjoying income with no money in the deal. That is an infinite return. And that is why debt infinitely trumps savings.

Anyone (including you) can learn how to get rich in real estate

The good news is you can begin to invest like outlined above. It might not be with large apartment buildings at first, but it can grow into that.

Robert’s wife, Kim, invested with OPM for her first investment—a rental house in Portland, OR. Today, she owns thousands of apartment units. She used this method of good debt to increase the velocity of her money from one small house to a huge portfolio. And you can too. It starts with thinking differently about money, increasing your financial intelligence, and getting to work today.