Robert Kiyosaki’s “rich dad,” (his good friend’s father) frequently criticized schools for teaching kids to think strictly in terms of “right” or “wrong.” He saw this as a major flaw in the educational system that’s neither realistic nor intelligent.

In the investing world—as in everyday life—there are often multiple solutions or answers. In contrast, schools typically teach that there’s only one correct answer. As teachers grade tests, they’re looking for the “right” answers.

Also in school, you’re considered intelligent if your answers match the teacher’s. If they do, you’re an “A” student. This concept of a single correct answer is the cornerstone of academic education. But in real life? It’s usually not so clear-cut.

Take, for example, when Robert asked his “poor dad” (his actual, biological father) what 1+1 equaled, the answer was straightforward: “Two.” However, his “rich dad” would answer the same question differently, saying “11.”

This illustrates why one man remained poor while the other became wealthy.

Good Investments or Good Investors?

In other words, an investment is only as good as the investor.

“The test of first-rate intelligence is the ability to hold two opposed ideas in the mind at the same time, and still retain the ability to function.”

— F. Scott Fitzgerald

This insight forms the backbone of this blog post.

While discussing the two sides of a coin is common, let’s consider the idea that every coin has three sides: heads, tails, and the edge. Fitzgerald believed the most intelligent people occupy this edge, seeing both sides clearly.

Many students graduate believing in absolutes: right or wrong, black or white, smart or stupid. Traditional education often limits rather than expands thinking, leading to a dislike of school even among high achievers.

If students never reach the edge, where they can see both sides, they see only one side of the coin—one answer, one viewpoint. Financial intelligence, however, involves viewing the subject of money from the edge of the coin, recognizing multiple perspectives.

This kind of thinking is crucial not just in personal finance but also in politics, where rigid “right or wrong” beliefs can fuel conflict and impede effective governance. The inability to see beyond black-and-white categorizations underlies many forms of conflict, from personal disagreements to global issues like aggression and war.

It’s essential, then, to develop the ability to consider and appreciate multiple viewpoints to navigate life’s complexities effectively.

Good Investment Strategy Embraces Both “Long” and “Short” Positions

The financial world is a realm of contrasts: income versus expenses, assets versus liabilities, bull markets versus bear markets. Often, we wrongly classify these contrasts as good or bad. As Robert often points out, “You don’t have a right hand and a wrong hand, you have a right hand and a left hand.”

To deepen your understanding of this concept and its application to investing, Robert Kiyosaki’s trusted “stock guy” and Rich Dad Advisor, Andy Tanner, offers his insights:

“Bill, Jane, and the Price of Oil”

Imagine there are two people: Bill and Jane.

Bill has a job that he drives to every day. Like everyone else, he has income and expenses in his life. Far away from where Bill lives, the price of oil increases. He doesn’t know about the forces that push the price of oil higher, but the next day when he goes to the gas station, he sees that the price of gas has gone up.

This is a big deal for Bill because a price increase in gas is an additional expense. Through no fault of his own, Bill will need to absorb this cost increase with a reduction in his monthly cash flow.

Now let’s look at Jane’s situation. A few years ago, Jane invested in an oil well. When the price of oil increased for Bill, it also increased for Jane. However, instead of reducing her cash flow, Jane’s monthly checks from the oil well grew bigger, and she didn’t even have to lift a finger.

This single event has two opposing sides. Whether this event (price of oil increase) is good news or bad news depends on your position.

Understanding this is very important when it comes to the stock market. People who have a big chunk of their money invested in a plan such as a 401(k) or IRA become sad when the market drops, and happy when the market goes up.

Remember—we want to stop thinking about investments as “right” or “wrong.”

Instead, realize they’re simply opposites of each other. When we understand that, we can take advantage of both sides. We can’t force the markets to move up or down to match our will. But what if there was a way that we could increase our asset column when the market goes down?

What if we could position ourselves to profit from a drop in the market?

The Phone of John: The Good Investor

Here’s another example of financial intelligence explained through short and long positions.

A popular mobile phone company will soon be coming out with a brand new phone called the Z9 that millions of people will want to buy. Right now, however, the mobile phone company is selling the Z8 version and people are snapping it up every day for $600.

When John hears about the new phone, he realizes that when the new Z9 model is released, the current Z8 model will become almost obsolete. Even though it currently sells for $600, John thinks it will sell for half of that when the new one arrives.

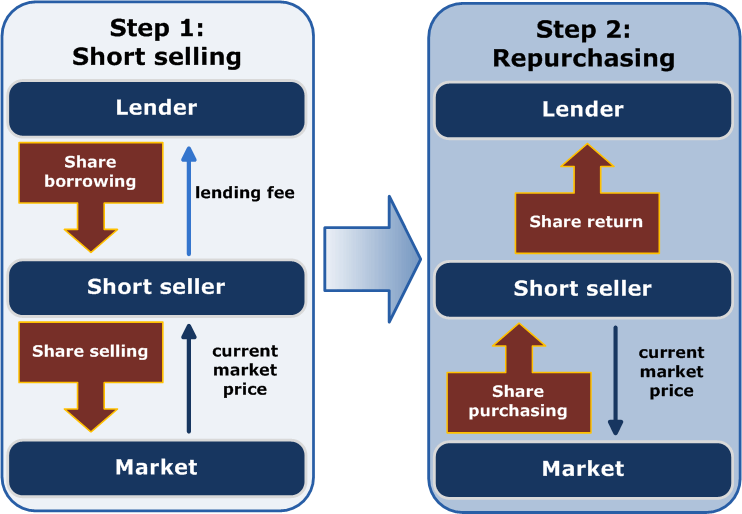

With this knowledge of the future coupled with his desire to invest without money, let’s consider how John can profit from this scenario. First, John talks to Sally, who has a Z8 phone but no longer needs it. Sally agrees to lend it to John for a few months. John doesn’t pay Sally for it, he simply agrees to give her a Z8 phone in the near future. So, the phone that John borrows now goes into his asset column.

But it also goes into his liabilities column, because he still owes it to Sally.

John’s next step is to take that Z8 phone and list it for $600. Within a few days, John has a buyer, and he ships it in exchange for $600. Now in John’s asset column, he no longer has a phone. Instead, he has the $600 he just earned from selling the phone. Over in the liabilities column, he still owes the phone to Sally.

Within a short amount of time, the new Z9 phone is released and the price for the Z8 phone goes down just as John predicted. Now the Z8 is available on eBay for only $300. So, John buys it for $300 and returns the Z8 phone to Sally.

Sally is happy because John has fulfilled their agreement, and John made $300 without any initial investment.

The Long and Short of Positions

When we anticipate that the price of something will go up, we want to buy it and own it to benefit when the value increases.

But when we anticipate that the price of something will go down, we do not want to own it, we want to borrow it. That puts us in a position to profit when the price drops.

When you look closely at what John did with the phone, you’ll notice that he bought low and sold high. This traditional way of buying low and selling high is called a “long position.” Our example transaction was similar, but because we borrowed, then sold, then bought, and then returned, it becomes a “short position.”

The benefit of short positions is that they give you the power to generate profits no matter what the market situation may be. Traditional wisdom advises us to get out of debt and save money. But as we’ve discussed in this section, it’s not wise to own something if you think it will go down in value. When we know that the value of something will decrease, we don’t want to own it. Instead, we want to borrow it.

Want to learn more from Andy Tanner?

Click the link to see his available classes.

Redefining Intelligence for Investors

Intelligence has many definitions and meanings.

For the purposes of this blog, we define intelligence as the ability to escape the trap of a binary right-or-wrong mindset that schools often promote, and to view the financial world from as many angles and perspectives as possible.

The rise of the stock market isn’t inherently right or wrong, good or bad. Similarly, a real estate market crash isn’t right or wrong, good or bad.

You, the savvy investor, determine the positive or negative nature of your investments. You’re in control. By getting educated, you gain more control. Conversely, if you opt not to educate yourself and remain in a dogmatic “right or wrong” mindset, you relinquish control to others.

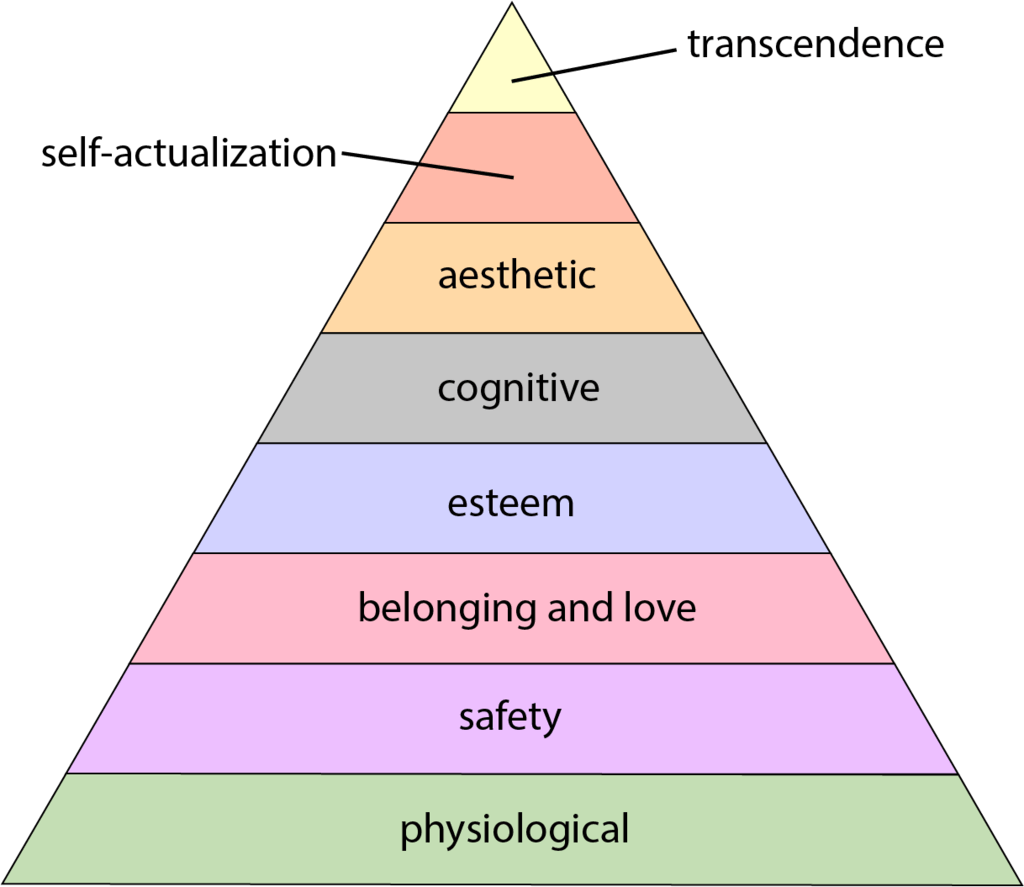

Abraham Maslow, in his Hierarchy of Needs, identifies the pinnacle of human existence as Self-Actualization. This stage is marked by a person’s ability to view the world without prejudice and accept facts as they are—one of which might be that there’s often more than one correct answer.

Achieving Self-Actualization as an investor also means being generous, giving back rather than taking. Many people are greedy because our educational systems fail to prepare them for Maslow’s second level: safety. When individuals feel unsafe or live in fear, it’s natural for them to take rather than give.

If your mind is open to opposing ideas, your intelligence expands. If it’s closed, ignorance takes the wheel. The choice between intelligence and ignorance hinges on your willingness to embrace diverse viewpoints—a decision that can transform your world and shape your future.

So, the next time an opportunity arises, think about what a wise investor would do.

If you’re unsure… perhaps it’s time to deepen your financial education.