Blog | Entrepreneurship, Personal Finance

How to Choose a Business Partner

New Rule of Money #7 - If you want to be successful, carefully choose your business partners

Rich Dad Entrepreneur Team

October 15, 2024

Summary

-

One of the keys to being a successful entrepreneur is to know that you can’t do it alone

-

It’s important to be careful - and wise - when choosing business partners

-

How you choose business partners directly impacts your success

Millions of people go through life repeating what they learned in school, taking the test of life on their own, not asking for help, and being bullied or told what to do by big and powerful organizations. Unfortunately, that won't make you successful in business. What separates those who slave away in the S-quadrant and those who thrive in the B-quadrant are those who choose their business partners wisely.

The CASHFLOW Quadrant and the power of a team

The “do-it yourself” mindset can be plotted to the CASHFLOW Quadrant.

On the left side are Employees and Self-Employed (Es and Ss).

On the right side are Business and Investing (Bs and Is).

Many people on the left side of the quadrant don’t like teams...or at least they don’t like having people on teams that are smarter than them.

Employees, for instance, often fear those who are smarter or better than them because it means they won’t get the promotion or the raise. They might not get the marquee project. There is often a lot of toxicity on teams that stem from fear employees have about their job security.

Self-employed people are often very bright and capable. They even have an entrepreneurial bent to them. But they don’t like teams. They want to be the smartest person in the room, and they often are, which is why companies hire them as consultants. But because they don’t play well with others, they have to do all the work and oftentimes, feel they don’t need business partners. They don’t own a business. They own a job.

On the other hand, those on the right side of the CASHFLOW Quadrant know that if they want to be rich and successful, a team of strong business partners is crucial. Employees and self-employed people often say of the people who own their company, “I’m so much smarter than them. Why do they get all the money?” That, however, is by design. In fact, the E and S inability to really embrace being around smart business partners is the reason why they could never succeed as a business owner or investor.

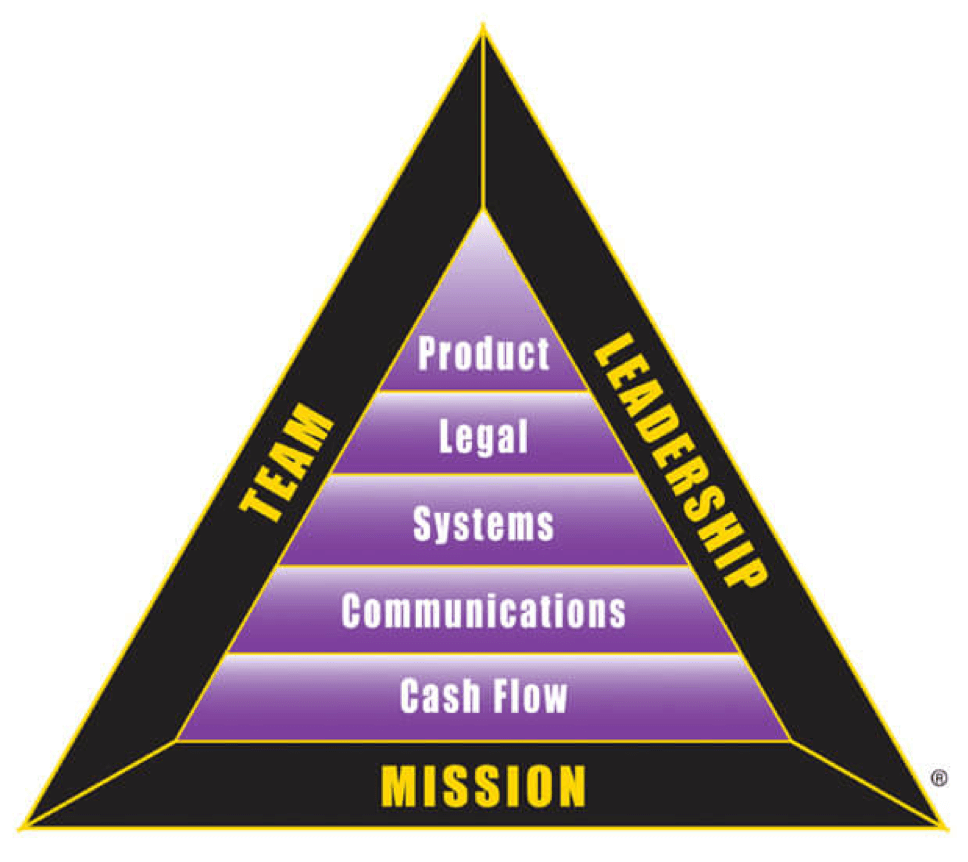

The reason a team is key to success in business and investing can be found in the B-I Triangle.

Find your business partners through the B-I Triangle

Rich dad said, “Business and investing are team sports.” The reason why most people struggle financially today is because they go onto the financial playing field as individuals, not as a team. And when a business fails, it’s often because they have poor leadership and a poor team.

The B-I Triangle illustrates the foundations a business needs to be successful.

As you can see, there are eight components, or what we call integrities, to a successful business.

- Mission

- Leadership

- Team

- Product

- Legal

- Systems

- Communications

- Cash flow

Most people focus on a product or a “great idea,” but that is actually backwards. As you can see, the product is the smallest integrity of the B-I Triangle.

In reality the most important integrities for a successful business are mission, team, and leadership. That is what they are on the outside of the triangle. Having these in place makes filling in the triangle much easier.

A great leader and a great mission attracts a great team of business partners. If you have a great leader and a great mission, but do not have a great team, however, you will not be successful. You can’t do everything alone, nor do you have all the knowledge you need to be successful.

This is why we have the Rich Dad Advisors. They are experts in their respective areas that provide guidance in business and investing. They are all smarter than Robert Kiyosaki himself in their areas, but he likes it that way, because the collective smarts of the team make him more successful. You don’t want to be the smartest person in the room. You want to be surrounded by the smartest people in the room.

When Robert has a question on paper assets, he calls Andy Tanner.

When he needs some sophisticated tax advice, Robert calls Tom Wheelwright.

When Robert has a legal need, Garret Sutton is his guy. And so forth.

The greatest individual performers in the world understand that they are nothing without a team. Take, for example, this quote by Babe Ruth, arguably one of the greatest baseball players in the history of the game: “The way a team plays as a whole determines its success. You may have the greatest bunch of individual stars in the world, but if they don’t play together, the club won’t be worth a dime.”

How to choose a business partner wisely

But a problem does occur when it becomes hard to figure out who is or should be on your team and who is playing for other teams.

For instance, when a young couple goes in to meet with a financial planner, odds are that planner is playing for the other team—the mega-financial corporation he or she works for. Every credit card you have is playing for the other team. Your mortgage plays for the other team.

The world is full of people who are employees and self-employed turning to businesses and investors to help them financially. The problem is those people and those tools all play for the businesses and investors—not for you.

Oftentimes these other teams have millions of dollars to throw at influencing individual players who don’t know any better. But the good news is there’s a way to fight back. And that’s by building your own team complete with professional business partners.

3 rules on business partners

See below some simple guideline rules when choosing the right business partners.

Your friend says to you, “Instead of paying an outside company to do it, I’ll do it for 10 percent of the deal.” You now have a choice:

-

Never take on a partner who needs money.

If a prospective partner’s number-one goal is to put more money in their pocket, then they will make and support decisions to satisfy the immediate need for money versus doing what’s best for the investment or the business in the long run. So, if their primary purpose is to make money for themselves, then there’s no alignment from the start — they won’t care about the partnership and the goals of the business partnership as a whole. And why would you want to have a partner like that?

-

Never give up equity to a person whose services you can buy in the marketplace.

Let’s say you own a duplex. Between your full-time job, your two kids, and assisting your aging mother, you decide to hire someone else to manage the property.

By granting equity (a percentage of the property) to someone else, that person is now your partner. It’s a good guess that they are offering you their services because they have no money to put into the deal (which violates rule 1). Also, by giving away 10 percent of your cash flow and 10 percent of the profit when you sell, this option may end up costing you a lot more in the long run.

You can always hire an outside service to manage your property, handle your accounting and run your marketing. And this way, you get the services you need while holding on to 100% of your asset.

-

Keep 100 percent of the property equity for yourself (since you put 100 percent of your time and money into acquiring it), and pay a monthly fee for a property-management service.

- Or, give up 10 percent equity of your duplex instead of paying the monthly fee.

-

Make sure you enjoy spending time with this person

Good business partners want to work together so that everyone prospers. They should have aligned values and be generous. When doing a deal, you work closely with your partners so it’s important to enjoy being around them. You’ll spend a lot of time dealing you’re your partner, on phone calls, in meetings, over text and email — frankly, if you don’t want to go out to dinner with these people, why would you want them as partners?

Getting the right business partners on your team

If you want to be successful in life, you need to have experts that are on your side that you can turn to for advice.

Key players for your team include an attorney, a CPA to help with accounting and taxes, an objective and well-vetted broker, various experts in your chosen investment and business areas, mentors, and coaches. Additionally, it never hurts to have athletic trainers, life coaches, and a strong network of friends and family who keep you sane.

Before moving forward with any business partnership, it’s important to take the time to think about your goals, the people you are considering, and what they bring to the table.

Each partner should contribute to all aspects of the business, including money, property, labor or skill. And in return, each partner shares in the profits and losses of the business. Which means, in short, a good partner is priceless.

The key is to choose wisely. Be picky. Don’t settle for people who you’re not sure if they play on your team or for other teams. If you don’t choose the right people to be on your team, it can cost you a lot, if not in money, then in time and emotional and spiritual energy. A bad team member is one of the most life-draining and dangerous things you can have.

At the end of the day, the person who chooses his or her team the wisest is the person who will win.

So, who’s on your team?

Original publish date:

July 06, 2016