Blog | Commodities, Paper Assets, Real Estate

The 5 Types of Investors

Which level of investing are you at? The answer could mean the difference between being rich or poor

Rich Dad Personal Finance Team

November 06, 2024

Summary

-

Identify Your Investor Level: Discover the five distinct levels of investors from "Rich Dad Poor Dad," ranging from novices without assets to expert investors who maximize returns using sophisticated strategies and other people's money

-

Importance of Financial Education: Learn how your level of financial education directly affects your investing success, empowering you to make smarter decisions and transition from basic saving to high-return investments.

-

Adapt to Modern Economic Challenges: Understand how to adapt your investment strategies to modern economic realities, leveraging technological advancements and new investment platforms to enhance your financial growth.

As you’ll find in Rich Dad Poor Dad, rich dad often said, “If you are a true investor, it does not matter if the markets are going up or coming down. A true investor does well in any market condition.”

In other words, your success is not dependent on the market but on you.

Success or failure, wealth or poverty, depends solely on how smart the investor is, i.e., what level of investing you are at. A smart investor will make millions in the stock market. An amateur will lose millions.

What Level of Investor Are You?

Below, you’ll find five levels of investors.

In Rich Dad Poor Dad, Robert Kiyosaki writes about his real dad—a man who was very educated, worked hard, and made a good income. However, he held traditional views about money and as a result, struggled financially all his life—Robert calls him his "poor dad."

He was in the first two levels of investors.

Robert also writes about his "rich dad," his friend’s father. His rich dad did not have a college degree but worked hard and thrived financially. Unlike poor dad, he had a rich mindset and thought about money very differently, becoming one of the richest men in Hawaii. Rich dad was a “Level Five” investor.

Take a few minutes, be honest with yourself, and determine which investor level you are at. Before you can reach your dreams, you’ve got to be honest about where you are starting from.

Investor level 1: “The Novice”

If there’s nothing in your asset column with no income coming in from your investments and you have too many liabilities, you’re starting at ground zero.

If you’re deeply in bad debt, your best investment right now might be to get out of bad debt.

There’s nothing wrong with being deeply in bad debt unless you do nothing. After Robert lost his first business, he was nearly a million dollars in debt. It took him almost five years to reach zero. In many ways, learning from his mistakes and taking responsibility was the best education he could have asked for. Had he not learned from his mistakes, he wouldn’t be as successful as he is today.

At this level, you also likely have little-to-no knowledge of money and investing. Another great investment is to simply start investing in your financial education. Read books, play CASHFLOW Classic, attend lectures, read the financial section of the paper, and seek out coaches and mentors.

With the rise of cryptocurrency platforms and robo-advisors post-COVID, novices now have access to financial markets like never before. These tools simplify the process, letting novices start with smaller capital and build confidence through automated guidance—a critical advantage in today’s unpredictable economy, where volatility is a norm.

Investor Level 2: “The Saver”

Most people were taught that being financially responsible means being a saver. If you are a saver, you’re a level two investor.

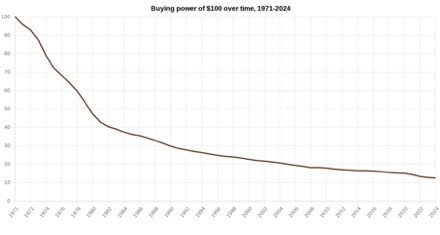

As a saver, you need to be careful, especially if you are saving money in a bank or a retirement plan. In general, savers are losers. Saving is often a strategy for people who do not want to learn anything. It takes no financial intelligence to save. You can train a monkey to save money.

Remember that the U.S. dollar has lost 85% of its value since 1971.

As we move into 2025, it’s easy to see that traditional saving strategies are losing ground. For instance, during the post-pandemic economic recovery, inflation surged, outpacing the returns on savings accounts. According to a report from the Federal Reserve, average savings rates fell well below inflation rates, eating into the purchasing power of savers.

Many savers are now seeking alternative options, like high-yield savings accounts or even bonds, which have recently become more appealing as interest rates remain low. Still, those returns often fall short when compared to inflation rates.

Investor Level 3: “The Amateur”

This level is similar to level two, except that this level invests in riskier instruments, such as stocks, bonds, mutual funds, insurance, and exchange-traded funds.

A person at investing level three knows they need to invest but doesn’t really know how. So, they default to what’s easy and right in front of them: 401(k)s and mutual funds.

Amateur investors are financially uneducated and look for people to tell them what to invest in. Because of this, they are often stuck in the same cycle of mediocrity.

With the rise of platforms offering fractional shares and other accessible tools, amateur investors in 2024 are in a better position than ever before to diversify their portfolios. For example, platforms like Robinhood and Fundrise now allow small-time investors to enter the real estate and stock markets, helping amateurs spread risk even in volatile markets.

Investor Level 4: “The Professional”

Very few people invest the time to learn and manage their own money.

But once you get to that point, you’ve become a professional investor. The key to success at level four is lifelong learning, great teachers, great coaches, and like-minded friends. Rather than passively dumping their money into 401(k)s or mutual funds, professional investors interview tax advisors, attorneys, stockbrokers, and real estate agents.

They seek advisors who practice what they preach and make money on the same investments they sell.

They often ask questions like:

-

What do you recommend I invest in?

-

Do you think I should buy real estate?

-

What stocks are good for me?

-

I talked to my broker, and he recommended I diversify. What do you think?

-

My parents gave me a few shares of stock. Should I sell them?

Today, professional investors are increasingly using AI-driven platforms like Betterment and Wealthfront to identify trends and analyze data to make more informed decisions. A recent Wall Street Journal article highlighted how machine learning algorithms are allowing professional investors to maximize profits and minimize risk, especially in volatile sectors like cryptocurrency and tech stocks.

Once you reach the professional level, the questions you ask and the decisions you make are more informed, and your investments are better thought out. Professionals seek out expert advice, but they no longer rely on others to make their financial decisions.

At this stage, you take control of your financial future, leveraging all available resources—whether it’s the latest AI tools or solid advice from experienced mentors. The fear of investing fades, replaced by confidence in your ability to navigate the financial landscape.

Now, let’s explore the final and highest level of investing...

Investor Level 5: “The Capitalist”

At level five, capitalist investors are at the top, using their expertise to spot and solve financial problems, expecting returns from 25% to infinity. They’ve mastered managing money and leverage other people’s money (OPM) to multiply wealth. Starting with small deals, like foreclosures, they eventually scale to larger ventures, such as $30 million acquisitions.

For example, when Robert first started investing with only $18,000, he focused on small condominiums and houses that were in foreclosure because of problems created by investors who did not manage their cash flow well and ran out of money.

After a few years, he was still looking for problems, but this time, the numbers were bigger. Several years ago, Robert was working on acquiring a $30 million mining company in Peru. While the problem and numbers were bigger, the process was the same.

Not only do level five investors make their living from their investments, but they also multiply their wealth exponentially by putting the velocity of money to work for them. Tom Wheelwright describes velocity of money as “compound interest using someone else’s money.” Capitalist investors understand how to use other people’s money (OPM), to make great investments in multiple places, keeping money moving fast to make great amounts of it.

In the post-COVID era, capitalists are tapping into global markets and emerging economies, where new policies offer high returns. If you're here, keep learning and giving back—there’s always more to gain.

Which Way Now?

So... what if Rich Dad and Poor Dad were around today?

-

Modern Poor Dad – Suppose Poor Dad were navigating the economic complexities of 2024. His steadfast dedication to traditional financial strategies, like maintaining savings in low-interest accounts and investing in conservative bonds, continues. However, these methods yield minimal returns due to the current low-interest rate environment.

Hypothetically, if Poor Dad were introduced to emerging financial platforms such as decentralized finance (DeFi), which offer higher returns and greater financial control, he might remain hesitant. His cautious nature and unfamiliarity with the technology could prevent him from capitalizing on these modern investment opportunities, potentially leaving significant gains on the table.

-

Modern Rich Dad – Conversely, imagine Rich Dad fully leveraging the opportunities of 2024’s dynamic economic climate. Embracing technological innovations, he utilizes AI-driven investment platforms to expertly navigate the fluctuating cryptocurrency and tech stock markets.

Rich Dad also hypothetically expands his real estate portfolio using platforms that manage properties with smart technology, tapping into booming international markets. His proactive approach and readiness to adopt cutting-edge investment strategies would likely enhance his wealth significantly.

These hypothetical scenarios underscore a pivotal Rich Dad principle: success in the modern economy often depends not just on hard work and traditional saving but also on a willingness to adapt to and embrace new technologies.

What matters the most is your level of financial education. Once you start learning more and more, you'll develop the confidence and clarity to discover a path that works with your personality traits. A path that lets you focus on your strengths, and helps you grow and improve your weaknesses.

As Warren Buffett recently said, “Expect some difficulties along the way, but if you’re thinking that way, you’re more likely to get there.”

Original publish date:

September 03, 2013