Blog | Paper Assets, Personal Finance, Real Estate

What is Cash Flow? Cash Flow is King!

Successful Investments are great, but cash flow is where you find peace and longer-term stability

Rich Dad Personal Finance Team

September 12, 2023

Summary

-

Understanding the difference between capital gains and cash flow is the first step on your investment journey

-

Establishing consistent cash flow is how you’ll achieve financial independence

-

While some invest for capital gains, investing for cash flow means you don’t worry as much about the short-term direction of the market

Do you ever worry about your financial future? According to a study by Lexington Law, 26% of Americans are worried about spending more than they earn this year. Another study shows that two-thirds of Americans would struggle to come up with $1,000 in case of emergency. And yet another survey shows that 25% of Americans are worried about running out of money during retirement.

What do all these statistics have in common? That the vast majority of Americans have no idea how to achieve financial independence. They work their butts off, live paycheck to paycheck, rack up credit card debt, and don’t have any savings to speak of. This is a scary position to be in; a position many people are all too familiar with.

So how do you turn things around? Through the power of a magical concept called cash flow.

What is cash flow? The answer will relieve your stress about money and provide an ongoing stream of income

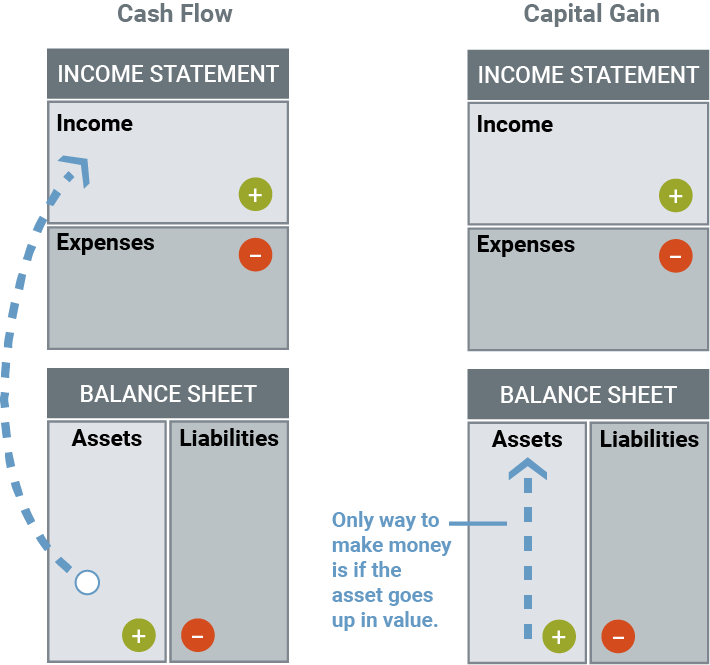

There are two primary things that people invest for: Capital gains and cash flow. The difference is in how they can impact your financial future.

Capital Gains

A one-time profit on the sale of an investment

Cash Flow

An on-going stream of income you receive from an investment

Here’s some examples. If you purchased a house for $100,000 and after some repairs, you sell it for $160,000. Your profit from the sale is your capital gains. You must sell the investment to realize the gain. You can also have capital loss if you lose money on the sale.

An example of cash flow would be the ongoing stream of rental income you would receive from the same investment if you did not sell it, but instead rented it out.

Stock investments can fall in both categories as well. If you purchase stocks and then sell them for a profit sometime later, your profit is considered capital gains. However, if you held on to the stocks and they paid you a dividend each year, that profit is called cash flow.

Forget the flipping and the flopping of capital gains real estate investment strategies

Sure, you might make a killing off flipping one house if all the stars align—but how repeatable is that process? We’d argue that it’s not, because each time you start a new flip project, you’re facing a host of unknown variables to transform the property to then sell it. You might get lucky and flip it for profit. But you could just as easily flop. The risks are an unknown.

Why is cash flow the way to go?

Cash flow investing is what most buy-and-hold real estate investors are after. For example, you buy a six-unit apartment building and rent each of the units. Every month you collect the rent, pay the operating expenses and the mortgage, and, if you’ve managed the property well, end up with positive cash flow. Is it possible to have a negative cash flow? Absolutely. That’s why having a strong financial foundation is so important, so that the investments you make generate positive cash flow.

So why is cash flow the way to go? Because it has numerous advantages, including:

- Financial freedom

One of the beautiful things about the Rich Woman formula for financial independence is that you do not need to acquire hundreds of thousands, or even millions of dollars in savings — yet, this is what most people think of when they talk about being financially free and never needing to work again. Instead, you increase your monthly cash flow until it’s greater than your living expenses. Once your life is no longer dictated by the constraints of money, your time is freed up to do whatever brings you joy.

- Carefree retirement

One more advantage of focusing on cash flow is that it eliminates the fear of running out of money. One concern you may hear from people who have retired is, “I’m worried I’m going to outlive my retirement account.” By accumulating assets that provide a monthly cash flow, money comes in every month until you decide to sell the asset(s).

- Control

If you want to maintain control, don’t invest in things where you have no control, like stock trading or house flipping. These require the ability to predict the timing of highs and lows of the stock market or real estate market; who wants that pressure? With cash-flow investing, your success is not dictated by the daily fluctuations of the market. You cannot control the markets, but you can control your rental properties.

The Path to Financial Freedom

Successful investors make millions by investing for cash flow. This means money is consistently coming in and they don’t have to worry as much about the short-term direction of the market as those focused on capital gains.

The core idea of investing for cash flow is to build wealth steadily to leave the rat race or prepare for retirement. This model is also used for building capital, as it assures you of a continual income at specific intervals.

For example, when Robert and Kim Kiyosaki “retired” in 1994, they didn’t have millions stashed aside. But they had $10,000 in cash flow coming in every month from their investments, primarily real estate. Since their living expenses were only $3,000 per month,they were financially free—the cash flow from their investments was more than paying for all of our living expenses. The goal is to build up your monthly cash flow so that it’s greater than your living expenses.

Today, they have roughly 14,000 real estate investment units and each one pays for next. That cash flow also keeps money flowing into our bank accounts.

What is Cash Flow for YOU?

What kind of life do you envision for yourself and your future?

Cash flow is what is known as passive income, which is the lowest taxed type of income. This is not always the case with capital gains taxes, which vary depending on the type of asset you've invested in and how long you've owned that asset. In some cases, the taxes can be very high.

Finally, you can start making money from day one—as soon as you get a tenant into the property, the income begins to flow. There’s no need to wait for a property to increase in value to see a return.

If money is a constant source of stress for you, then cash flow may bring the peace of mind you are looking for.

Original publish date:

July 02, 2009